- Hedera, Chainlink, and Avalanche lead Santiment’s latest RWA development rankings

- Mid-ranked projects like VeChain and IOTA show renewed developer momentum

- RWA-focused protocols continue to build aggressively despite market volatility

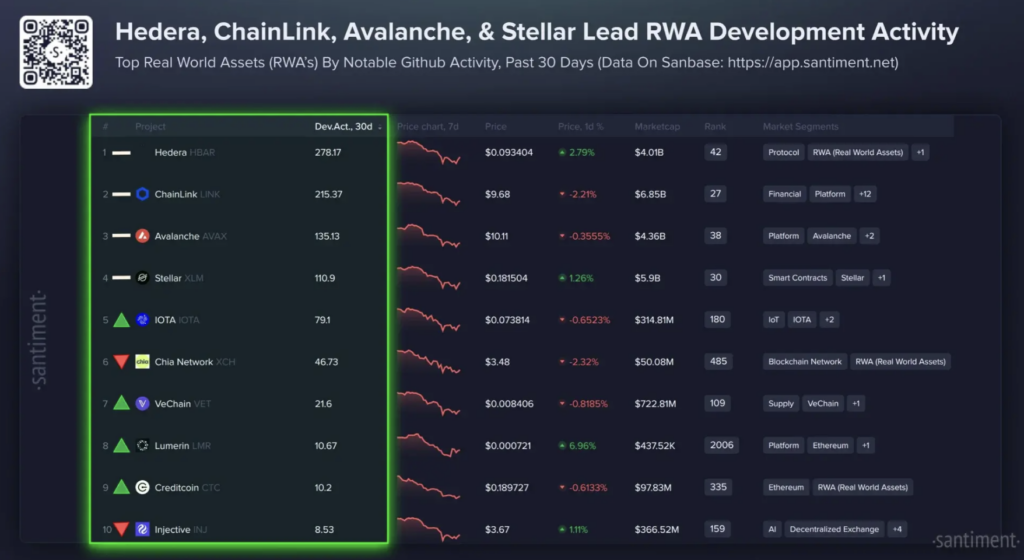

Analytics firm Santiment has released its latest rankings tracking crypto projects focused on Real World Assets, a sector that continues to pull in both institutional interest and serious developer attention. The data looks at development activity across protocols working on tokenized finance, payments, and supporting infrastructure. It also shows how each project’s position has shifted since last month, offering a snapshot of where momentum is quietly building.

While prices across the market remain choppy, the underlying work hasn’t slowed. In fact, Santiment’s numbers suggest the opposite, with RWA-focused development continuing to accelerate even as traders remain cautious. That contrast is becoming more common across crypto right now.

Hedera leads as enterprise focus stays strong

Hedera held on to the top spot once again, reflecting its continued push into enterprise adoption and real-world tokenization frameworks. The network has spent years positioning itself as infrastructure-first, and that approach appears to be paying off in terms of sustained development effort.

Chainlink followed closely in second place, which comes as little surprise. As the leading oracle provider, LINK plays a central role in connecting blockchains to off-chain data, a requirement for most RWA use cases. Avalanche secured third, supported by recent integrations with banks and asset managers experimenting with tokenized funds and stablecoins.

Mid-table shifts signal renewed momentum

Stellar claimed fourth place, maintaining its long-standing focus on payments and cross-border settlement. IOTA climbed into fifth, signaling renewed interest in machine-to-machine payments and finance tied to IoT ecosystems, an area that had gone quiet for a while.

Further down the list, Chia slipped to sixth, while VeChain moved up to seventh as activity around supply chain tokenization picked up again. Lumerin and Creditcoin also posted gains, landing in eighth and ninth positions respectively, suggesting more developers are circling niche RWA use cases. Injective rounded out the top ten, falling slightly despite its strong footing in decentralized derivatives.

RWA development keeps accelerating despite volatility

Taken together, the rankings underline how Real World Assets are becoming a major focal point for blockchain development. From tokenized treasuries to state-backed stablecoins and on-chain settlement rails, teams are racing to build systems that bridge traditional finance with decentralized networks.

Santiment’s data suggests that even as crypto prices swing sharply, developer activity around RWA protocols continues to climb. That steady progress could position these projects as key infrastructure players when the next phase of adoption begins, whenever the market decides to cooperate.