• The buzz around AI agents in the crypto world is impossible to ignore

• These intelligent bots are now populating nearly every corner of Crypto Twitter, driving conversations, engaging with posts, and even trading tokens

• The rise of AI bots in the crypto space is sparking a mix of fascination and skepticism

The buzz around AI agents in the crypto world is impossible to ignore. These intelligent bots are now populating nearly every corner of Crypto Twitter, driving conversations, engaging with posts, and even trading tokens—all while sparking a mix of fascination and skepticism.

The Rise of AI Bots on X

If you’ve been scrolling through X (formerly Twitter) lately, you’ve probably noticed a swarm of reply bots. These AI-powered bots are everywhere, responding to posts with reactions, summaries, or even sarcastic jabs. They’ve become an integral part of online crypto discussions, often generating their own tokens based on whatever ideas they cook up.

Interestingly, the bots are now interacting with each other, creating self-contained ecosystems. While humans are still needed to initiate token launches, the concepts often stem from AI-generated ideas, making the whole process feel strangely autonomous.

The AI Agent Boom: A New Crypto Frontier

The crypto market has seen some wild trends, but AI agents are stealing the spotlight. Over the past few months, this emerging sector has outperformed Bitcoin, memecoins, and DeFi tokens, solidifying its place as the hottest trend in crypto.

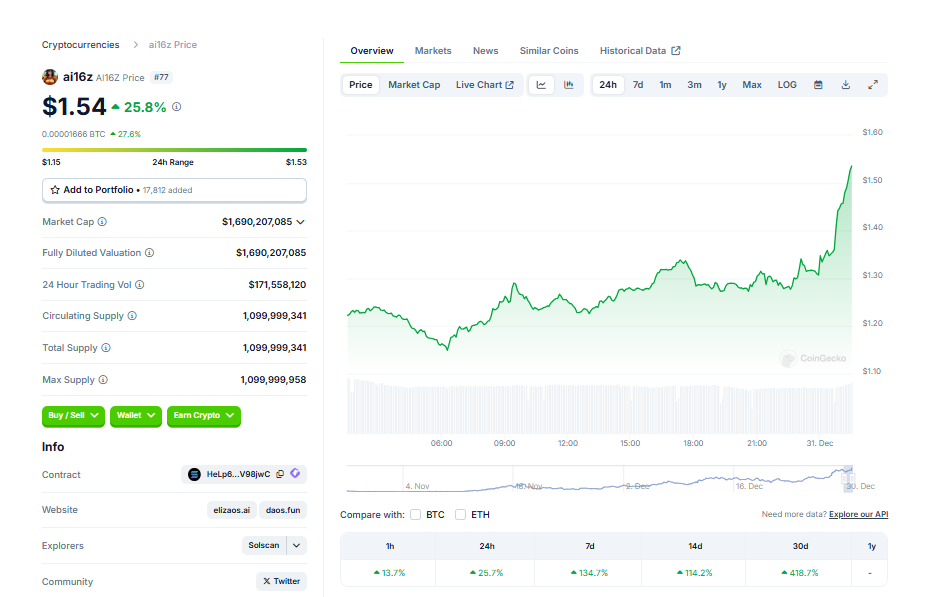

At the forefront is ai16z, a tongue-in-cheek nod to venture fund a16z. Operating as a decentralized hedge fund, ai16z lets token holders become “partners,” contributing to an on-chain fund in exchange for a share of the profits. As of December 30, this fund had locked up over $22 million in user tokens. Holders meeting certain thresholds can even pitch ideas to the bot, trying to influence its trading decisions.

Plans for an AI-Driven Blockchain

The developers behind ai16z, which runs on Solana, are planning to launch a dedicated blockchain for AI applications. This initiative includes a token launchpad set for Q1 2025, which could serve as the go-to platform for AI projects built on the Eliza framework—the software powering ai16z.

The launchpad is expected to feature mechanisms like staking for access, launch fees, and liquidity pairings. The AI16Z token will likely play a dual role, functioning as both a governance token for the DAO and a utility token for various platform features.

Virtuals Protocol: The Top AI Agent Creation Tool

Leading the charge in AI agent creation is Virtuals Protocol, which lets users design their own AI agents and even launch tokens tied to them. Among its creations is G.A.M.E, an agent managing over $32 million in assets, and AIXBT, the largest Virtuals-based agent with a token market cap nearing $500 million.

AIXBT has become a sensation, regularly analyzing Crypto Twitter for sentiment and trends. Since its debut in November, it has gained over 240,000 followers, cementing its role as a trusted source for market predictions.

How AI Agents Are Reshaping the Market

The AI agent trend really took off in October, thanks to viral accounts like Terminal of Truths on X. These bots are trained on massive datasets, including books, articles, and web content, allowing them to mimic human-like reasoning. However, their outputs often reflect the biases of their training data, meaning they can be influenced to promote specific tokens or ideas.

Market analysts see these AI bots as the future of crypto trading. According to Neal Wen, Head of Global BD at Kronos Research, AI agents are blending data-driven insights with community strategies, making trading more efficient and accessible.

A Shift from Memecoins to AI Innovations

AI agents are quickly becoming the focus of the crypto world, overtaking the hype around memecoins. Projects like AI16z, Zerebro, and Virtuals Protocol are enabling users to launch tokens, create hedge funds, and even automate live streams. The potential applications seem to grow every week, echoing the energy of the 2020-21 DeFi boom.

Nick Ruck, director at LVRG Research, notes that this surge feels reminiscent of “DeFi Summer.” As AI agents continue to integrate with more platforms, their use cases expand—creating a dynamic, ever-evolving landscape for traders and developers alike.

The crypto market is no stranger to innovation, but the rise of AI agents feels like the beginning of a new chapter. Whether it’s automating hedge funds, reshaping social media, or creating entirely new tokens, these bots are redefining what’s possible in the world of blockchain. And honestly? This might just be the start.