- XRP surged to $2.11 after a strong 25% weekly rally, but it remains nearly 45% below its all-time high.

- Analysts predict a short-term dip below $2 by April 20, despite long-term bullish outlooks like Standard Chartered’s $12.50 forecast.

- XRP’s recent growth and renewed attention show promise, but short-term volatility could rattle investors.

Ripple’s XRP has been through the wringer, no doubt. Once squeezed by regulators and largely ignored by a good chunk of the crypto world, it somehow held the line. Now? It’s popped back over $1 and people are starting to take notice again. Even banking giant Standard Chartered has jumped in with a bold claim: XRP could skyrocket over 500% and hit $12.50 by 2028. That’s a big number—but let’s take a breath… what’s the deal in the short term?

XRP Price Right Now

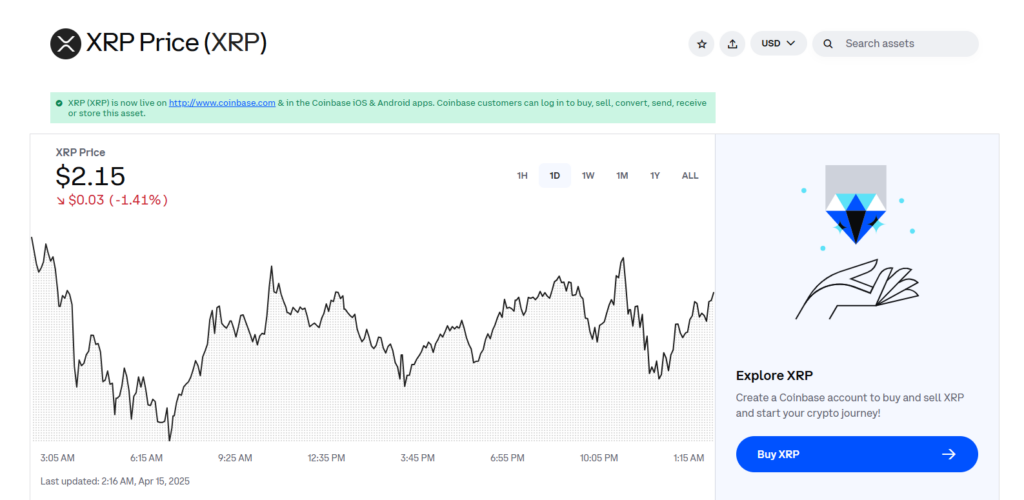

Lately, the crypto market’s been a little messy. Some coins are creeping up, others slipping back—and XRP has been doing a bit of both. At the moment, it’s sitting around $2.11, which is down 1.73% in the last 24 hours. But zoom out a little, and the past week looks great—it’s up about 25%, which is nothing to scoff at.

Now, XRP did touch a local high of $3.39 not long ago, but it’s still nearly 45% away from its all-time high of $3.84, which was… wow, almost seven years ago. If Standard Chartered’s forecast plays out, though, long-term holders could be in for a serious payday.

But Short-Term? Not So Pretty.

Here’s where things cool off a bit. According to data from CoinCodex, XRP might not hold above the $2 mark for long. Their models suggest the token could dip to $1.89 by April 20—just a few days from now. Not ideal for anyone who bought in at the top.

Still, this might just be one of those temporary dips before the next leg up. With long-term projections looking spicy, short-term pain might just be part of the ride.