- AAVE would need a $15B market cap and strong TVL growth to hit $1,000 by 2030.

- Its strategy leans on Aave V4, GHO stablecoin growth, and a $1M weekly buyback.

- Competition, regulations, and stability risks could derail the climb.

Everyone in DeFi seems to have their eyes on AAVE, wondering if this token can break into four-digit territory by 2030. That kind of price tag doesn’t come easy. The entire crypto market would need to keep booming, and Aave itself would have to avoid major stumbles while delivering on its ambitious roadmap. Predictions are all over the place, but digging into the numbers shows it’s tough—though not impossible.

Crunching the Numbers Behind $1,000 AAVE

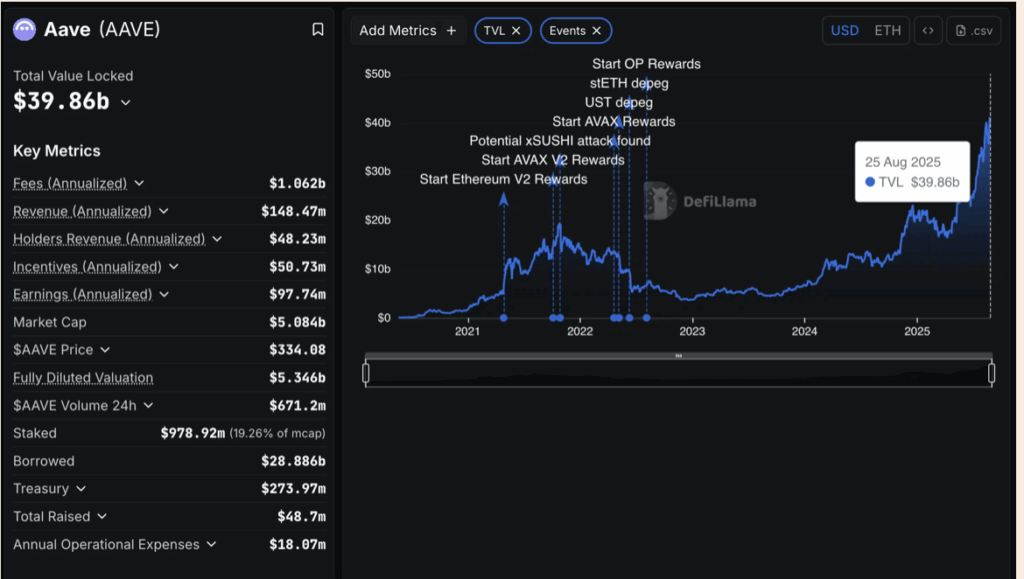

For AAVE to hit $1,000, its market cap would need to reach about $15 billion, since the supply sits around 15 million tokens. Right now, in mid-2025, AAVE trades near $351 with a $5.3 billion market cap. That means it needs roughly a 3x jump from here.

It’s not fantasy—it depends heavily on Aave’s Total Value Locked (TVL). Already, the protocol holds over $57 billion and controls about 62% of DeFi lending. To justify a $15 billion valuation, it likely needs to keep TVL in the $30–$50 billion range. Considering the whole DeFi market could swell past $230 billion by 2030, that scenario is within reach.

Aave’s Big Moves: V4, Buybacks, and GHO

The backbone of Aave’s plan is its “Aave 2030” vision. Aave V4, expected mid-2025, will bring the “Unified Liquidity Layer,” making liquidity more efficient across chains. On top of that, a $1 million weekly AAVE buyback program and a new revenue-sharing token could boost token value directly for stakers.

Then there’s GHO, Aave’s native stablecoin, already pulling in millions in annual revenue for the DAO. By tying GHO into Lens Protocol as its gas token, Aave is weaving DeFi and social finance together. Add in its reputation as a blue-chip protocol, backed by repeated security audits, and the pitch for institutional adoption gets stronger.

Roadblocks: Competition, Regulation, and Black Swans

But let’s be real—nothing is guaranteed. Aave’s rivals, from MakerDAO to emerging protocols, are hungry and agile. Regulation looms large, with governments exploring how to box DeFi into traditional frameworks with KYC/AML demands. Walking that line without betraying decentralization ideals will be messy.

And of course, there’s always the shadow of a black swan hack or prolonged bear market. Even the GHO stablecoin has battled to hold its peg, and failures like that could scare off big players. Plus, if traditional finance keeps offering high interest rates, DeFi’s yields could lose some sparkle.

Final Word: Doable, but a Steep Climb

Breaking $1,000 by 2030 is a tall order. It assumes Aave nails its V4 upgrade, scales GHO adoption, fends off rivals, and weathers regulation—all while crypto grows into a multi-trillion dollar industry. Aave has the vision, but the path is packed with risks. Investors should treat the milestone as a bold possibility, not a guaranteed outcome.