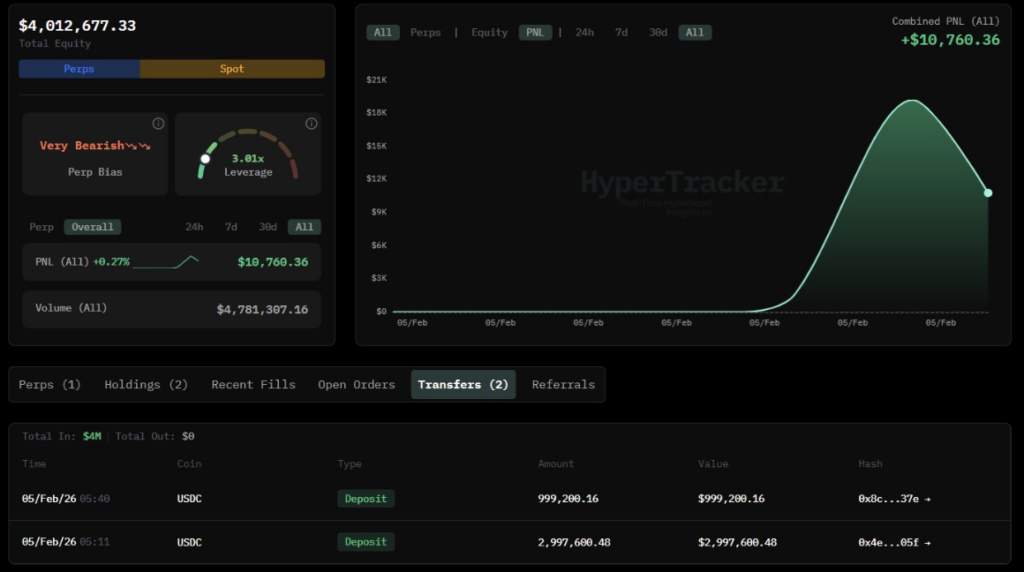

- A new wallet deposited $4M into Hyperliquid and opened a 3x SOL short, signaling downside conviction

- SOL remains in a descending channel with weak RSI, and $90 is the key level bulls must defend

- Top traders remain heavily long, increasing the risk of forced liquidations if price breaks lower

A newly created wallet just deposited $4 million in USDC into Hyperliquid, then immediately opened a 3x leveraged short on Solana. That kind of move usually isn’t casual, and it doesn’t look like a hedge either. It reads like fresh capital coming in with a clear bearish view, especially since the trader chose moderate leverage, enough to matter, but not so high that liquidation risk becomes reckless.

The timing adds another layer. This short was opened while SOL was already trading below key structural levels, which strengthens the downside narrative. New wallets can sometimes signal new information, or at least a strong macro bias, and this one showed up with conviction. What makes it more interesting is that this short isn’t happening in a vacuum, it’s directly clashing with broader market positioning.

Solana structure stays weak as sellers defend the trend

Solana remained trapped inside a well-defined descending channel on the daily chart at press time. Lower highs, lower lows, same story, and price has continued to respect that structure. The rejection near $120 ended up being a big deal, because it lined up with horizontal resistance and the channel midpoint, basically a perfect place for sellers to step in and defend.

Once SOL failed there, downside pressure accelerated and price slid below the $100 level, reinforcing bearish control. Overhead, $147.85 remains the major invalidation zone, and repeated failures to reclaim it have looked more like distribution than healthy consolidation. Meanwhile, price is now hovering near the lower boundary of the channel around $90, a zone that previously offered only brief pauses before continuation lower.

Momentum supports the bearish case too. The daily RSI has slipped toward 23, which reflects sustained selling pressure rather than a clean capitulation bounce. More importantly, RSI hasn’t printed a bullish divergence, and prior rebounds struggled to even push above 40. That’s weak. If $90 fails decisively, SOL could extend toward the $80 support area, where historical demand and psychological interest may finally show up again.

Top traders remain heavily long despite the downtrend

Here’s where things get messy. Binance top trader data shows long accounts sitting near 82%, with shorts around 18%, pushing the long-to-short ratio above 4.5. That’s a pretty extreme skew, and it tells you one thing: the crowd still expects a rebound, even while the chart keeps bleeding.

But heavy long concentration can become a problem, not a bullish signal. When price fails to recover, forced unwinds often follow, and that’s how downtrends suddenly speed up. This positioning also contrasts sharply with the Hyperliquid whale short, creating a clear divergence between concentrated capital and aggregated trader exposure. That imbalance is where volatility usually comes from.

Open Interest drops as leverage resets, but risk remains

Open Interest has declined by about 4.37%, falling to roughly $6.19 billion. That suggests leverage is being reduced across the derivatives market, with traders closing positions rather than adding aggressively. In a falling market, declining OI often reflects long exits, and given the long-heavy positioning, that interpretation fits.

Still, reduced leverage doesn’t remove directional risk. It just resets it. The market can now rebuild leverage in either direction, and if price continues to stall or grind lower, new short exposure could come in, extending volatility instead of calming it down. So this isn’t “relief” yet, it’s more like cleanup.

Long liquidations dominate as SOL trades near support

Liquidation data shows longs taking most of the damage recently. Total long liquidations reached around $3.59 million, while shorts saw roughly $733,000. That imbalance confirms downside stress on bullish positioning, and it wasn’t isolated to one venue either. Binance, Bybit, and OKX all recorded heavier long liquidations, and Hyperliquid also showed more long pressure than shorts.

These liquidations occurred while SOL hovered near $90, meaning price weakness is already forcing leveraged bulls out. At the same time, liquidation clusters remain relatively modest so far, which is important. It suggests there is still room for a larger downside flush if SOL fails to hold support and the market begins to unwind more aggressively.

Solana sits at a dangerous junction

Solana is now sitting at a point where structure, momentum, and positioning are colliding. The chart remains bearish, RSI is weak, and price is still trapped in a descending channel. At the same time, the broader trader crowd remains heavily long, while a well-capitalized Hyperliquid short signals that at least one big player is leaning the other way.

Open Interest is falling, but that looks more like leverage resetting than real relief. If SOL stalls near support or slips further, long liquidation pressure could accelerate quickly. And in that kind of environment, Solana may need to go through a forced deleveraging phase before any durable recovery can finally stick.