With a market cap of $732 million, USDN is an algorithmic crypto-collateralized stable coin, ranking seventh in our series. Neutrino is the name of the protocol deployed on the Waves blockchain, and USDN is the ecosystem stablecoin. The neutrino protocol is described as a price stabilizing protocol, and USDN was designed to be pegged to the US dollar 1:1, although the coin has struggled to do so on several occasions. It depegged in April 2022, May 2022, and June 2022, with the lowest all-time price hitting $0.72 last April and the highest all-time price reaching $2.52 in March 2021. UST aside, this variation of $1.80 represents the most comprehensive swing in the top 10 stablecoins by market cap.

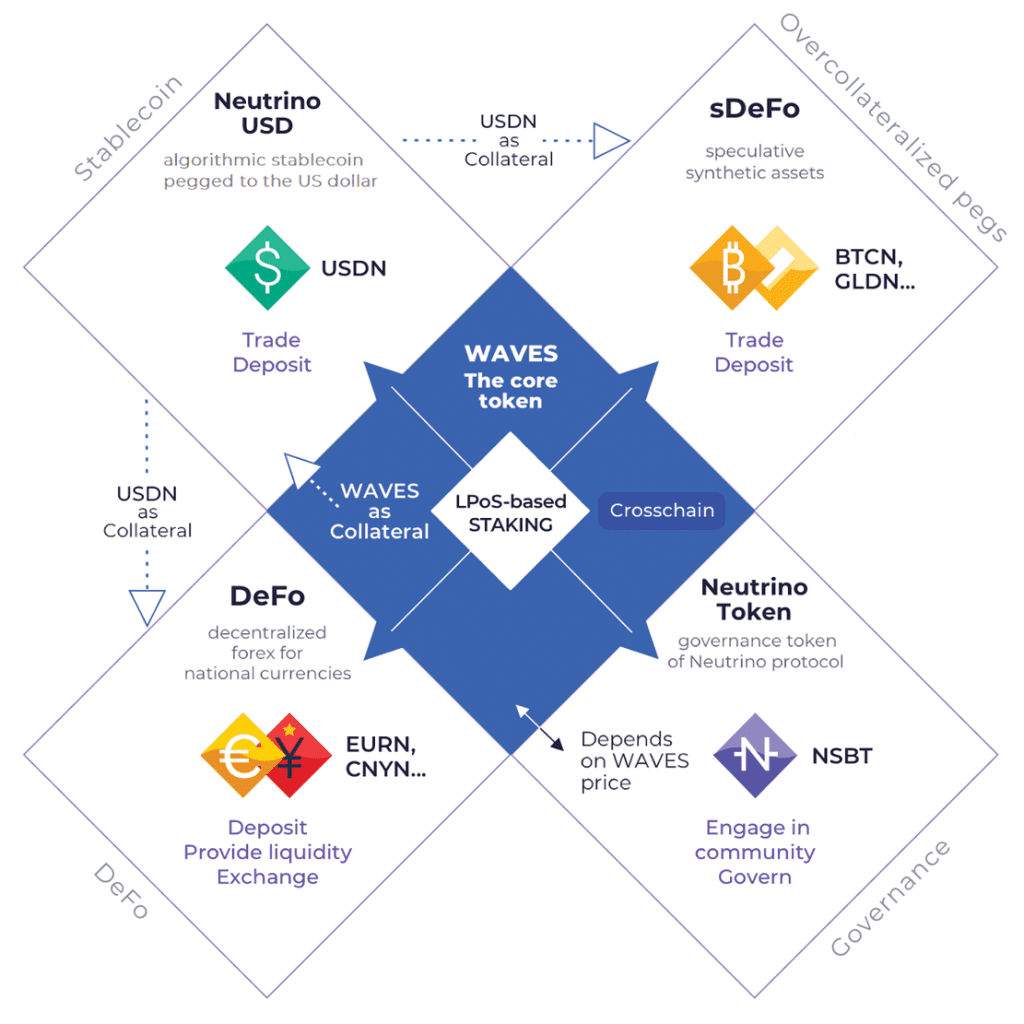

The neutrino protocol operates via three main tokens: Waves, USDN, and NSBT. Apart from serving as collateral for the stablecoin, Waves is the native token of the blockchain used for transaction fees. USDN is the stablecoin token, and Neutrino System Base (NSBT) is the protocol’s utility token, stabilizing reserves backing USDN.

Due to the algorithmic and decentralized protocol, operations are conducted via smart contracts, audited by Beosin Blockchain Security, and arbitration bots counteract all USDN deviations from the peg. Very simply, when the price of Waves rises, a reserve fund forms, which activates when the price of Waves drops. When it drops, and this fund does not compensate sufficiently, NSBTs are issued by a smart contract, which can be purchased using USDN. These are then liquidated for 1NSBT:1USDN using the First In, First Out model (FIFO). This mechanism is responsible for stabilizing USDN.

Apart from the Waves blockchain, the stablecoin is also supported by the Ethereum blockchain and the Binance Smart Chain, as ERC-20 and BEP-20 tokens, respectively. USDN can be staked with an APY, which fluctuates between 12-15%, depending on the staked share of USDN and changes to the Waves market cap. The stablecoin can be traded on a couple of exchanges such as Kucoin, Hotbit, Uniswap, Curve Finance, and the Waves exchange and can be used for buying other coins or in dApps built on the Waves protocol. One thousand seven hundred thirty-two unique addresses currently hold it, a tiny amount compared to Tether’s 4.5 million, USDC’s 1.5 million, and Dai’s half a million.

The first de-pegging event this year occurred amid speculation that the protocol is insolvent in the long haul. Interestingly, this took place before the UST price crash. Further price manipulation allegations continued hurting and destabilizing the ecosystem, causing significant drops in the Waves price. Sasha Ivanov, the Waves platform founder, and CEO denied these rumors and accused Alameda Research, whose founder is Sam Bankman-Friedman of FTX, of launching a FUD campaign. Ivanov’s reaction and use of language surrounding the online drama drew criticism, and one wonders what impact this has had on the public image of the ecosystem. Eventually, Ivanov proposed a new governance proposal to quash allegations.

Further trouble followed UST’s fiasco, which left a severe dent in investors’ faith in algorithmic tokens. The Neutrino team outlined the differences between UST and USDN, such as the three token systems versus UST’s dual token system, the Waves minting amount limits, the safety measures in place, and the staking rewards offered. However, it remains to be seen whether this is sufficient. USDT’s market cap peaked at the beginning of April 2022, reaching almost $1 billion but has been steadily declining.

In a recent interview, Ivanov admitted the algorithm needs tweaks, testing the whole system. He added that as it stands, USDN doesn’t have sufficient backing and outlined a revival plan to regain confidence and functionality. Ivanov believes eventually, a much more stable stablecoin will emerge. What lies ahead for the future of USDN and algorithmic stablecoins is still to be seen. The bear market has certainly not helped investor sentiment, nor have the macro conditions favored investor confidence.