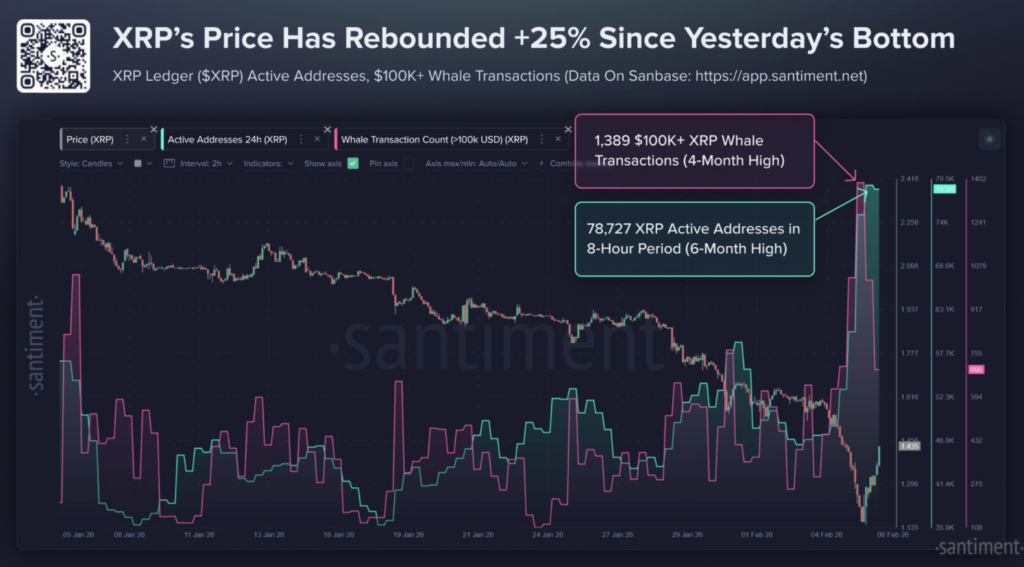

- XRP rebounded roughly 25% from the lows after dropping below $1.15 during peak market panic

- Whale transactions over $100K spiked to a four-month high, signaling aggressive accumulation

- XRPL active addresses hit a six-month record, confirming heavy participation during the reversal

The last few days have been some of the ugliest crypto has seen in months. Bitcoin, Ethereum, and XRP all took brutal hits, with major assets dropping around 15% in a single day as panic ripped through exchanges. Liquidations piled up, fear spiked, and a lot of traders did what they always do in these moments, they rushed for the exits.

But XRP is now doing something that caught the market off guard.

According to a new report from Santiment, XRP’s sharp breakdown below key psychological levels may have been the exact moment whales were waiting for. Instead of continuing to collapse, XRP snapped back aggressively, climbing roughly 25% off the bottom in less than a day, making it one of the strongest recoveries among large-cap crypto assets.

And the on-chain data suggests this move wasn’t random luck or a “dead cat bounce.” Something bigger was happening underneath.

Santiment says XRP bounced 25% from the lows in 18 hours

Santiment highlighted that XRP bottomed below $1.15 less than a day ago, right in the middle of peak market panic. At that moment, sentiment was breaking down fast, and traders were openly questioning whether XRP could slide below $1.00.

Then the market flipped.

Within roughly 18 hours, XRP surged back above $1.50, forcing a lot of panic sellers to watch the bounce without them. Santiment described the move as “a particularly huge tear,” noting that even in a broader market rebound, XRP’s recovery stood out.

The takeaway is pretty simple, even if it’s uncomfortable for anyone who sold the lows: the sell-off may have been driven by fear, but whales were treating it like an opportunity.

Whale accumulation spiked to a four-month high during the dip

One of the strongest signals in Santiment’s data was the sudden explosion in whale activity. During the sell-off, the XRP Ledger recorded 1,389 separate transactions worth $100,000 or more. That’s the highest whale transaction count in four months, and the timing is the part that really matters.

It happened precisely when retail traders were panic-selling.

This is the classic footprint of smart-money behavior. Large holders tend to accumulate when liquidity is high and weaker hands are exiting, because it lets them build positions without chasing price. Santiment’s chart suggests the XRP dip wasn’t just a crash, it was also a major accumulation window happening in real time.

XRP active addresses hit a six-month record in one burst

Even more striking than whale transfers was the spike in network participation. Santiment reported that unique active addresses on XRPL surged to 78,727 in a single 8-hour candle, marking the highest activity level in six months.

On the chart, it shows up as a sharp vertical move, basically a participation explosion. And when you see that kind of address growth during a sell-off, it usually means one of two things.

Either the market is getting flooded with speculative interest because volatility is insane, or large-scale accumulation and repositioning is taking place as traders rotate back in. Sometimes it’s both. Either way, it confirms the same point: XRP’s dip was heavily traded, heavily watched, and not ignored.

Panic selling and whale buying created a textbook reversal setup

Santiment’s commentary makes the dynamic clear. Retail traders were focused on fear, asking the usual questions: is XRP going below $1, is the crash getting worse, should I exit before the next leg down. Meanwhile, whales were doing the opposite, stepping in during the exact window when panic was peaking.

That contrast is what makes this rebound feel different. Historically, strong reversals often begin when retail capitulates, on-chain activity spikes, large holders step in, and price rebounds sharply off the lows. XRP may have checked every one of those boxes in a single day, which is not common.

It’s also why the bounce felt so violent. When selling exhausts and buy pressure hits at the same time, price doesn’t recover slowly. It snaps.

What this could signal next for XRP

Santiment emphasized that both whale accumulation and active address surges are major reversal signals for any asset. That doesn’t mean XRP is guaranteed to move straight up from here, because crypto never moves that cleanly. But it does suggest the market may have reached an important inflection point.

After one of the harshest multi-day drawdowns in recent memory, XRP’s bounce now has on-chain confirmation behind it, not just price action. If whale demand continues and broader market conditions stabilize, XRP could enter a new recovery phase faster than many traders expected, and maybe faster than they’re ready for.