- Bitcoin Holds Steady, Altcoins Rally: BTC is consolidating above $109K, creating room for altcoins like Monero (XMR), Aave (AAVE), and Worldcoin (WLD) to surge. Traders are rotating capital into high-beta assets while BTC remains stable.

- XMR, AAVE, and WLD Show Strength: Worldcoin is up 35%, Monero hit $411 but now looks overbought, and AAVE rose to $267 with signs of exhaustion. All three show strong momentum, but technical indicators suggest potential short-term corrections.

- Caution Amid Bullish Moves: While the uptrends are clear, falling volume and high RSI readings hint that some of these rallies may be running hot. A cool-off or consolidation phase might be healthy before the next leg up.

With Bitcoin holding its ground above $109K, a few altcoins have quietly (or not-so-quietly) started making waves. Monero (XMR), Aave (AAVE), and Worldcoin (WLD) are showing impressive momentum, even as the broader market stays cautious. While BTC consolidates, capital’s clearly rotating into riskier plays — and traders are chasing the heat.

Bitcoin’s Still Rangebound… but It’s Steady

Right now, BTC’s just chillin’ around $109K, not doing anything dramatic — but that’s not a bad thing. It’s been trading in the upper Bollinger Band zone, with RSI sitting up near 67.7. That’s high, but not screaming overbought just yet.

OBV? Pretty flat. Which just means… buyers might be catching their breath. So yeah, Bitcoin’s not making headlines — but it’s giving altcoins room to breathe.

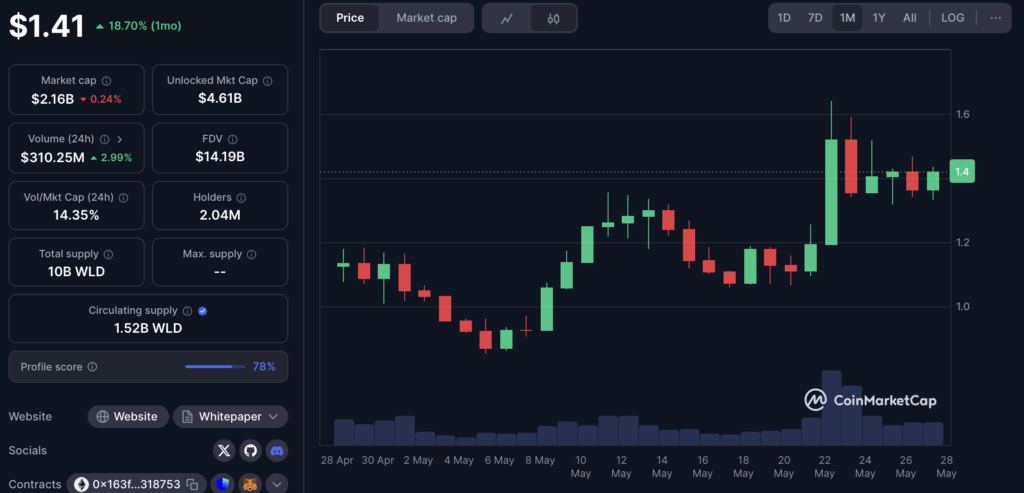

Worldcoin Pops 35%, But Can It Hold?

Worldcoin’s had a solid two weeks, tacking on over 35% and now sitting confidently above $1.43. RSI at 63.9 tells us it’s got momentum, but it’s not overheated. That said, the CMF is still in the red, so we’re not exactly seeing whales throwing money at it just yet.

Still, with the privacy coin sector jumping over 3% and now worth more than $10B, WLD’s in good company. But unless more volume rolls in, it might struggle to keep this pace going for much longer.

