- XRP remained the fifth-largest crypto asset in Q4 2025, but market cap fell 34.5% quarter-over-quarter

- Network fee activity dropped sharply, reflecting weaker demand and reduced burn

- Spot XRP ETFs launched in the U.S. and reached $1B AUM quickly, reshaping institutional access

XRP closed Q4 2025 still holding its place among the biggest names in crypto, finishing the quarter as the fifth-largest asset by market cap. That’s the headline. But the details underneath it are a lot less comfortable.

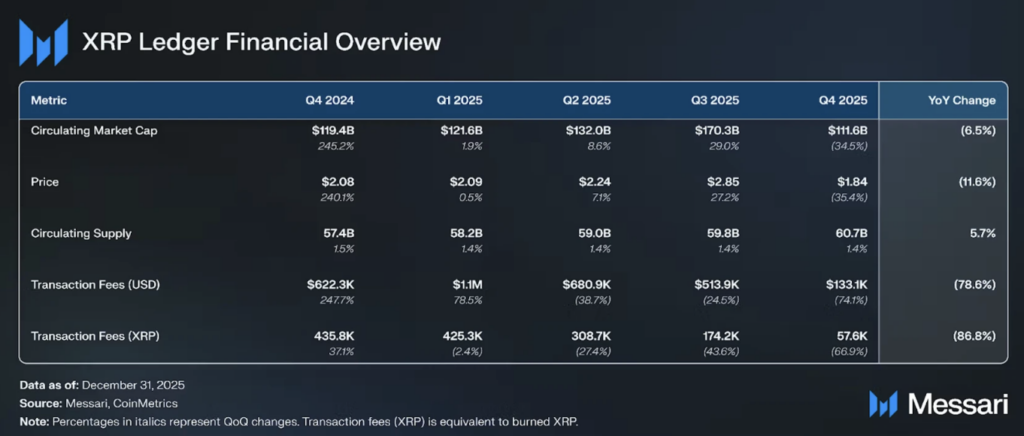

According to Messari’s February 6 report, XRP’s circulating market cap ended the quarter at $111.6 billion, down 34.5% from Q3. That decline was sharper than the combined drop across Bitcoin, Ethereum, and Solana, which together fell 24.4% over the same period. So yes, the whole market pulled back, but XRP got hit harder than the majors.

Price also weakened, with XRP dropping 35.4% quarter-over-quarter to around $1.84. The market cap decline was slightly smaller than the price drop because circulating supply grew by about 1.4%. Compared to the same quarter a year earlier, XRP’s market cap was also down 6.5% from the $119.4 billion level recorded at the end of Q4 2024.

Network fee activity collapsed, and it’s not a small dip

One of the clearest weak spots in the report was fee activity. Transaction fees measured in dollars dropped from roughly $513,900 in Q3 to about $133,100 in Q4, a 74.1% decline. Native fee totals also fell sharply, with fees dropping from 174,200 XRP to 57,600 XRP over the same period.

XRPL is different from many chains in one key way. These fees are burned rather than distributed to validators or stakers, which means lower fee activity doesn’t just reflect reduced demand, it also reduces the already small amount of XRP being removed from supply. And since XRPL fees are tiny to begin with, it highlights how quiet things were during the quarter.

Spot XRP ETFs changed U.S. market access fast

Despite the weaker quarter in price and fees, one major development came from Wall Street. Q4 2025 marked the launch of large U.S. spot XRP ETFs after SEC approval, a moment that would have sounded impossible a few years ago. These ETFs reached $1 billion in assets under management in under four weeks, making them the fastest-growing crypto ETF segment since Ethereum.

The first listing was Canary Capital’s XRPC on November 13. It was followed by Franklin Templeton’s XRPZ, Grayscale’s GXRP, 21Shares’ TOXR, and Bitwise’s XRP product. By January 28, 2026, spot ETFs held 789.8 million XRP, around 1.3% of circulating supply, which is a meaningful chunk for such a short timeframe.

Canary led holdings with 182.6 million XRP, followed by Bitwise at 160.2 million, Franklin Templeton at 142.8 million, 21Shares at 118.5 million, and Grayscale at 112.3 million. The pace of adoption was fast, even if the market itself was trending down.

This ETF surge only became possible after the Ripple vs. SEC case officially closed in August 2025, resolving XRP’s legal status for secondary market trading in the U.S. CME also expanded access through XRP futures options in October and spot futures in December, giving institutions more regulated ways to trade and hedge.

XRPL supply mechanics remain a long-term factor

XRPL’s supply structure continues to shape the asset’s long-term dynamics. Since inception, only about 14.3 million XRP has been burned, valued around $26.3 million at Q4 prices. The reason is simple: transaction fees are extremely low, often under $0.0008 per transaction, so burn remains minimal even during active periods.

Ripple also continues releasing one billion XRP from escrow each month. Any unused XRP is recycled back into new escrow contracts until the remaining 34.2 billion XRP is eventually in circulation. This predictable monthly flow is a constant factor traders keep in mind, even if it doesn’t dominate short-term price action every day.

Network activity stayed mostly flat, with small shifts in behavior

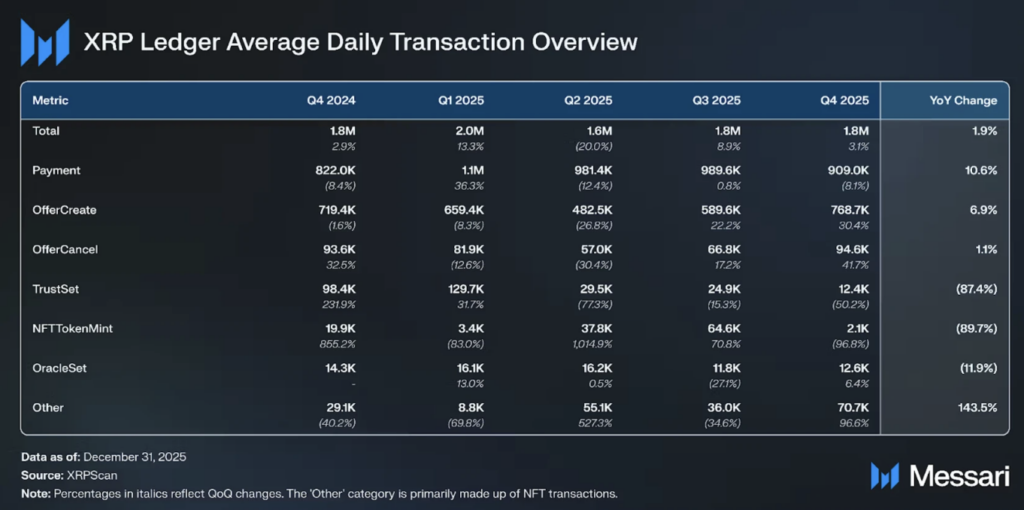

Network activity overall remained relatively steady. Daily active addresses fell 8.2% to about 49,000, while total addresses grew 5.7% to 7.3 million. Transactions per day averaged 1.83 million, up 3.1%, showing that usage didn’t collapse even as fees dropped sharply.

Payments remained the most common activity on XRPL, but OfferCreate rose as well, suggesting more usage of the built-in exchange functionality. That shift matters because it hints at growing engagement with XRPL’s trading features, even if the broader market was cooling off.