- XRP’s breakout from a symmetrical triangle suggests a potential 60% surge, targeting $4 in the coming days.

- Ripple’s legal victory and SEC leadership changes, with Paul Atkins replacing Gary Gensler, add to market optimism.

- Analysts warn XRP must stay above $2.37 to maintain momentum, or risk falling toward $2.30 support levels.

Ripple’s XRP is in the spotlight as it prepares for what analysts predict could be a 60% price surge, fueled by bullish technical indicators and major developments in its ongoing battle with the SEC. The resignation of SEC Chair Gary Gensler on January 20 adds further optimism to the outlook.

Bullish Technical Patterns Signal $4 Target

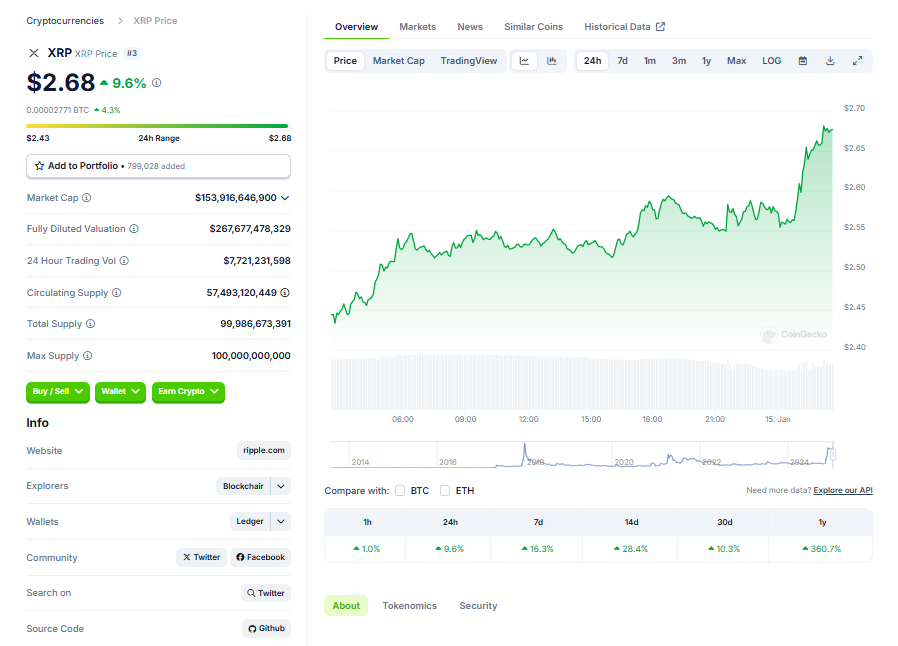

XRP recently broke out of a symmetrical triangle formation, a classic continuation pattern indicating further gains when prices breach the upper trendline with rising trading volumes. As of January 13, XRP was trading around $2.54, showing strong bullish momentum despite minor pullbacks.

The breakout height suggests an upside target of $4, which could materialize within days, according to analysts like World of Charts, who noted:

“The cryptocurrency could reach the level in the ‘next couple of days.’”

XRP’s trading volume surged by over 80% on January 12, reaching $8.98 billion, with $1 billion of this activity stemming from Korea’s Upbit exchange. This spike underscores growing investor interest, coinciding with a 9% price increase that pushed XRP to $2.60 before a slight pullback.

Ripple’s Legal Battle Adds Momentum

Ripple scored a win on January 11, when a federal judge approved a motion to seal sensitive documents tied to its ongoing case with the U.S. SEC. This decision complicates the SEC’s position as the agency approaches a critical January 15 deadline to file its appeal challenging Judge Analisa Torres’ ruling, which found XRP’s regular sales did not meet the Howey Test for securities.

Adding to the positive outlook, regulatory leadership is shifting. With Gary Gensler stepping down as SEC Chair, Paul Atkins, known for his market-friendly stance, is poised to take over. Analysts believe Atkins’ approach could ease regulatory pressures on Ripple and the broader cryptocurrency market.

Former SEC Internet Enforcement Chief John Reed Stark commented on Atkins’ potential impact:

“Paul favors free markets and hates over-regulation, which could be a huge win for the cryptoverse.”

Key Support and Risks Ahead

While the outlook is bullish, analysts caution that XRP must hold above $2.37, the triangle’s upper trendline, to maintain momentum. A fall below this level could push prices toward $2.30, aligning with the 50-12H EMA, potentially invalidating the breakout.

Conclusion

With rising trading volume, a bullish breakout pattern, and favorable developments in Ripple’s legal case and SEC leadership, XRP appears well-positioned for significant gains. If momentum holds, 2024 could be a standout year for Ripple and its token, with the $4 target firmly in sight.