- XRP rebounded from the $1.50 area, but the bounce is being driven mainly by short-term traders rather than long-term holders.

- Falling exchange outflows and weak participation from broader buyers suggest limited demand beneath the current price.

- With key resistance near $1.69 and fragile support below $1.47, XRP remains vulnerable to another downside move if conviction fails to return.

XRP is attempting to steady itself after a sharp, market-wide sell-off rattled prices at the end of January. The token briefly dipped near $1.50 before bouncing back toward the $1.61 area, following the broader breakdown between January 31 and February 1. At first glance, the move looks like a clean technical rebound, maybe even the early stages of something larger.

Dig a little deeper, though, and the picture becomes less convincing. On-chain and flow data suggest this recovery is fragile. The buyers propping up XRP right now are mostly short-term traders, while broader demand remains muted. Three key indicators help explain why this bounce could still struggle to hold.

Short-Term Traders Are Driving the Bounce

XRP is still trading inside a long-term descending channel that’s been in place since early July. The recent rebound occurred right near the lower boundary of that channel, around $1.50, where buyers predictably stepped in. That part isn’t unusual. Who those buyers are, however, matters much more than where price bounced.

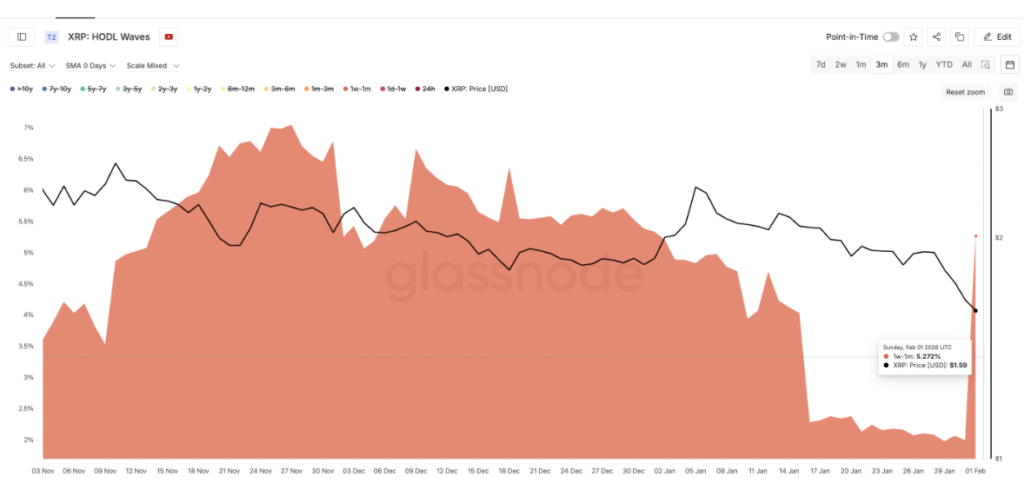

HODL Waves offer a clear look at this. These metrics track how long investors have held their coins, breaking supply down by holding period. Recent data shows that the 1-week to 1-month cohort, essentially short-term traders, accounted for most of the buying during the bounce.

Between January 31 and February 1, this group’s share of XRP supply jumped from roughly 1.99% to 5.27%. That’s a sharp increase in just two days, and it signals a surge in speculative positioning rather than long-term accumulation.

History explains why that’s risky. When XRP topped near $2.35 on January 5, this same group held around 4.83% of the supply. As price stalled, they quickly reduced exposure to about 2.15%, helping push XRP down toward $1.65 in the weeks that followed.

In simple terms, these traders buy dips and sell early. They don’t sit through uncertainty. With short-term holders once again leading the rebound, current support is built on fast-moving capital, not conviction. If price runs into resistance and hesitates, this group could exit just as quickly, triggering fresh downside.

Exchange Outflows Are Drying Up

The second warning sign comes from exchange flow data. Exchange outflows track how many coins are being moved off trading platforms. Rising outflows usually suggest accumulation or longer-term holding, while falling outflows point to weaker buying interest.

Strong recoveries tend to be supported by increasing outflows during dips, showing that new demand is stepping in. XRP is showing the opposite behavior.

On January 31, exchange outflows were around 31.38 million XRP. By early February, that number had fallen to roughly 9.81 million, a drop of nearly 70%. This happened while XRP declined about 14% from its late-January highs.

Instead of accelerating as price fell, buying pressure actually weakened. That tells us something important. Only a narrow group of traders is supporting the price right now, mainly the short-term cohort already highlighted. Broader market participants are not increasing exposure.

This creates a thin structure. Price may hold temporarily, but there’s limited depth underneath it. If short-term holders decide to sell again, there isn’t much fresh demand waiting to absorb that supply.

Conviction Buyers Are Still Missing

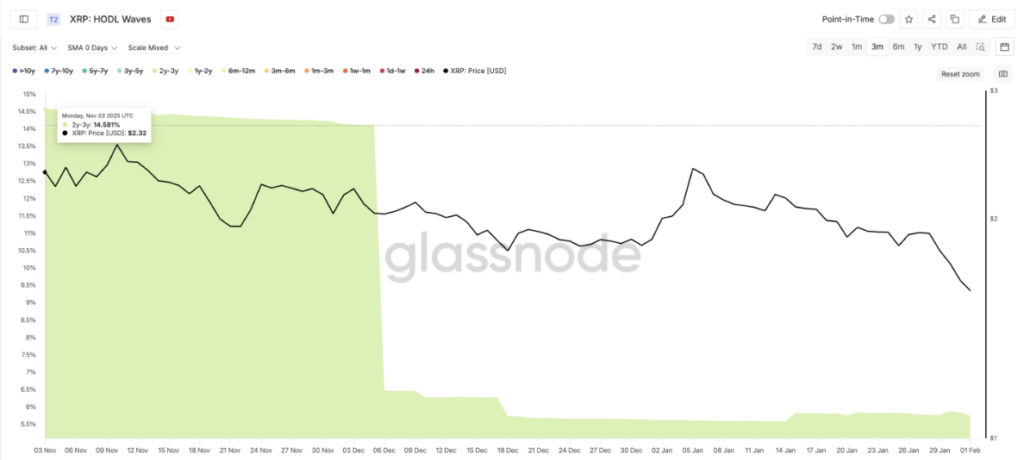

The final risk comes from the absence of long-term, high-conviction investors. HODL Waves show that longer-duration holders, particularly the 2-year to 3-year cohort, have not returned.

This group once controlled more than 14% of XRP’s supply in late 2025. That figure has since dropped to around 5.7% and remains flat. Even during the recent dip, there’s been no meaningful accumulation from this cohort.

These investors typically step in during major bottoms. Their continued absence suggests the market doesn’t yet view current levels as attractive for long-term entry. That lack of conviction lines up closely with the price structure itself.

Several levels now define XRP’s near-term outlook. On the upside, $1.69 is the first key barrier. A move above it would hint at improving confidence. Beyond that, $1.96 becomes critical. Holding above this level would challenge the falling channel and could shift the trend toward neutral.

On the downside, the $1.47 to $1.50 zone remains vital support. A failure there opens the door toward $1.25. That would confirm a breakdown of the channel and imply a deeper move, potentially as much as 27% lower, with $0.93 coming into view.

For now, XRP is stuck between $1.47 and $1.69, and uncertainty dominates. The recent bounce shows that selling pressure has slowed, but weak exchange flows, fragmented holder behavior, and missing conviction buyers limit upside potential.

Right now, the same traders holding XRP up are the ones who sold early last time. Unless broader demand and long-term participation return, this fragile support could end up being the trigger for the next sell-off, rather than the foundation for a recovery.