- A U.S. pension fund bought Strategy shares for indirect Bitcoin exposure

- Pension capital exceeds $70 trillion, making small allocations significant

- Institutional comfort, not hype, is what drives long-term adoption

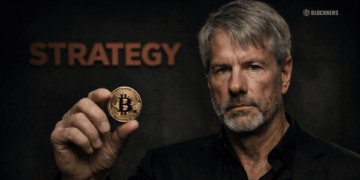

When a U.S. pension fund buys shares of Strategy, it isn’t chasing headlines or riding a momentum trade. Pension capital moves slowly, filtered through committees, mandates, and risk models that are built to avoid speculation. That’s precisely why this purchase matters. It represents a deliberate, indirect bet on Bitcoin using the framework Michael Saylor has constructed, and it signals a shift in how some of the most conservative pools of capital are thinking.

Strategy as the Institutional Shortcut to Bitcoin

For many institutions, direct Bitcoin custody remains a hurdle. Strategy offers a workaround that fits comfortably inside existing compliance structures. Pension funds can buy equity in an operating company, hold it like any other stock, and gain Bitcoin exposure without touching wallets, private keys, or custody infrastructure. It’s not a perfect proxy, but it’s familiar, and familiarity is how institutional capital begins to move.

The $70 Trillion Reality Most People Overlook

The global pension system controls more than $70 trillion in assets. That number tends to get mentioned and quickly dismissed, but the math matters. Even modest reallocations have an outsized impact. BlackRock has suggested that a 2% Bitcoin allocation can make sense in certain portfolios. Apply that percentage to pension assets alone, and the implied inflows approach Bitcoin’s entire current market capitalization. That’s not hype. It’s arithmetic.

This Is How Adoption Actually Happens

Bitcoin doesn’t need dramatic announcements or viral narratives to succeed. It needs quiet acceptance from institutions that rebalance portfolios methodically, quarter after quarter. Pension funds don’t move on emotion. They move when something crosses from “too risky” to “acceptable.” This kind of purchase suggests that threshold is starting to shift.

Why This Signal Matters More Than Price

One pension fund buying Strategy stock won’t move Bitcoin tomorrow. But it reflects a deeper change in mindset. When long-term capital begins treating Bitcoin exposure as a legitimate component of diversified portfolios, price discovery changes. It becomes less about speculation and more about allocation. And once that process starts, it rarely reverses quietly.