- TRON has overtaken Ethereum in USDT dominance, capturing the largest share of USDT supply

- TRON’s USDT supply is rising while Ethereum’s is declining, even during a risk-off market

- High staking plus growing stablecoin liquidity may be helping TRON build a more resilient DeFi base

Stablecoin dominance is basically the first step toward DeFi dominance. The logic is pretty simple. Networks that hold more stablecoins on-chain usually have deeper liquidity, and that liquidity makes everything work better, trading, lending, borrowing, the whole loop. It’s not the most exciting metric, but it’s one of the most important.

And with Tether’s USDT still making up roughly 60% of the stablecoin market, the chains that host the most USDT get a real structural advantage. That’s why Layer 1s have started treating stablecoin share like a competition, not a side statistic.

TRON just edged out Ethereum in USDT dominance

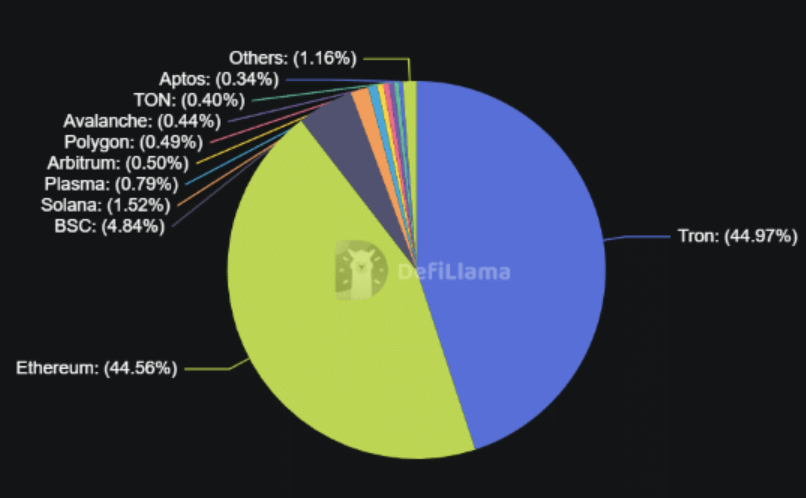

According to DeFiLlama, TRON has now officially overtaken Ethereum in USDT dominance. TRON currently holds about 44.97% of USDT supply, while Ethereum sits slightly behind at 44.56%. The gap is small, sure, but the signal is loud. Stablecoins are becoming a key battleground, and TRON is clearly pushing hard.

Zooming out makes the shift even more obvious. Over the past month, TRON’s USDT supply increased by around 3.62%, reaching 83.49 billion. During the same period, Ethereum’s USDT supply dropped by about 5.6%, falling to 82.74 billion. That’s not just a rounding error, it’s a meaningful swing in stablecoin flow.

What makes this especially interesting is the timing. TRON’s growth is happening in a risk-off market, when major assets are correcting and traders are moving more defensively. Ethereum, for example, fell roughly 15.36% over the month and hit multi-month lows. TRX, meanwhile, limited its losses to about 2.6%, which raises an uncomfortable but fair question.

Is TRON positioning itself as a more resilient DeFi hub, one that can handle volatility better than ETH, simply because its stablecoin base is growing while others are shrinking?

The “stablecoin war” is real, but Ethereum still dominates TVL

Liquidity is still what drives DeFi dominance, and analysts have started calling this whole trend a “stablecoin war” between Layer 1s. TRON is winning the USDT share fight right now, but Ethereum still owns the broader DeFi landscape. Ethereum’s TVL is sitting near $58 billion, compared to TRON’s roughly $4 billion, which is a massive gap.

So yes, Ethereum remains the primary hub for overall DeFi liquidity. That hasn’t changed. But TRON is carving out a very specific lane, being the most efficient stablecoin rail, especially for USDT, and that lane matters more than people want to admit.

TRON’s locked supply is rising fast, and it changes the market structure

Another piece of the puzzle is staking. Data shows TRON’s locked supply just hit a record 46.2 billion TRX, roughly 48% of the total supply. That’s a big number. Ethereum’s locked supply sits closer to around 30%, meaning TRON has a higher share of tokens removed from active circulation.

From a technical perspective, higher staking participation reduces circulating supply pressure, which can help a token hold up better during volatile markets. It doesn’t make TRX immune, obviously, but it can dampen the sell-side impact. Combine that with a growing USDT base, and you start to see a flywheel forming.

Staked tokens can reduce volatility. Stablecoin liquidity can attract more users and activity. And more activity, in turn, can strengthen the network’s role as a DeFi rail.

TRON is quietly building a different kind of DeFi moat

TRON may not be competing with Ethereum head-on in every DeFi category. It doesn’t need to. Instead, it’s building a more focused moat around stablecoin settlement, and it’s doing it while the market is in a risk-off phase. That’s what makes this shift feel more structural than hype-driven.

If stablecoins are the fuel of DeFi, then TRON is trying to control the fuel line. Ethereum still owns the broader liquidity hub, but TRON is positioning itself as the chain that moves USDT most efficiently. And in crypto, sometimes being the rail matters just as much as being the destination.