- Bitcoin fell to around $74,000, its lowest level since April 2025

- Jim Cramer questioned whether major bulls like Michael Saylor would step in

- Markets are watching key support near $73,000 and resistance at $77,000

Bitcoin slid sharply over the weekend, briefly trading near $74,000 and marking its weakest level since April 2025. The move put immediate focus on a potential support zone around $73,000, a level highlighted by strategist Jessica Inskip. According to Jim Cramer, reclaiming $77,000 is critical, as that area could act as a launching pad back toward the low-$80,000 range if momentum stabilizes.

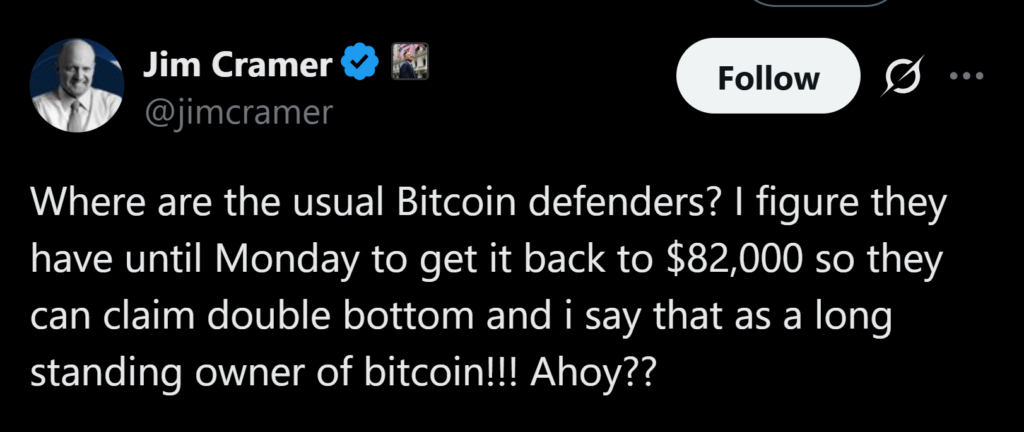

Where Are Bitcoin’s Loudest Defenders?

Cramer used the selloff to question the absence of Bitcoin’s most vocal supporters during moments of stress. He repeatedly referenced Strategy executive chairman Michael Saylor, asking whether the longtime Bitcoin bull still had “dry powder” to deploy at lower prices. Saylor fueled speculation by posting “more orange” on social media, hinting that Strategy may have added to its Bitcoin position over the weekend.

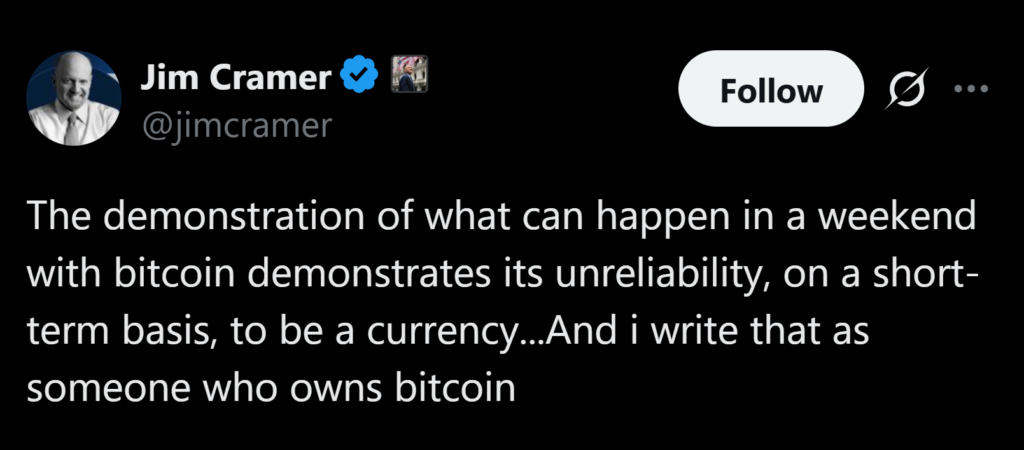

Volatility Undermines the Currency Narrative

Despite owning Bitcoin himself, Cramer framed the weekend move as another reminder of the asset’s short-term instability. He argued that sharp swings like this reinforce Bitcoin’s limitations as a reliable currency in the near term, even if its long-term investment case remains intact. The speed and scale of the drop, in his view, highlight how fragile sentiment can become when key levels break.

Spillover Into Broader Risk Markets

Cramer also suggested the crypto selloff may be bleeding into other risk assets. When leveraged traders face losses in Bitcoin, metals, or other speculative markets, they often sell equities to raise cash. That dynamic, he warned, can amplify volatility across markets even if the original shock starts in crypto.

Looking Ahead to the Next Catalyst

With Strategy set to report later this week, Cramer speculated that short sellers could be pressuring Bitcoin ahead of any potential disclosure. He cautioned that familiar bullish narratives may not be enough if downside momentum accelerates, urging investors to stay grounded and avoid getting consumed by worst-case scenarios.

Conclusion

Bitcoin’s slide has reopened uncomfortable questions about volatility, conviction, and who really steps up during drawdowns. Whether support near $73,000 holds or breaks will likely shape sentiment in the days ahead, especially as markets watch for signals from major corporate holders.