- ATOM jumped 8% in under 24 hours on heavy volume, breaking through $4.78 resistance.

- Support is locked in at $4.65, with bulls eyeing the $4.90–$5.00 range.

- Institutional volume patterns confirm continued interest even during consolidation phases.

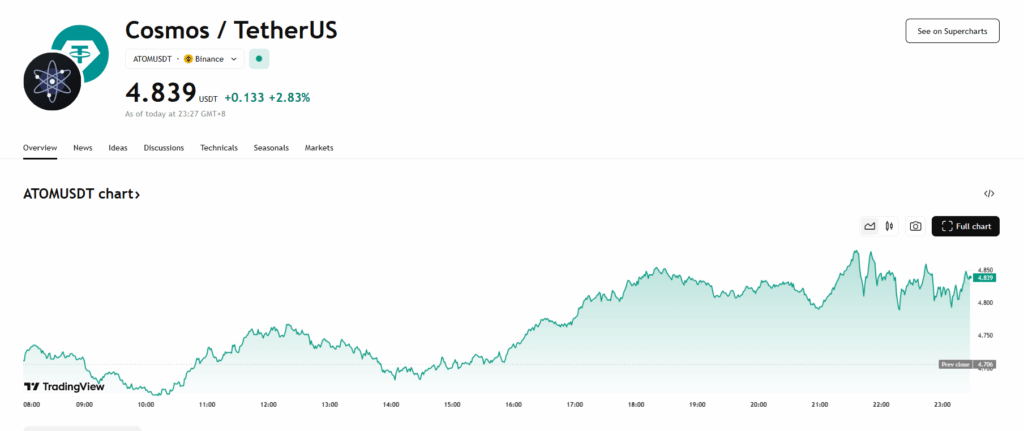

ATOM saw a strong 8% move higher between Aug. 12 at 11:00 and Aug. 13 at 10:00, climbing from $4.49 to $4.84 on surging volume that crossed 2 million units. This spike in activity hints at robust institutional interest, with the rally breaking past the $4.78 resistance before consolidating just under $4.85. Support has now formed firmly at $4.65, giving bulls a platform to push for the $4.90–$5.00 range in the near term.

The final hour of trading added to the bullish tone, with ATOM pushing from $4.82 to $4.85—a modest 0.62% lift—before easing slightly to $4.83. That $4.85 mark was tested with a sharp 24,467-unit volume spike at 10:20, followed by profit-taking that nudged prices down. Still, quick recovery attempts were backed by hefty volume surges, including 47,638 units at 10:44 and nearly 60,000 at 10:48, suggesting institutions stayed engaged even during consolidation.

Market Context and Altcoin Strength

The broader market backdrop also favors altcoins right now. Bitcoin dominance dipped below 60% for the first time since January, allowing assets like ATOM to show relative strength. That said, a decisive Bitcoin breakout above $124,000 could shift capital back to BTC, potentially slowing the altcoin momentum.

ATOM’s price action remains technically bullish, marked by an ascending support structure, repeated volume-backed rebounds, and a clean breakout above prior resistance zones. Analysts are eyeing the $4.90–$5.00 level as the next challenge, with current trading dynamics hinting that bulls may not be far from testing it.

Key Technical Takeaways

- Range & Movement: ATOM traded through an 8.5% range, from $4.49 lows to $4.85 highs, in just under a day.

- Support & Resistance: Strong base at $4.65, with resistance cleared at $4.78 before testing $4.85.

- Volume Signals: Multiple high-volume spikes at inflection points confirm ongoing institutional activity.

- Breakout Validity: Sustained buying pressure and higher lows point to a market preparing for further upside.