- Aptos jumped 4% as trading volume surged 35%, outperforming most major cryptocurrencies.

- BlackRock’s BUIDL Fund deployed $500M in tokenized assets to Aptos, boosting its institutional credibility.

- Jump Crypto and Aptos Labs launched Shelby, a decentralized storage system aiming to rival traditional cloud solutions.

While most of the crypto market has been crawling sideways, Aptos has quietly stolen the spotlight. The layer-1 blockchain climbed 4% in the past 24 hours as trading volume spiked 35%, making it one of the few large-cap coins showing real strength. With a market cap back above $2.3 billion, Aptos is still far from its $19.90 all-time high, but its comeback story is gaining traction fast. Two catalysts are fueling this push — BlackRock’s massive $500M tokenization move and Jump Crypto’s new decentralized storage system, Shelby.

BlackRock’s $500M tokenization boost

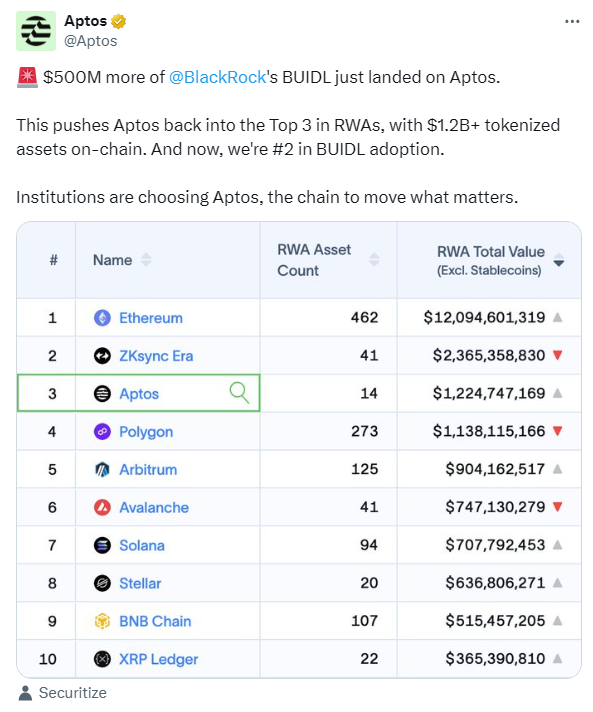

BlackRock’s BUIDL Fund has officially expanded to Aptos, adding $500 million in tokenized assets to the chain. This makes Aptos the second-largest blockchain for BUIDL deployment, right behind Ethereum. The total tokenized asset value on Aptos has now crossed $1.2 billion — ranking it third globally in the tokenized real-world asset (RWA) race.

The BUIDL Fund, which BlackRock co-launched with Securitize, focuses on low-risk, liquid assets like U.S. Treasuries and repo agreements. Originally built on Ethereum earlier in 2024, it branched out to Aptos in November to tap into the network’s scalability and performance edge. For Aptos, this kind of institutional validation is huge. It signals confidence in its infrastructure and positions the chain as a major player in the real-world asset movement.

Jump Crypto launches Shelby with Aptos Labs

Meanwhile, Jump Crypto unveiled Shelby, a decentralized high-speed storage layer built alongside Aptos Labs. The goal? To break away from reliance on centralized cloud giants like AWS and Google Cloud. Shelby combines Aptos’ blockchain coordination with distributed storage nodes and RPC endpoints, delivering what Jump calls “sub-second storage access” and “programmable data layers.”

It’s designed to be leaner, faster, and cheaper than traditional cloud solutions — charging under $0.01 per GB per month for writes and about $0.014 per GB for reads. Shelby’s architecture also cuts the typical replication factor in half, from 4.5+ down to 2, thanks to erasure coding that maintains durability without overdoing redundancy. This efficiency could make decentralized storage actually competitive for real applications, something the blockchain world has long struggled to achieve.

Aptos looks primed for more momentum

Between BlackRock’s institutional trust and Jump Crypto’s technical innovation, Aptos is suddenly sitting in a sweet spot. Its fundamentals look stronger than ever, and the ecosystem’s focus on scalability and real-world integration is paying off. With tokenization and decentralized infrastructure both trending hot, Aptos might just be one of the most underrated layer-1 plays heading into 2025.