- BitMine bought around 20,000 ETH for $41.98M as Ethereum continued to slide.

- The firm now holds roughly 4.29M ETH, already past 70% of its goal to control 5% of supply.

- BitMine is also pivoting into staking and higher-risk acquisitions to outperform the cycle.

BitMine, now widely viewed as the largest corporate holder of Ethereum, has been treating the market’s chaos like a discount window. While a lot of investors have been spooked by ETH’s recent volatility, the firm has leaned into it and expanded its treasury holdings instead. It’s an aggressive stance, and it makes it pretty clear BitMine is playing a long game here.

BitMine Buys 20,000 ETH as Prices Slide

On February 7, blockchain tracker Lookonchain flagged BitMine’s latest purchase, citing Arkham Intelligence data. The company acquired around 20,000 ETH for roughly $41.98 million, which is a serious allocation considering how fragile the market looks. This move also pushes BitMine closer to its longer-term goal of controlling 5% of Ethereum’s circulating supply, a target that would put them in a league of their own.

The Company Is Quietly Closing In on Its 5% Supply Goal

Strategic ETH Reserve data shows BitMine currently holds about 4.29 million ETH, meaning it has already reached more than 70% of that objective. That’s the part that really separates this story from the usual corporate dip-buy headlines. This isn’t a one-time treasury play, it’s a sustained accumulation campaign, and BitMine seems comfortable being one of the biggest whales in the ecosystem.

Ethereum’s Crash Hasn’t Shaken BitMine’s Conviction

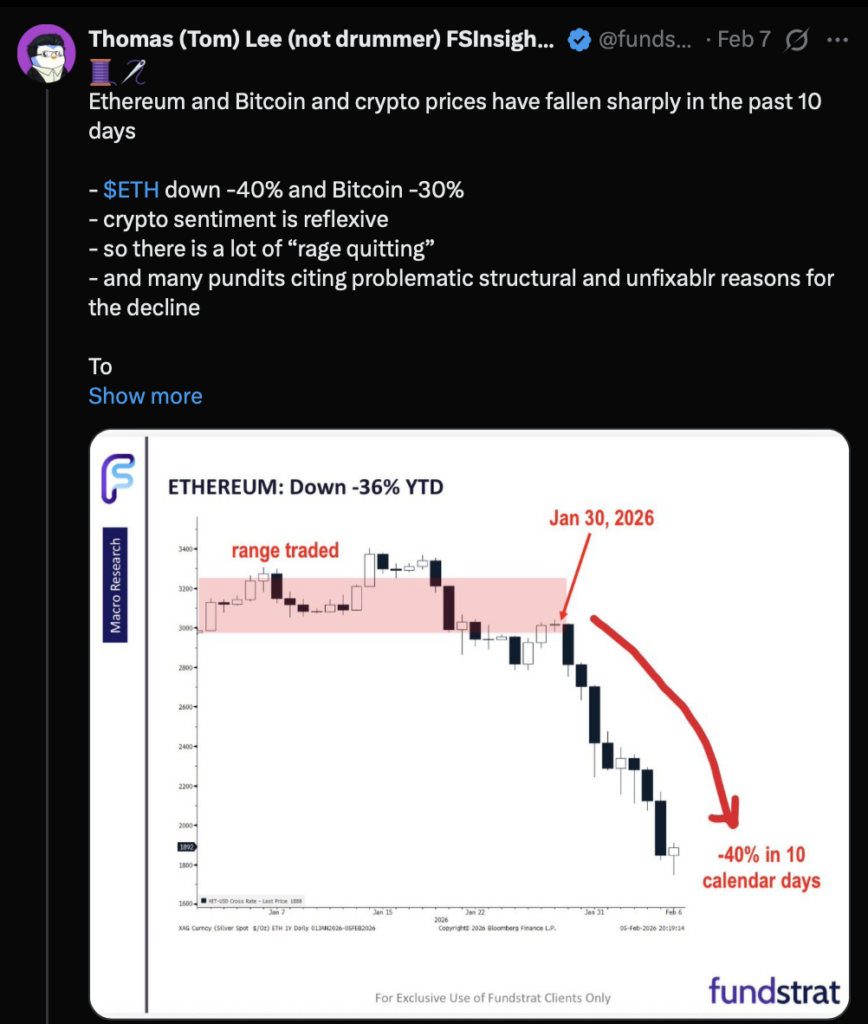

The timing is bold because Ethereum has been under heavy pressure. ETH is down roughly 31% over the last 30 days and was trading around $2,117 at press time, with the past week seeing lows near $1,824. That’s the weakest level since May 2025, and it’s exactly the kind of drawdown that normally forces big holders to rethink their exposure.

Tom Lee Calls Volatility “A Feature, Not a Bug”

Even so, BitMine chairman Tom Lee has stayed firm, saying Ethereum is “the future of finance.” He’s also dismissed concerns around deepening unrealized losses, arguing that the volatility is part of what makes the asset unique. Lee backed up his stance by pointing out that Ethereum has survived drawdowns of 60% or worse seven times since 2018, framing this downturn as painful but historically normal.

BitMine Is Moving Beyond a Simple Buy-and-Hold Strategy

Another key detail is that BitMine is evolving past the standard corporate treasury model. The firm says it is shifting toward “accretive acquisitions” and more aggressive capital deployment, aiming to outperform the cycle instead of just holding through it. That includes high-risk “moonshot” allocations into smaller-cap tokens like Orbs, plus unconventional investments such as media exposure through Mr Beast.

Staking Nearly 3 Million ETH for Yield in a Risk-Off Market

Alongside these moves, BitMine continues to generate yield by staking nearly 3 million ETH. The idea is to reduce the drag of falling spot prices while the macro environment remains sharply risk-off. In simple terms, BitMine is trying to keep the machine running even while the market feels frozen, and they’re betting Ethereum’s long-term fundamentals will outlast the current fear cycle.