- Andreessen Horowitz is scaling back its UK crypto efforts to refocus on opportunities in the US, driven by Trump’s pro-crypto policies.

- Bitcoin hit a record $109,000 on Inauguration Day, reflecting optimism around lighter US crypto regulations.

- Despite its London office, a16z’s decision-making has always been US-centric, with UK investments now handled remotely.

Andreessen Horowitz (a16z), often hailed as one of Silicon Valley‘s top venture capital firms, is reportedly steering its crypto ambitions back to the United States, scaling down its efforts in the UK. This pivot, according to a report from the Financial Times, comes amidst a whirlwind of political and market changes.

The decision follows Donald Trump’s re-election and his administration’s issuance of an executive order focused on bolstering crypto assets and exploring the idea of a national digital asset reserve. This move has seemingly re-energized the US crypto landscape, pulling a16z’s attention stateside.

Having opened its first overseas office in London in 2023, a16z had initially signaled an ambitious push into the UK market. However, insiders familiar with the matter revealed that the firm now plans to trim both its investment and operational footprint across the pond. It’s a notable reversal, hinting at shifting priorities among the firm’s leadership.

Interestingly, Marc Andreessen and Ben Horowitz, a16z’s co-founders, have become vocal Trump allies, with reports suggesting they’ve taken on roles as informal policy advisors. Meanwhile, Sriram Krishnan—who spearheaded the London expansion—stepped away from the firm last year to join the Trump administration. Coincidence? Maybe not.

The reorientation reflects a broader strategy to capitalize on the US crypto market’s potential. Trump’s executive order has created a sense of optimism around relaxed regulations and government support for digital assets, sparking a fresh wave of enthusiasm.

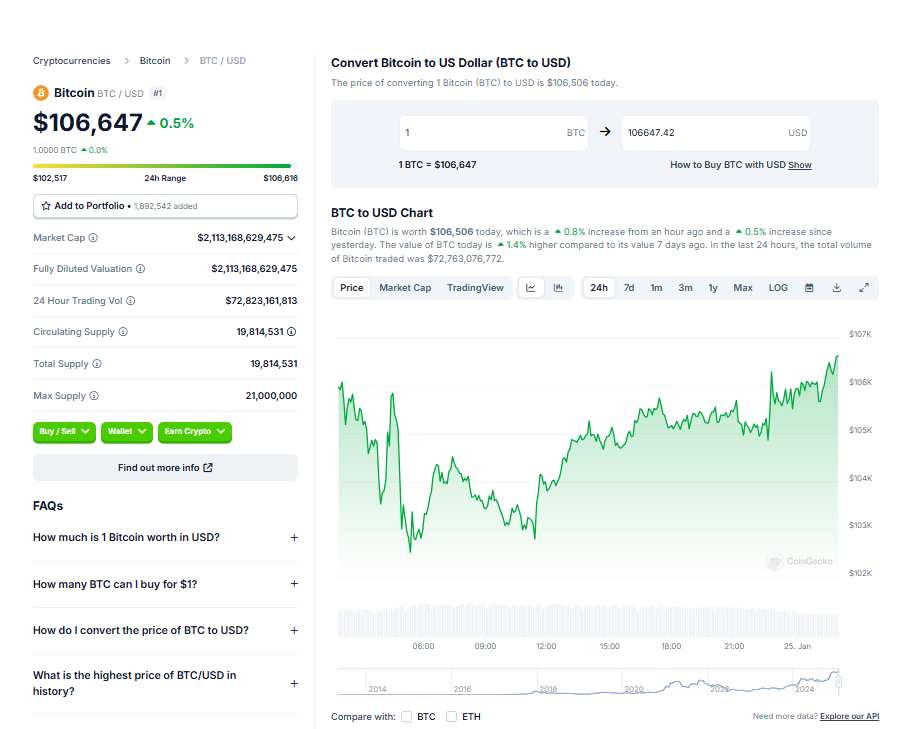

On top of that, Bitcoin prices have surged since the election, climbing to new heights on expectations of favorable policies. On Inauguration Day, Bitcoin shattered records yet again, skyrocketing past $109,000—an eye-popping milestone that underscores the buzz surrounding Trump’s pro-crypto stance.

Still, a16z hasn’t entirely severed ties with the UK. The firm can, technically, still engage with British crypto ventures through US-based partners. But, as one UK official bluntly told the Financial Times, the firm’s presence in London was “never really here” to begin with. Decision-making, it seems, remained firmly anchored in the US.

Worth noting, a16z has previously invested in several prominent UK-based crypto initiatives—names like Arweave, Aztec, and Improbable come to mind. But now, with $43 billion in managed capital, the Silicon Valley titan is clearly doubling down on opportunities closer to home.

It’s a shift that raises questions: is the UK’s crypto future dimming, or is the US just shining a little brighter these days?