- Polygon Capital and Coinfund raise over $350M for their investment fund.

- Polychain raised $200M for its fourth fund and plans to raise a total of $400 million.

- Coinfund had its sights set on raising $125 million but managed to rake in an additional $33 million.

Crypto venture capital firms Polychain Capital and Coinfund have raised over $350 million for their investment fund, indicating returning confidence in the crypto industry.

According to a July 18 report, Polychain Capital has raised an impressive $200 million in the “first close” of its fourth investment fund, with plans to reach $400 million. The close signals that Polychain has now signed agreements with investors and can begin issuing funding to start-ups and projects. Additionally, Polychain let go of three members of its research team due to its new investing priorities.

As per Pitchbook data, Polychain manages three funds totaling around $2.6 billion in assets under management.

On the other hand, Coinfund, a VC firm, raised $158 million for its fourth seed fund, exceeding its initial target of $125 million by $33 million. This increase was attributed to a renewed interest in the crypto space.

The New York-based firm, known for its portfolio of 105 companies, prioritizes projects that contribute to developing crypto infrastructure, specifically focusing on enabling greater decentralization.

Coinfund’s Significant Investments

Coinfund has already made significant investments in companies such as Giza. This AI-focused venture raised about $3 million in seed funding and infrastructure projects like Cosmos, where it helped raise $10 million to advance the development of its Neutron smart contract platform in collaboration with Binance Labs and others.

The latest developments by Coinfund come amidst a broader retreat from crypto investments after a challenging year marked by multiple failures, including the downfall of the Terra-Luna stablecoin and FTX exchange. Higher interest rates have notably made borrowing more expensive, complicating fundraising.

Coinfund’s co-founder and chief investment officer, Alex Felix, has stipulated that the demise of cryptocurrency exchange FTX last year had led developers to double down on completing the roadmap to a decentralized application developer stack. As a result, scalability, interoperability, and user experience have become renewed focus areas.

While previous fundraising rounds centered on established categories like NFT gaming and DeFi, this recent round shifted its spotlight towards emerging sectors, particularly early-stage crypto start-ups, especially those involving artificial intelligence (AI).

As of Jan. 1, the AI industry had seen more than 12 billion dollars in venture funding as investors race to capitalize on the nascent sector.

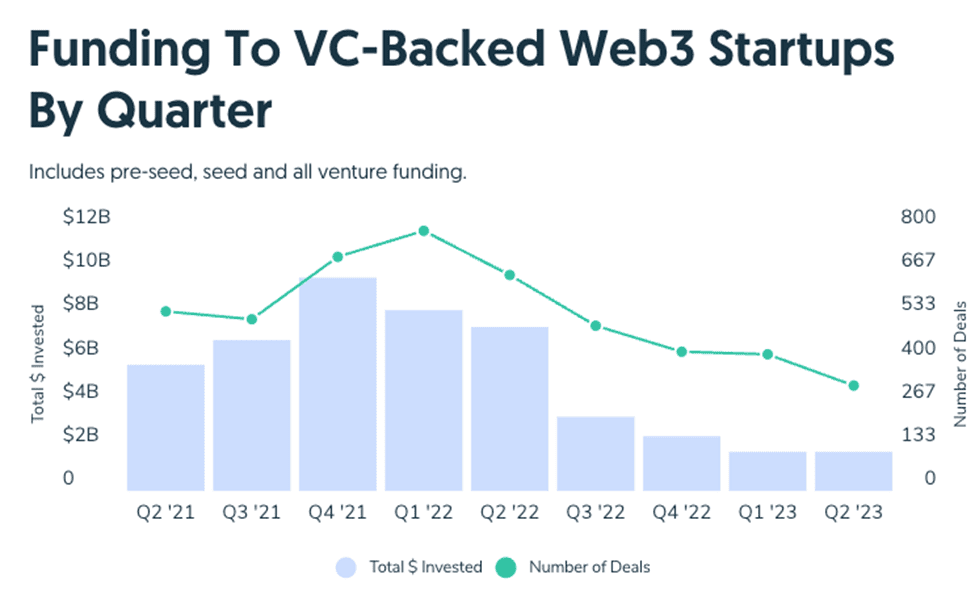

However, per the business analytics firm Crunchbase data, the total volume of venture funding for crypto and Web3 start-ups has declined by 76% from last year.

Venture funding for crypto start-ups in the past two years. Source: Crunchbase

It is worth mentioning that, despite the challenges in the crypto space, the recent funding achievements by Polychain Capital and Coinfund demonstrate the continued interest and resilience of the crypto venture capital landscape.

These investments will fuel the growth and development of innovative projects within the crypto ecosystem, contributing to the industry’s overall advancement.