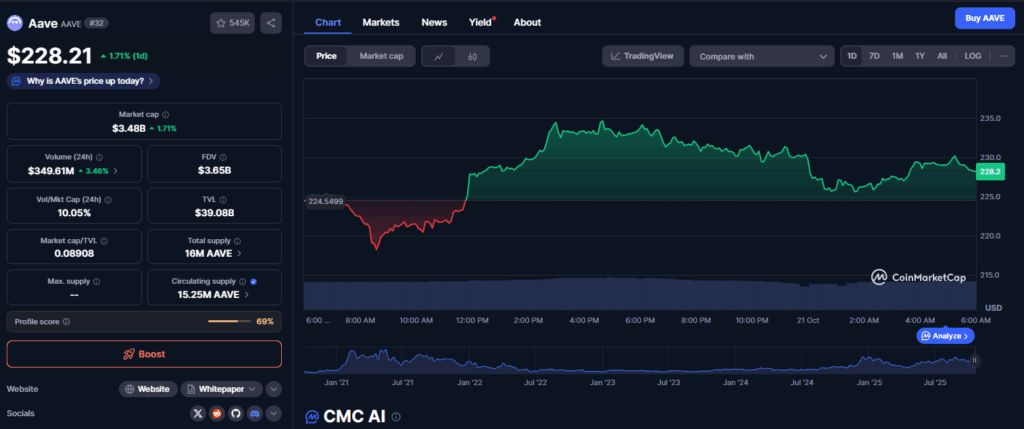

- AAVE rose over 10% from Friday’s lows, peaking near $230 before consolidating above $225.

- Grove plans to supply RLUSD and USDC liquidity to Aave’s Horizon institutional market.

- The integration could deepen tokenized real-world asset lending and expand institutional use.

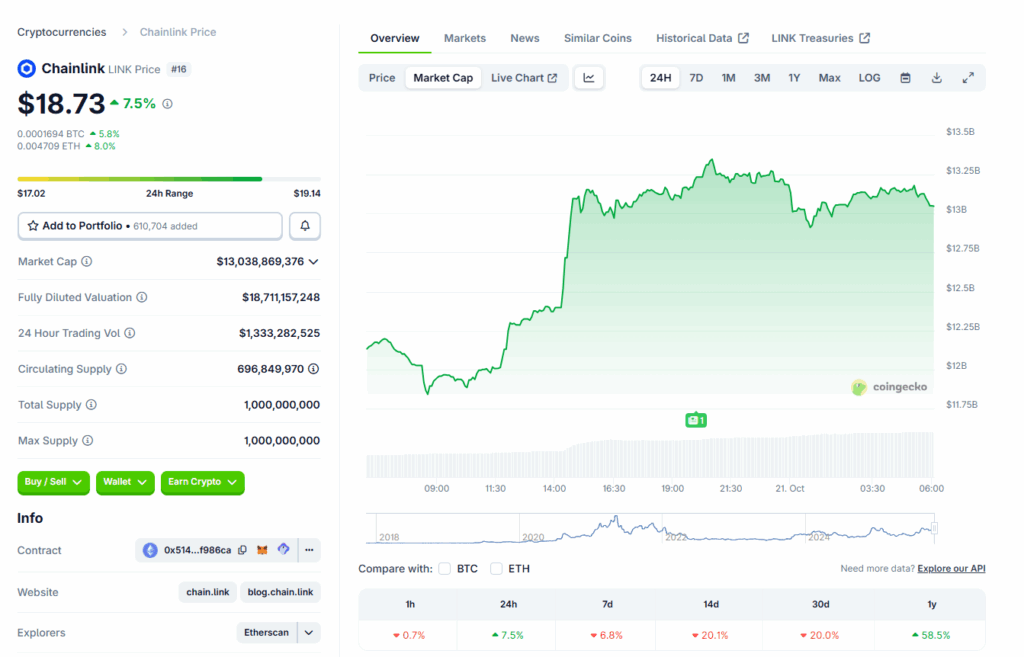

Aave (AAVE) staged a strong weekend recovery, climbing more than 10% from Friday’s lows to briefly top $230 on Monday. The decentralized lending protocol’s governance token became one of the best performers in the market, second only to Chainlink (LINK) among the CoinDesk 20 Index. While short-term profit-taking trimmed some gains later in the session, AAVE managed to hold steady above $225 — a sign that bullish momentum is still intact despite resistance at the $231 level.

Grove Fuels Institutional Liquidity Push

The rally wasn’t just technical. Onchain capital allocator Grove announced plans to inject stablecoin liquidity into Aave’s Horizon, the protocol’s institutional lending market designed for tokenized real-world asset (RWA) borrowing. Grove’s proposal would add Ripple USD (RLUSD) and Circle’s USDC to Horizon, enabling qualified borrowers to use tokenized Treasuries and other real assets as collateral. Pending governance approval, this integration could expand liquidity access for institutions and strengthen Aave’s position in the fast-growing RWA lending space.

Aave’s Expanding Institutional Reach

Aave’s Horizon market already supports collateral from issuers like Superstate and Centrifuge, with valuation data supplied by Chainlink and risk analysis from Llama Risk and Chaos Labs. Grove’s potential contribution could significantly deepen liquidity, turning tokenized assets into usable capital for institutional borrowers. The move reflects Aave’s broader push to merge DeFi efficiency with traditional finance standards — a bridge that’s quickly becoming one of crypto’s most promising frontiers.

Technical Setup Remains Bullish

Technically, AAVE’s structure continues to show strength despite the pullback from intraday highs. The token has maintained an uptrend above key support levels, though repeated failures to break through $231 signal heavy resistance in that zone. A decisive close above that line could open the path toward $250 in the near term, analysts note. For now, Aave’s mix of strong fundamentals and technical resilience keeps it firmly on traders’ watchlists.