- Vitalik Buterin argues that the creator economy’s core issue isn’t a lack of incentives, but the failure to surface high-quality content in an AI-flooded internet.

- Ethereum has fallen more than 20% recently, though historical patterns suggest the drawdown may resemble prior cycle resets rather than a breakdown.

- Despite heavy selling and ETF outflows, Ethereum remains a central infrastructure asset, with long-term relevance still intact.

The internet is getting louder, messier, and a lot harder to trust. With AI now pumping out content at scale, signal-to-noise has become a real problem, not just an abstract one. In that environment, Ethereum co-founder Vitalik Buterin thinks the way we reward creators may be fundamentally broken, and overdue for a rethink.

Rewarding Creators Is Harder Than Ever

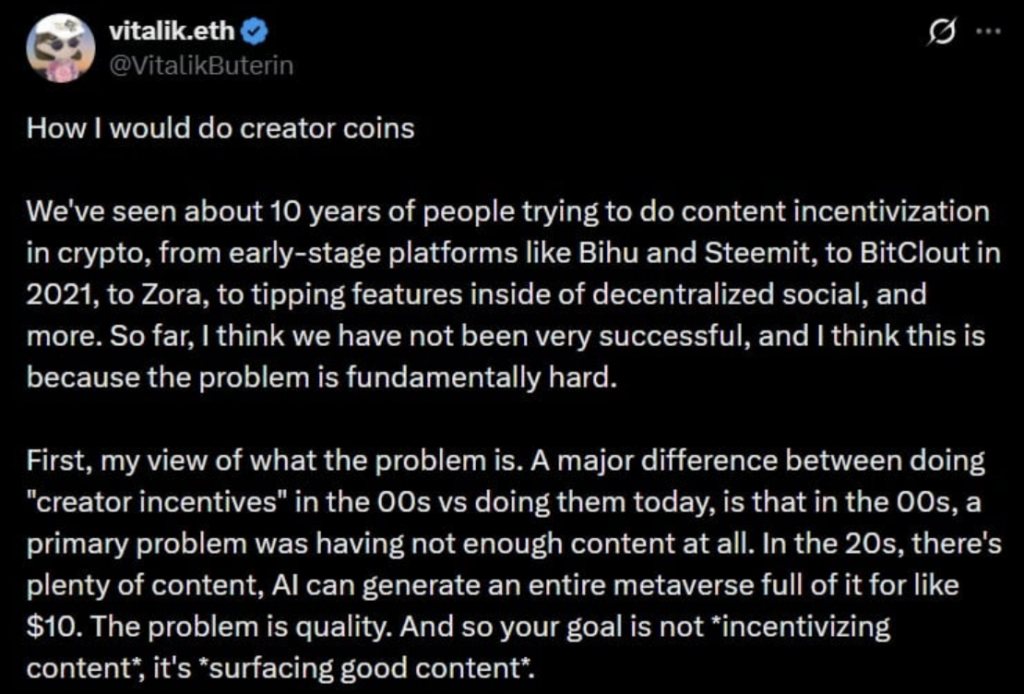

In a recent post on X, Buterin pointed to what he sees as the core issue behind crypto’s long-running struggle with creator incentives. There’s simply too much content, and not nearly enough quality.

AI can now generate endless posts, videos, and threads at almost zero cost. The internet doesn’t need more output, Buterin argues, it needs better filters. What’s missing is a reliable system for surfacing genuinely good work and making sure it’s rewarded in a fair, sustainable way.

He highlighted Substack as one of the few platforms that seems to get this right. Not because it uses tokens or flashy incentives, but because it relies on curation and editorial judgment. That human layer still matters, maybe more than ever.

By contrast, most creator coin experiments have struggled. In practice, they’ve often ended up rewarding people who were already popular, rather than discovering new or high-quality contributors. As Buterin put it bluntly, “your goal is not incentivizing content, it’s surfacing good content.” It’s a subtle distinction, but an important one.

Ethereum’s Price Tells a Different Story, For Now

While the ideas around Ethereum’s future remain ambitious, the present hasn’t been especially kind to its native token. ETH is down more than 20% over the past week, with heavy selling pressure dragging prices lower and sentiment cooling quickly.

Still, not everyone sees this as the end of the road. Analyst Michael van de Poppe pointed out that during the last cycle, Ethereum actually bottomed months before gold peaked, only to drop another 30–40% before finally turning around. Painful, yes, but not unusual.

In the current cycle, ETH appears to be tracing a similar path. If history even partially rhymes, the rough phase may be closer to a reset than a collapse. In the previous run, Ethereum went on to outperform Bitcoin, posting gains of more than 300%. That doesn’t guarantee a repeat, but it does keep longer-term optimism alive.

Tested, but Not Abandoned

Ethereum’s recent slide has put real pressure on large holders. Bitmine Immersion Technologies, a major ETH treasury player, is reportedly sitting on an estimated $6 billion in unrealized losses. That’s not small noise, that’s real balance sheet stress.

Institutional flows have also turned shaky. Ethereum spot ETFs saw more than $326 million in weekly net outflows, according to SoSoValue. Those exits have coincided with the price drop, and likely contributed to it.

Even so, Ethereum doesn’t look abandoned, just tested. Between ongoing institutional interest, long-term infrastructure relevance, and debates around how value and attention should be rewarded online, the network remains very much in the conversation. The market may be punishing ETH right now, but the bigger questions Vitalik is raising suggest the story is far from over.