- A decade-old Bitcoin whale has been steadily selling small portions of a 5,000 BTC stash at six-figure prices

- On-chain data shows long-term holder selling has largely cooled, with institutions absorbing remaining supply

- Rising whale dominance on exchanges suggests short-term volatility, even as the broader structure stabilizes

Twelve years ago, Bitcoin was barely taken seriously. It was a digital experiment trading around $332, something tech forums debated more than financial desks. Fast forward to January 18, 2026, and that same experiment is now sitting at the center of one of the most disciplined exit strategies the crypto market has ever seen.

New data from Lookonchain shows that a long-dormant OG holder, someone who’s held 5,000 BTC for over a decade, has sold another 500 BTC, worth roughly $47.77 million. This wasn’t a panic move. It was deliberate. Since December 2024, this whale has been trimming the position slowly, selling into six-figure prices and turning an original $1.66 million bet into a half-billion-dollar outcome, while still holding on to half the stack.

What This Whale Behavior Really Signals

This kind of selling tells you a lot about mindset. The whale isn’t treating Bitcoin like a speculative trade anymore. It’s more like long-term family wealth. By selling in small chunks, risk gets reduced without sacrificing future upside. There’s patience here, not urgency.

Instead of dumping everything and rattling the market, the holder sells during periods of strong demand. That approach has helped them lock in an average price north of $106,000, while keeping price action relatively stable. It’s almost textbook, and honestly, kind of rare.

Market Sentiment Isn’t as Bearish as It Looks

When ancient wallets move, fear spreads fast. In crypto, old coins waking up are often read as a warning sign. But the data suggests this isn’t distress selling. It looks more like a valuation milestone being met.

In a strange way, these sales are necessary. They provide the liquidity that institutions need to enter at scale. Spot Bitcoin ETFs, corporate treasuries, and other large allocators can’t build positions unless someone is willing to sell. Without OG holders taking profits, the market simply wouldn’t have enough supply to function at this size.

On-Chain Data Shows the Pressure Has Eased

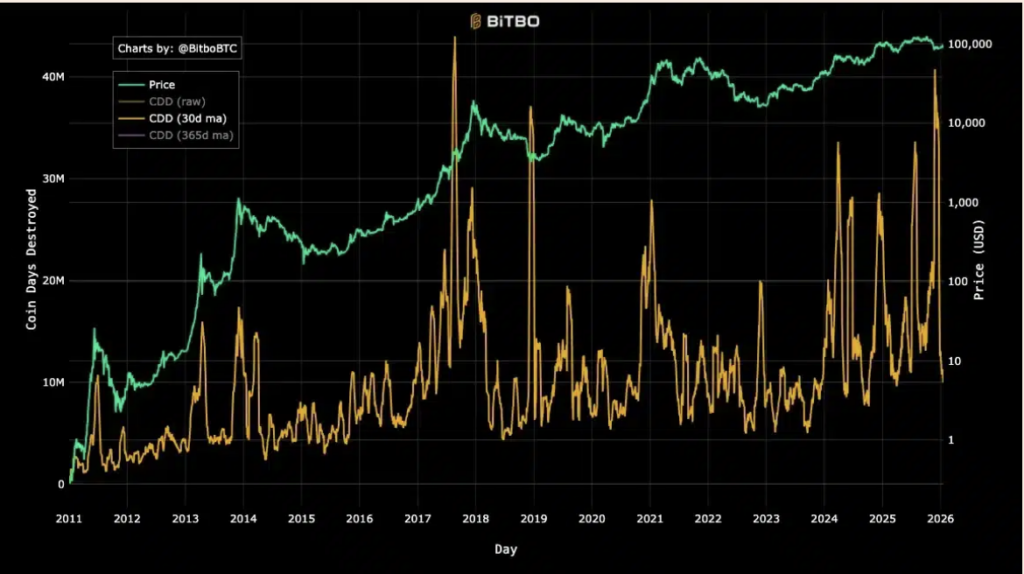

To see whether this selling hinted at something more dangerous, AMBCrypto looked at Bitcoin’s Coin Days Destroyed metric. CDD measures the economic weight of transactions by factoring in how long coins were held before being moved. Older coins moving equals higher CDD.