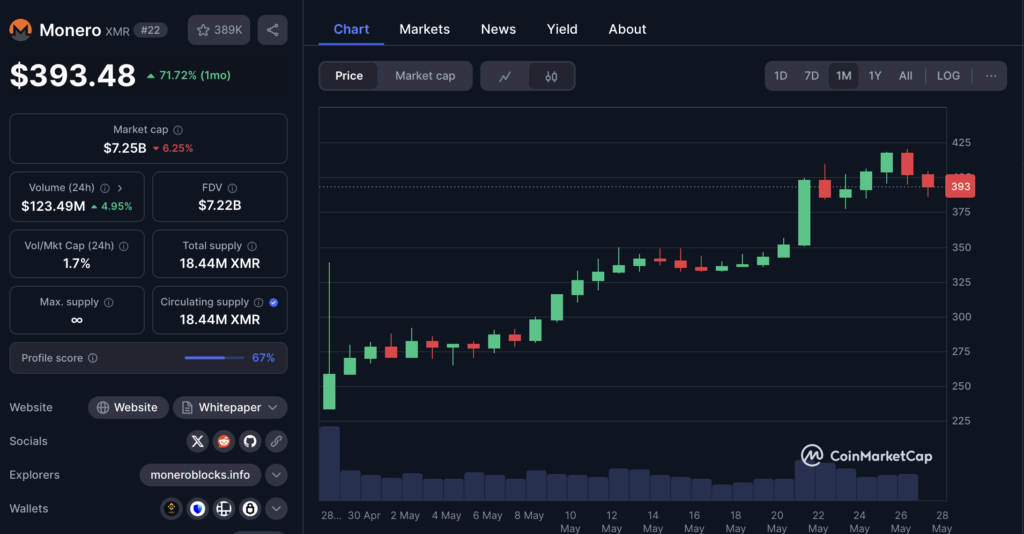

Monero’s On Fire — For Now

XMR’s rally’s been nothing short of explosive — pushing all the way to $411, riding the wave of the privacy coin narrative. The RSI’s flashing 81.8 though… yeah, that’s deep in overbought territory.

MACD still looks strong, but the slight dip in daily volume could be a red flag. Basically, the pump’s been wild, but unless something new shows up to keep it going, a cool-off might be just around the corner.

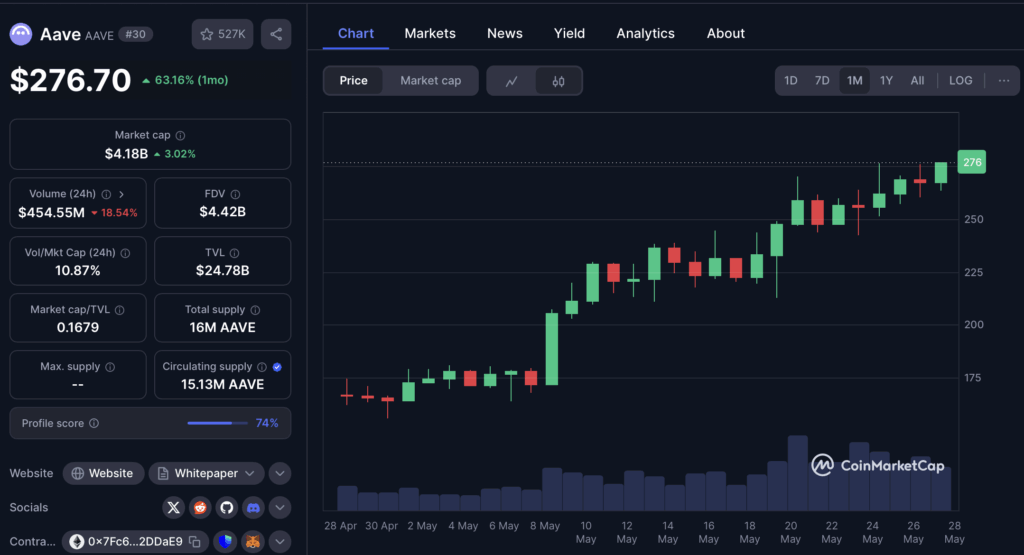

AAVE Breaks Out… But Is It Getting Tired?

AAVE climbed up to $267, following its breakout in mid-May and riding the hype that’s sweeping through DeFi and privacy coins alike. Momentum’s solid, and it’s been printing higher lows — always a good look.

But, RSI’s clocking in at 71.5, which is definitely edging into overheated territory. The candles are starting to look a little indecisive too, and volume’s not really helping the case. Could be time for a breather — and honestly, after nearly 80% gains in a month, it wouldn’t be the worst thing.