- Memecoin share on Solana DEXs has fallen from ~35% to under 9% while total volume remains strong.

- Traders are shifting toward stablecoins, tokenized assets, and mid-sized trades instead of speculative micro-plays.

- Solana appears to be maturing past its memecoin era toward a more utility-oriented ecosystem.

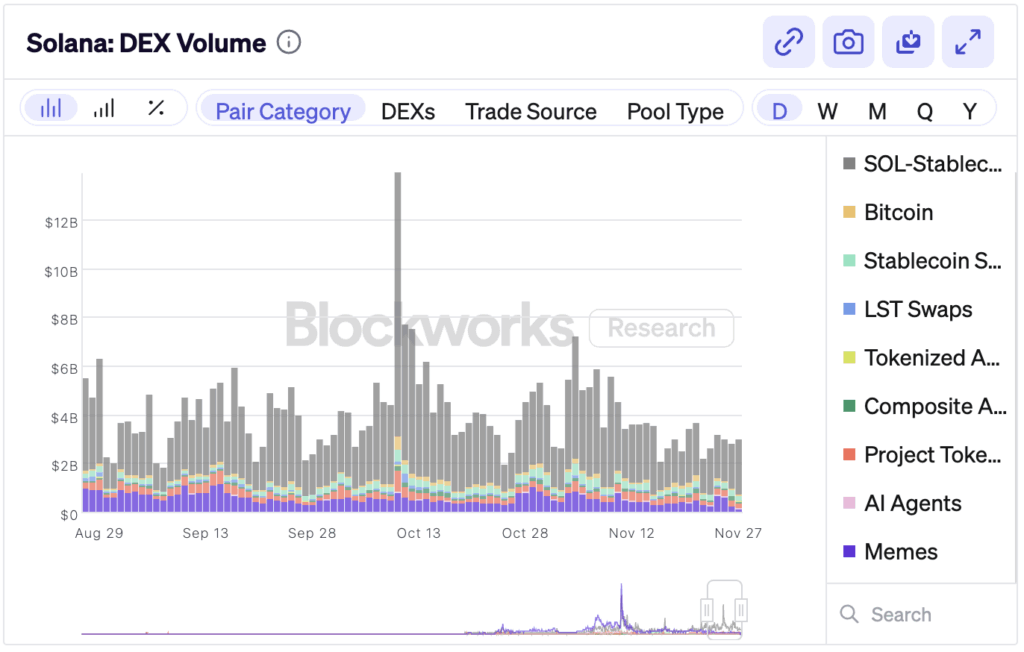

Solana’s trading landscape is shifting in a way that’s easy to miss unless you’re watching volume patterns closely. After dominating much of early 2025, memecoins now make up less than 5% of daily DEX activity, a level not seen since early 2024. Over the past hundred days, their share of weekly volume has dropped from roughly 35% to under 9%, even though total weekly DEX volume remains high at around $18.6 billion. This change isn’t caused by fading interest in Solana itself — it’s a sign that users are rotating their capital into different parts of the ecosystem.

Why Traders Are Exiting Memecoins

The decline doesn’t look like a seasonal cooldown. Smaller trade sizes that usually dominate memecoin flipping have shrunk sharply, while mid-sized trades between $1,000 and $10,000 have grown. This shift shows traders moving away from hyper-speculation and toward markets that offer deeper liquidity and more reliable execution. At the same time, activity is migrating toward stablecoin pairs, tokenized real-world assets, and perpetual futures markets. These are areas where volatility is still present, but the trading is quieter, larger, and often more strategic.

What This Means for Solana Right Now

Solana isn’t losing activity — it’s maturing. The memecoin frenzy that fueled huge swings earlier this year has cooled, but the money hasn’t vanished. It has simply moved into sectors with longer-term viability. For memecoin traders, this phase may feel sluggish, with thinner liquidity and fewer explosive pumps. For developers and investors targeting utility-focused tokens or DeFi infrastructure, it might be one of the strongest signals yet that Solana is progressing beyond its meme-driven cycle.

The Bigger Picture

Trading patterns often reveal the future before narratives do. The waning dominance of memecoins on Solana, paired with steady overall volume, suggests the ecosystem is entering a new phase defined more by fundamentals than hype. The rotation doesn’t eliminate memecoins from the equation, but it reshapes their influence as capital gravitates toward deeper, more sustainable markets across the network.