Back in November 2025, when Bitcoin fell from its $126,000 peak, CDD spiked sharply. That was real distribution. Long-term holders were selling in size. Today, that picture looks very different. CDD has dropped to around 9.96 million, far below recent highs.

That cooldown suggests most long-term sellers are done. A few early investors are still active, but the bulk of old supply appears to have already changed hands. Institutions, quietly, seem to be absorbing what’s left.

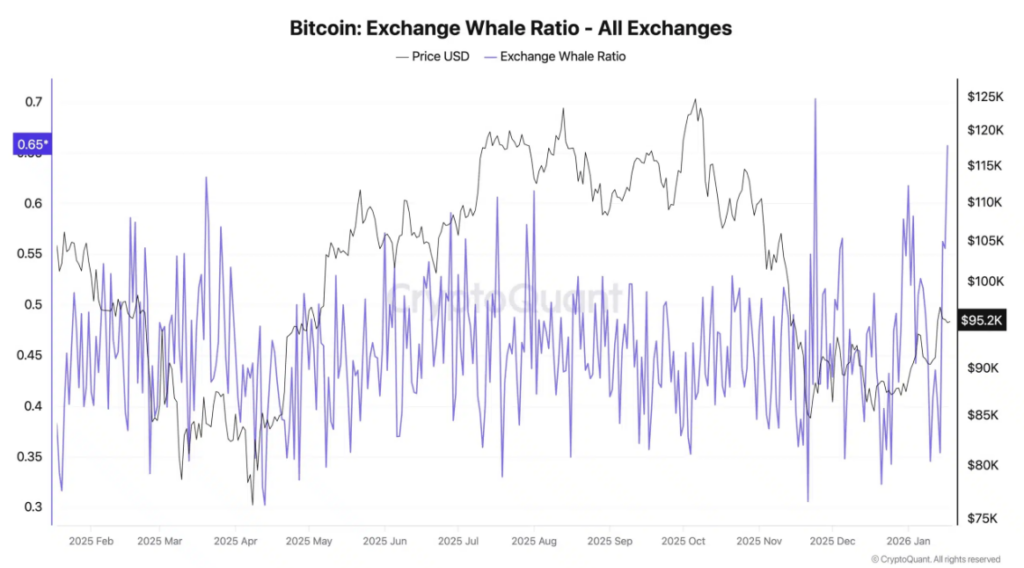

The Whale Ratio Adds a Short-Term Twist

Not all signals are calm though. The Exchange Whale Ratio, sitting near 0.657 at press time, points to short-term fragility. This metric tracks how much of total exchange inflow comes from the top ten largest transfers.

Anything above 0.5 is usually a red flag. At current levels, more than two-thirds of Bitcoin flowing into exchanges is coming from just a handful of large players. That implies retail demand has cooled, leaving price more sensitive to the actions of a few big wallets.

So while long-term selling pressure has eased, the market still feels top-heavy near the $95,000 area. It doesn’t mean collapse, but it does mean volatility can show up fast.

A Different Kind of Market in 2026

As January 2026 unfolds, the data points to a structural reset rather than a breakdown. The selling that defined late 2025, driven by OG exits, ETF outflows, and leverage getting wiped out, has mostly run its course.

What’s replacing it looks different. In mid-January alone, institutions absorbed roughly 30,000 BTC from the market. During that same period, miners produced just 5,700 BTC. That imbalance matters.

Bitcoin is no longer just reacting to speculation. It’s being redistributed, slowly, from early believers to long-term allocators. The chart may still chop, sentiment may still swing, but underneath it all, the structure feels… sturdier than before.