- 37.5M ADA worth $22.8M moved off Coinbase, signaling whale accumulation.

- ADA’s holding steady between $0.60–$0.62, forming a strong accumulation base.

- Rising futures activity and deepening exchange outflows suggest a bullish setup for a move toward $0.70–$0.87.

Cardano (ADA) seems to be waking up again. A massive $22.8 million transfer—roughly 37.5 million ADA—from Coinbase to an unknown wallet has caught the market’s attention, hinting at something bigger brewing behind the scenes. Exchange data shows consistent negative netflows, with the latest figure sitting around -$3.02 million. That means whales are moving their holdings off exchanges, a move that usually screams confidence.

Historically, when large holders start pulling tokens into cold storage, it’s because they’re expecting price strength ahead. These kinds of withdrawals have often lined up with early stages of bullish reversals. If the trend continues, it could tighten sell-side liquidity and set the stage for an upside breakout in the coming weeks.

Cardano’s Price Is Coiling Up

Right now, ADA’s hovering between $0.60 and $0.62—a tight range that’s starting to look like a strong accumulation zone. Every dip into this region has been met with quick rebounds, a sign that buyers are quietly defending their ground. The structure suggests that bulls are absorbing pressure and loading up for a move above $0.70, which would flip the short-term trend back in their favor.

This price pocket also aligns with a key demand zone that triggered ADA’s mid-year rally earlier in 2025. If history repeats, it could act as the foundation for another leg upward. For now, it looks like Cardano is stabilizing, gathering energy before the next big push.

Exchange Outflows Keep Climbing

On-chain data keeps reinforcing the bullish narrative. Exchange outflows have intensified again, hitting -$3.02 million, confirming that large holders are still pulling their ADA out of trading platforms. This exodus reduces the available supply and, in turn, limits potential selling pressure.

The pattern feels familiar—similar waves of outflows earlier this year marked the start of sustained recoveries. When liquidity dries up like this, volatility tends to spike upward. In simple terms, fewer sellers mean sharper moves when demand kicks back in. That’s why analysts see this as a quiet accumulation phase that could soon shift into full-blown expansion.

Futures Data Shows Aggressive Buying

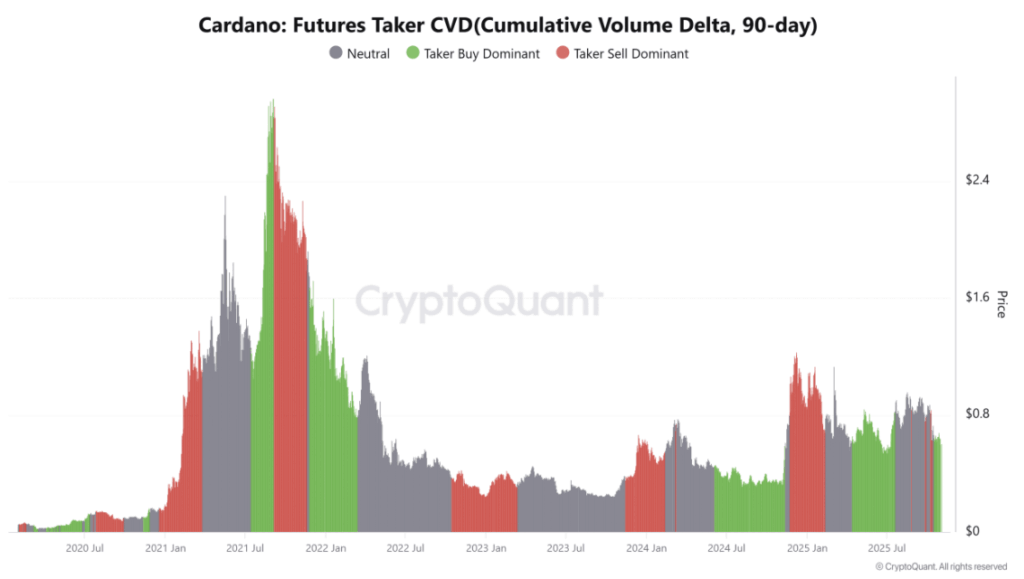

The derivatives market is also flashing green. Futures data shows a 90-day CVD reading that’s Taker Buy Dominant—basically, buyers are the ones pushing volume right now. That’s a big deal because it signals that traders aren’t just sitting back; they’re betting on further upside.

This aligns perfectly with what’s happening on-chain: tightening supply and rising buy-side pressure. Together, those two signals often mark the start of a broader uptrend. The alignment between derivatives and spot data shows both retail and institutional players seem to be positioning for a potential rally.

The Road Ahead for ADA

With whales accumulating, exchange balances shrinking, and futures markets leaning bullish, the pieces are starting to line up for ADA. The token looks like it’s shifting from accumulation to expansion, setting up for a retest of the $0.70 zone—and possibly $0.87 if momentum builds.

For now, all signs point to confidence quietly returning to Cardano’s market. If this rhythm keeps up, the next breakout might come faster than most expect.