- XRP surged as stock markets rebounded and ETF approval odds hit 76%.

- Whale accumulation signals confidence, with one investor buying 10.3 million tokens.

- A breakout above $3.00 could fuel a rally toward $5.00, while losing $1.9445 risks a drop to $1.00.

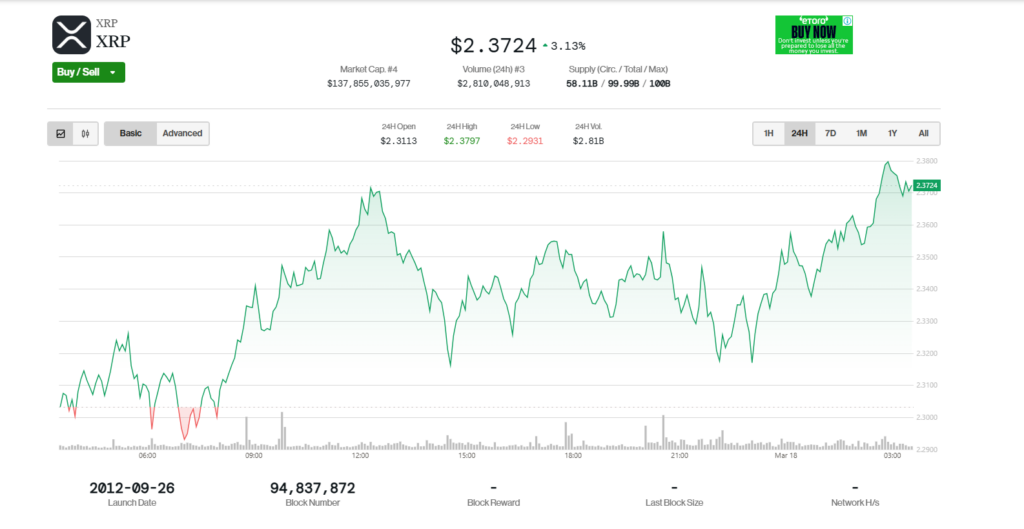

XRP’s latest surge can be traced back to last week’s rebound in both crypto and stock markets, with major U.S. indices like the Dow Jones, S&P 500, and Nasdaq 100 all securing gains of over 1.5% on Friday. The momentum in traditional markets appears to have bled into crypto sentiment, giving XRP an extra boost.

Adding fuel to the rally, optimism is rising over the potential approval of a spot XRP ETF by the Securities and Exchange Commission. Data from Polymarket suggests that the likelihood of an approval now stands at 76%. If granted, such an ETF could draw significant institutional inflows, potentially reshaping XRP’s market dynamics.

Speculation is also swirling that the SEC might drop its long-standing lawsuit against Ripple Labs. If true, this would be a game-changer, freeing the company to solidify its partnerships with banks and financial institutions seeking efficient cross-border payment solutions. Ripple Labs has long been angling to challenge SWIFT’s dominance, a network that processes an astonishing $150 trillion annually.

Whales Are on the Move

Further bolstering XRP’s price action, some whales appear to be accumulating hefty positions. Case in point: a single investor just shelled out $24.2 million for 10.3 million XRP tokens on Bitfinex. This kind of large-scale accumulation is often seen as a bullish signal in crypto markets, pointing to confidence among deep-pocketed investors.

XRP Price Action: Critical Levels in Play

From a technical standpoint, XRP’s current rally began after a strong defense of the key support level at $1.9447. This price zone has acted as a solid floor since December, with just one brief breakdown on February 3—an apparent false breakout that quickly reversed.

Notably, this level also forms the neckline of a head-and-shoulders pattern that’s been developing since November. The “head” stands tall at $3.40, while the left and right shoulders hover near $3.00. This pattern typically leans bearish, so traders are watching closely.

A decisive drop below $1.9445—coinciding with the 200-day moving average—could set the stage for further declines, potentially dragging XRP toward the psychological support at $1.00.

On the flip side, if bulls can muster the strength to push XRP beyond the $3.00 right shoulder, it would invalidate the bearish structure. In that scenario, the next major target is $3.40, marking the highest point of the year. Should bullish momentum persist, XRP could be eyeing a climb toward $5.00.

With whale activity intensifying, ETF speculation running hot, and critical price levels on edge, XRP’s next move could be explosive—one way or another.