- AAVE rebounded from $166 and is holding above the key $180 support, trading around $183–$185 with a market cap near $2.81 billion and ~$309M in 24-hour volume.

- Price briefly faked out below $180 before snapping back and testing resistance at $195, a level analysts say could unlock a stronger rally if broken with conviction.

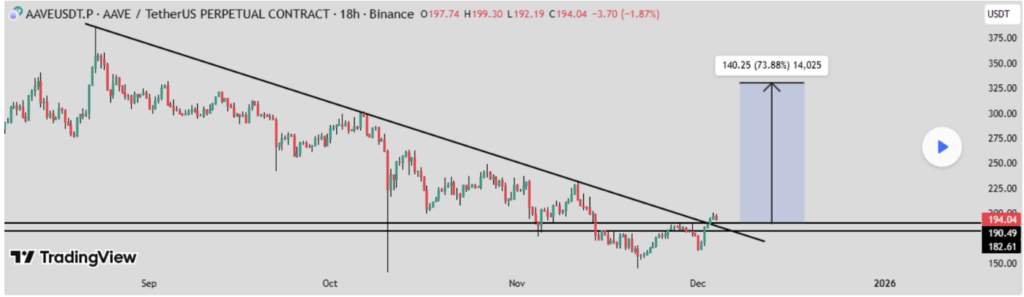

- As long as the $180–$195 zone holds, analysts see room for a bullish breakout toward the $250–$320 range, with traders waiting for clear confirmation before entering.

AAVE has been trying to carve out its next move, and honestly, the chart is starting to look a bit more constructive than it did a couple weeks ago. After dipping to $166, the token bounced sharply and managed to hold above the $180 support, which is becoming a pretty important line in the sand.

Right now, AAVE is hovering around $183–$185, carrying a market cap near $2.81 billion. Daily trading volume sits around $309 million, though the token is still down about 4.2% over the past 24 hours. Even so, the structure looks like it’s trying to build a base for something bigger — maybe even a breakout above $195, which could open the doors toward the $250–$320 range if momentum kicks in.

Watching the $195 Level: AAVE’s Make-or-Break Zone

Crypto TXG pointed out something interesting: AAVE broke above $180, held that zone for several days, then briefly dipped under it in what looked like a fakeout. The price tagged $166, then immediately snapped back — a pretty solid sign that buyers were lurking underneath.

Since then, AAVE has retested the $195 resistance, although sellers defended it on the first attempt. The token is now drifting back toward the $180 support, almost like it’s gathering energy for another push.

Traders have their eyes glued to that $195 level because a clean break could flip sentiment and trigger a much stronger move. If volume spikes on the breakout, the next leg might come quicker than people expect.

AAVE Aims for $250–$320 as Long as Key Support Holds

On the larger timeframe, AAVE/USDT is holding firm above its critical horizontal support structure. Analysts say that as long as the token defends the $180–$195 zone, the setup remains constructive. It’s the kind of region where bullish reversals often take shape — not guaranteed, but the ingredients are definitely there.

A strong reaction around current levels could lay the foundation for the next rally toward $250, and if momentum really builds, even the $300–$320 area isn’t off the table. But traders need clear confirmation, not just guesses — ideally a breakout candle above $195 with sustained follow-through.

For now, AAVE is still in the “coiling” stage — tightening up, pulling back slightly, maybe even testing patience — but the chart shows it’s trying to stay on the bullish path.