- Do Kwon’s attorneys are requesting the SEC’s case be dismissed, citing a lack of personal jurisdiction and arguing that stablecoin UST is not a security but a currency outside of the SEC’s jurisdiction

- Terraform Labs, founded by Kwon, didn’t perform any public offerings of securities, making the SEC’s legal position weak

- Kwon’s lawyers argue that Congress has not granted the SEC the power to regulate the digital assets at issue

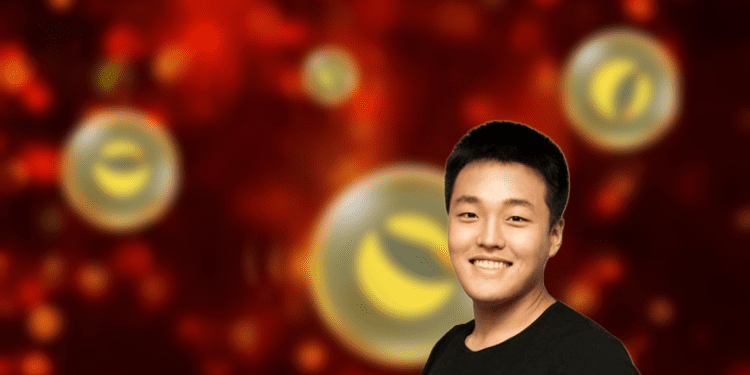

The battle between Do Kwon and the Securities and Exchange Commission (SEC) has taken an unexpected turn. Kwon’s attorneys claim that the SEC should not be authorized to bring charges against their client, and they’ve submitted paperwork requesting the case be dismissed.

In filings submitted to the court, Kwon’s legal team cites a lack of personal jurisdiction in the SEC’s case and argues that the stablecoin UST at the core of the situation isn’t a security but rather a currency – this means it’s outside of the SEC’s jurisdiction.

Furthermore, the filings state that Terraform Labs, which Kwon founded but which collapsed earlier this year, didn’t-didn’t perform any public securities offerings that would have necessitated SEC registration. The SEC’s legal position needs to be stronger.

The court filings said, “UST are not securities because stablecoins are currency and thus specifically exempt from the federal securities laws. Like other currencies, UST served as a unit of account, a store of value, and a medium of exchange. Indeed, the expectation that UST would remain stable and not fluctuate significantly in value precludes alleging any expectation of “profit” from UST (as opposed to from individual, irrelevant use of UST), which is essential to something being an ”investment contract.” The SEC’s theory that UST later became an investment contract when deposited in the Anchor Protocol fails.”

Do Kwon’s lawyers argue, “Congress has not granted the SEC the power to regulate the digital assets at issue here?”

Kwon was detained in Montenegro last month after being on the run for a while over the collapse of his company, which had been worth billions of dollars. Kwon is also facing charges of violating capital-markets law in South Korea and criminal fraud charges in the United States.

The United States and South Korea have requested Kwon’sKwon’s extradition, but his arraignment in Montenegro must come first. Despite the various legal challenges he faces, Kwon’sKwon’s attorneys feel confident in their ability to get the SEC’s case dismissed. The SEC has until May 12th to challenge this motion.

Request for Do Kwon’s Extradition

The founder of the collapsed cryptocurrency issuer Terraform Labs, Do Kwon, and his business associate, Han Chang Joon, were arrested in Podgorica, Montenegro’s capital city, in March. However, the extradition process will not start until after Kwon and Joon’s separate case for falsifying identification documents.

Kwon and Joon were subjects of an international warrant issued by South Korea after the collapse of the stablecoin, terraUSD (UST), last year, which shook the crypto market to its core. Montenegro’s Justice Minister, Marko Kovac, said that he needed to be made aware of how and why the two arrived in the country.

Apart from South Korea, the US has also requested Kwon’s laptops and other devices, alongside suspected cryptocurrency, for potential evidence. Given the high possibility of crucial evidence in these devices, this is a critical step in the ongoing investigation.