- IBIT investors are now underwater after Bitcoin’s sharp 2026 pullback

- Over $900 million has exited BlackRock’s Bitcoin ETF since late January

- The selloff raises questions about whether institutions will buy the dip or step back

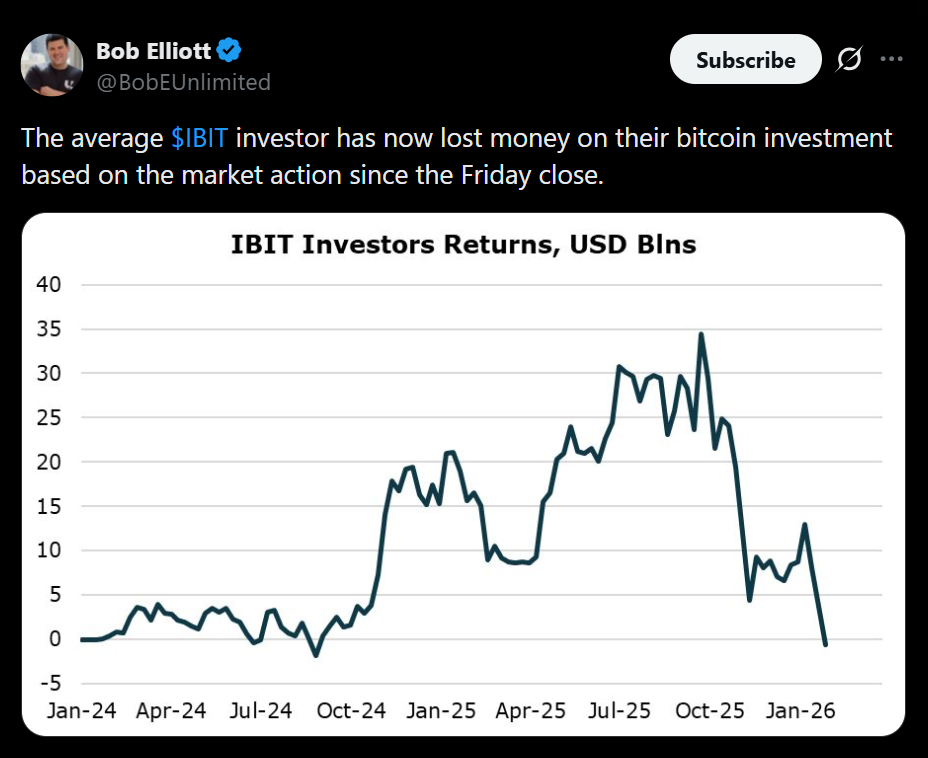

According to an X post by Unlimited Funds CIO Bob Elliot, the average investor in BlackRock’s Bitcoin ETF is now sitting on losses after Bitcoin’s latest downturn. Data from Farside Investors shows that more than $900 million has flowed out of IBIT since Jan. 27, 2026, marking one of the fund’s most challenging stretches since launch. The reversal is notable given how strongly ETFs were positioned as a gateway for long-term institutional capital into Bitcoin.

Why This Matters for BlackRock and the Broader Crypto Market

BlackRock’s move into Bitcoin was widely viewed as a stamp of legitimacy for crypto as an asset class. Heavy outflows do not change that overnight, but they do highlight how sensitive ETF investors are to price volatility. Unlike early Bitcoin adopters, many ETF holders entered during higher price ranges, making drawdowns harder to ignore and potentially amplifying short-term selling pressure.

Will BlackRock See This as a Buying Opportunity

Despite the current losses, there is a real chance BlackRock views the pullback as an opportunity rather than a threat. CEO Larry Fink has previously suggested that digital assets like Bitcoin could eventually challenge the dominance of the US dollar, signaling long-term conviction rather than tactical trading. If that view still holds internally, lower prices could attract fresh institutional accumulation once volatility stabilizes.

Macro Pressure Is Driving the Fear

The latest crash has been tied in part to political and macro uncertainty, especially following President Trump’s decision to nominate Kevin Warsh as Federal Reserve Chair. While Warsh has recently sounded more open to digital assets, his past skepticism toward crypto has unsettled markets. For now, Bitcoin appears to be reacting more to macro risk and confidence shocks than to fundamentals.

What Analysts Expect Next for Bitcoin

Even with bearish momentum in control, several major firms remain optimistic about Bitcoin’s longer-term trajectory. Analysts at Grayscale and Bernstein argue that Bitcoin is tracking a five-year cycle rather than the traditional four-year pattern, pointing to a potential new all-time high later in 2026. If that thesis plays out, current ETF losses could end up looking like a temporary detour rather than a structural failure.

Conclusion

BlackRock’s Bitcoin ETF outflows highlight the growing pains of institutional crypto adoption. Short-term losses are testing conviction, but they are not rewriting the long-term thesis just yet. Whether BlackRock leans into this drawdown or waits for calmer conditions will be an important signal for how traditional finance plans to navigate crypto’s volatility going forward.