• Ethereum’s price metrics have replicated 3 key bullish actions which resulted in a 120% rally in Q1 2024, hinting at a possible rally to $6,000

• Ethereum broke above the descending trendline and pushed out of its longer-term accumulation range, securing a daily close above the 50, 100, 200-day EMA levels

• Ethereum ETF flows witnessed a $132 million positive net flow between Nov 6 and Nov 7, regaining smart money’s interest after ETH’s recent rally

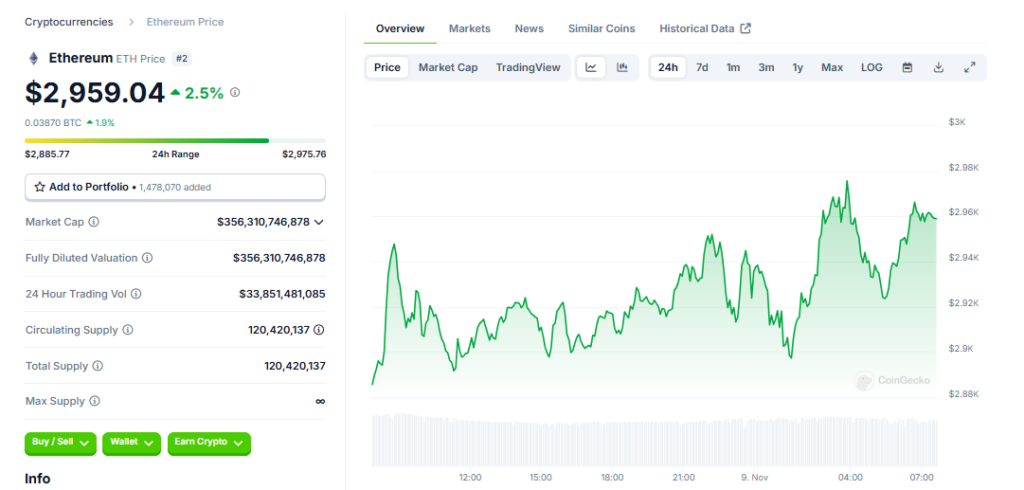

Ether (ETH) has demonstrated a bullish setup similar to early 2023, hinting that the asset may be gearing up for a major rally. Multiple metrics indicate growing scarcity and rising demand for Ethereum.

Ethereum Reflects Bullish Setup from 2023

In 2023, Ethereum witnessed a downtrend between Q2 and Q4, followed by an accumulation range in Q3 and Q4. Once ETH broke out of the range, it registered a break above its descending resistance trendline, exhibiting a trend reversal. The final confirmation came after Ethereum closed above the 50, 100 and 200-day EMA levels. Following this, Ethereum rallied 129% by Q1 2024.

Now, Ether has shown the same bullish setup – a downtrend, accumulation, breakout above the descending trendline, and close above key EMA levels. If price action replicates 2023, Ethereum could reach $6,000 – $6,500 by Q1 2025.

Ethereum ETFs Welcome $132M Inflows

While institutions have accumulated Bitcoin through BTC ETFs, Ethereum ETF flows have been more muted – until now. Between Nov 6-7, Ethereum ETFs saw $132 million in net inflows, a stark reversal from the $632 million in outflows on Nov 4. Rising institutional interest adds further tailwinds.

Ethereum Entering ‘Scarcity Mode’

According to VC Henrique Centieiro, Ethereum is entering a supply crunch as over 426,000 ETH is now locked in staking contracts and exchange reserves are at record lows. This scarcity combined with rising demand could trigger a massive ETH rally.

Conclusion

Multiple metrics point to growing scarcity and demand for Ethereum. If history repeats, ETH could surge to $6,000 – $6,500 by early 2025. While risks remain, Ethereum’s setup is increasingly bullish.