- ASTER has dropped over 40% in Q4, but whales recently bought 2.9 million tokens, hinting at long-term confidence.

- The team is shifting toward fundamentals with a 77.8M token burn and buybacks increasing from $3M to $4M per day.

- These moves suggest a potential supply rotation from short-term sellers to long-term holders, setting up a bullish 2026 outlook.

For all the noise, the memes, the excitement — the market always circles back to fundamentals sooner or later. And lately, Aster has become a pretty clean example of that cycle playing out in real time. When its Q3 launch hit, the token went full risk-on, ripping more than 300% in a single quarter. It was such a wild run that traders were openly comparing it to Hyperliquid (HYPE). The funny thing? HYPE only managed about a 14% move in the same period, which shows just how aggressively capital flowed into Aster.

But Q4 has been a whole different story. The hype cooled off, liquidity thinned out, and ASTER dropped more than 40% already — a move sharp enough to shake out late buyers and rattle anyone who jumped in expecting a straight-line moonshot.

Volatility Bites Back as ASTER Nears Its ICO Baseline

Looking at the chart, Aster’s drawdown is starting to cut deeper. Another 30% slide would send the token right back to its ICO baseline, which is a pretty harsh reversal for something that looked unstoppable just a few months ago. The speed of the rise — and the speed of the fall — highlights how speculation-heavy this market gets when the hype machine fades. A lot of late-entry HODLers are sitting underwater now, and some are already capitulating outright.

Even so, conviction hasn’t vanished entirely. AMBCrypto recently highlighted that whales scooped up around 2.9 million ASTER tokens, which suggests big players still see a long-game opportunity here. And honestly, some of the dev team’s latest moves do help explain why the smarter money hasn’t walked away.

Buybacks, Burns, and a Pivot Toward 2026

Now that the hype cycle has cooled, ASTER is shifting its focus back to fundamentals — something it probably needed. The project’s 2026 roadmap feels much more structured, and the pivot started with a pretty aggressive 77.8 million token burn. Burns shrink circulating supply, and that kind of tightening can pay off later if demand returns.

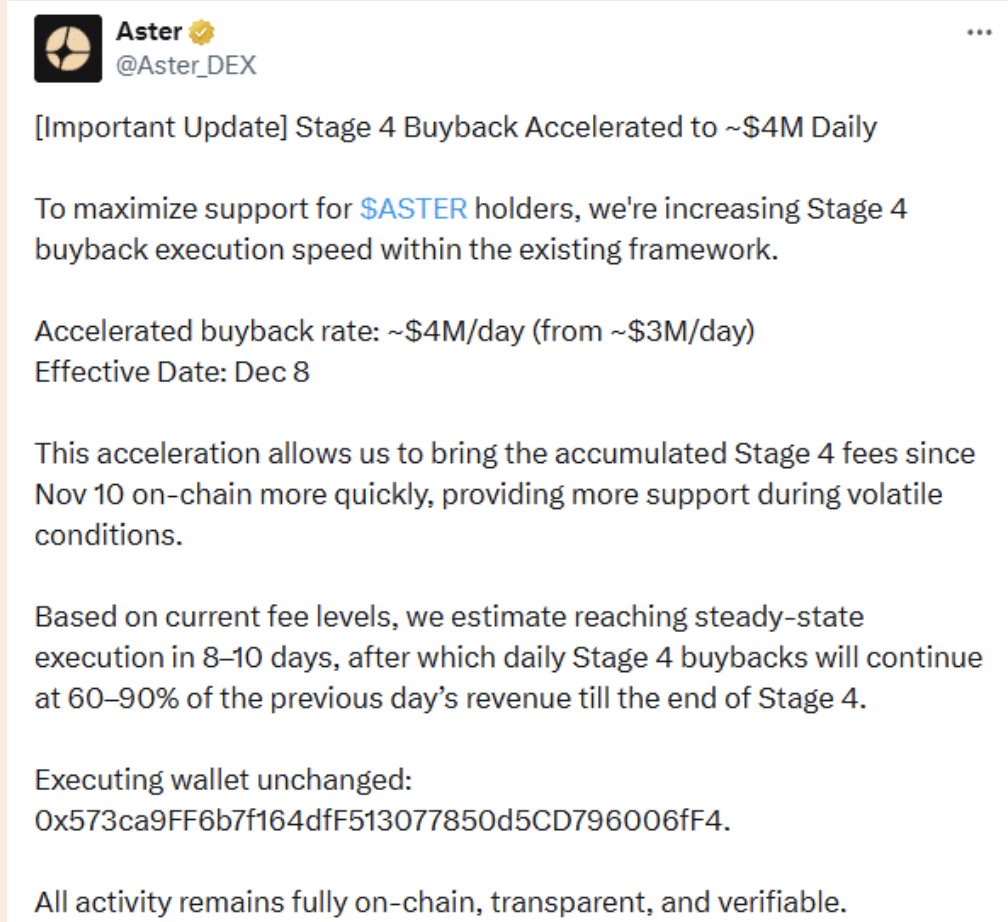

Building on that, the team is ramping its buyback throughput from $3 million to roughly $4 million per day. That’s a big jump. And it tells you exactly where their priorities are right now: strengthen the token’s supply-side mechanics before anything else.

Meanwhile, the order books aren’t exactly thick — the bid-wall is thinning out, and it’s struggling to absorb the selling pressure behind ASTER’s 40%+ drawdown. With that in mind, leaning into supply reduction makes sense. Fewer tokens floating around strengthens each remaining one, which could boost long-term confidence and slowly shift sentiment back in ASTER’s favor.

Why This Could Be the Start of a Longer-Term Rotation

Given all this, the recent whale accumulation doesn’t look random. It looks more like early positioning ahead of a bigger structural shift. With burns, buybacks, and a more disciplined roadmap taking shape, ASTER might be entering the early phase of a supply rotation — away from short-term holders and into the hands of long-term believers.

If that rotation continues, Aster could be setting the foundation for a stronger runway heading into 2026, even if the current price action feels rough. Sometimes the biggest setups get built quietly, right after the hype has burned off and everyone else walks away.