- Jupiter plans to bring Polymarket to Solana, positioning prediction markets as a core product

- The exchange disclosed a $35 million JUP-denominated investment from ParaFi Capital with limited detail

- Key questions around rollout, settlement, and compliance remain unresolved

Jupiter announced it plans to bring Polymarket to Solana for the first time, marking a notable expansion of its on-chain product lineup. The Solana-based decentralized exchange shared the update on X, framing prediction markets as a core vertical rather than a side experiment. The timing stood out, especially as prediction markets have been quietly regaining attention across crypto trading platforms.

This Solana news landed alongside a separate funding disclosure from Jupiter, which the exchange positioned as part of a broader on-chain expansion push. Taken together, the updates suggest Jupiter is trying to widen its footprint beyond swaps, leaning into more expressive financial products. Still, many of the details remain, for now, loosely defined.

Jupiter outlines prediction markets as a core product

According to Jupiter, users will be able to trade prediction markets directly on a single on-chain platform. In its post, the exchange said that for the first time, Polymarket would be accessible on Solana through Jupiter itself. The messaging was clear in intent, even if execution details were not.

Jupiter described Polymarket as the largest prediction market in crypto and said the integration would support its goal of building a more complete predictions hub. However, the announcement stopped short of explaining how markets would be listed, priced, or ultimately settled. There was also no clarity around custody, access mechanics, or how compliance considerations would be handled.

Neither Jupiter nor Polymarket shared a rollout timeline or launch sequence. These omissions left open questions, especially as prediction markets increasingly intersect with elections, macro events, and major news cycles. Regulatory scrutiny has followed that growth, and this announcement did little to address those concerns directly.

ParaFi Capital backs Jupiter with a JUP-denominated investment

Alongside the integration news, Jupiter disclosed a $35 million strategic investment from ParaFi Capital. The exchange said the investment was fully denominated in JUP, its native token, and settled entirely in JupUSD, its dollar-pegged asset. While the deal reportedly closed at spot price, Jupiter did not share the reference rate or how pricing was determined.

Jupiter also said ParaFi agreed to an extended token lockup, but details were scarce. The exchange did not disclose lock duration, vesting schedules, or whether governance rights were involved. That lack of transparency leaves some room for speculation around influence and long-term alignment.

Jupiter co-founder Meow noted that prediction markets would be a major focus over the coming year. He pointed to planned work on prediction market APIs and discovery tools, suggesting an effort to make these markets easier to find and trade, not just easier to launch.

Jupiter’s existing scale raises expectations

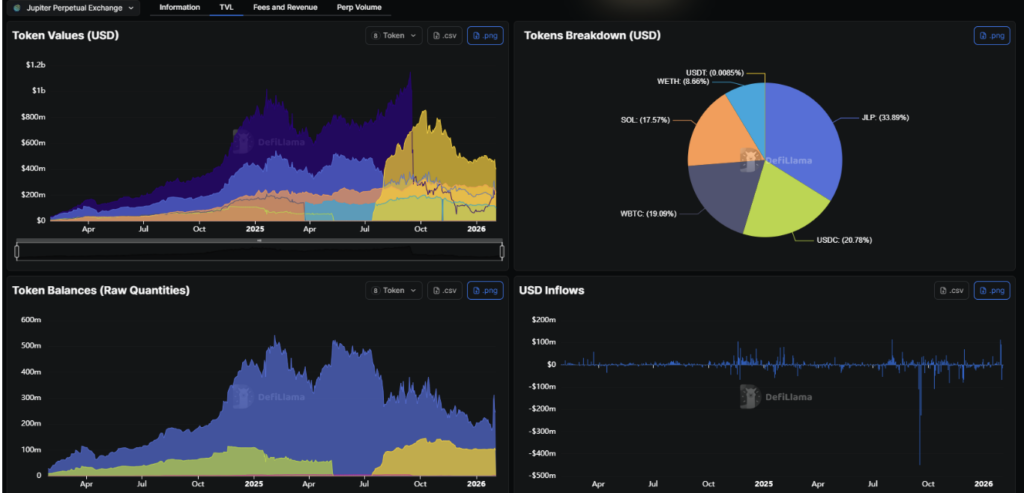

Jupiter already operates at significant scale on Solana, according to DefiLlama data. Total value locked sits near $2.35 billion, with annualized fees approaching $650 million and protocol revenue estimated around $150 million. These numbers place Jupiter among the most active decentralized venues in the Solana ecosystem.

With that scale comes higher expectations, especially around execution quality and risk management. Prediction markets depend heavily on reliable settlement and oracle infrastructure, yet Jupiter has not specified which oracle model it plans to use. That detail will matter once real capital starts flowing into these markets.

The Solana news also highlights unresolved compliance questions. Regulators continue to scrutinize prediction markets in several jurisdictions, and Jupiter has not addressed geographic availability or access restrictions. For now, those questions remain unanswered.

What this means in the near term

The immediate impact of this development depends almost entirely on implementation and timing. Jupiter has not announced a launch date, phased rollout, or liquidity plan, leaving traders without clarity on when markets might actually go live. The exchange has positioned prediction markets alongside swaps as a pillar of its growth strategy, but execution is still ahead.

Jupiter also has not shared volume targets, fee structures, or incentive programs tied to prediction markets. That suggests more disclosures are likely before any meaningful activity begins. For now, the market is left waiting for details that turn strategy into live, usable trading functionality.