- XRP has erased all gains made since mid-2025 after a sharp monthly drawdown

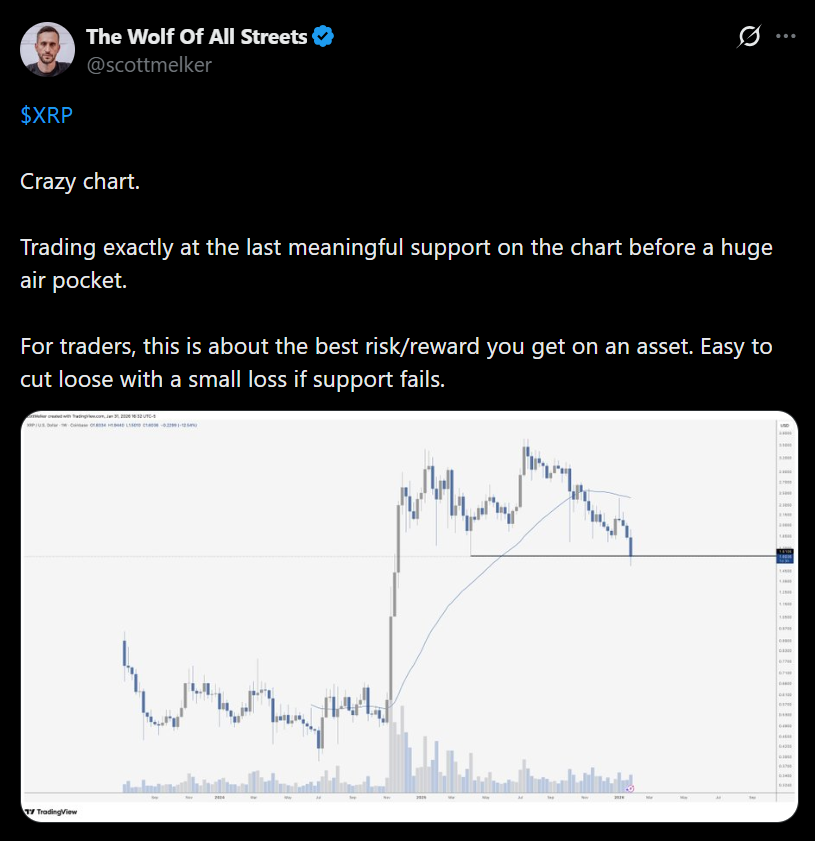

- Analysts see a rare high-risk, high-reward setup near critical support

- A broader Bitcoin breakdown could decide XRP’s next major move

XRP fell sharply to the $1.50 level early Monday, dropping nearly 6% in a single session and extending a brutal month-long slide. Over the past 30 days, the token has lost more than 22% of its value, fully erasing the rally it built after July 2025. For many holders, the move has been especially painful, as prices briefly traded above $3 before reversing hard and leaving late sellers underwater within six months.

Why Traders Are Watching This Level Closely

Despite the damage, some analysts believe XRP is now sitting at a decisive inflection point. Scott Melker, known as the Wolf of All Streets, described the current zone as one of the cleanest risk-to-reward setups on the chart. XRP is trading near what many consider its last meaningful support before a potential air pocket lower, meaning downside risk is clear and easily defined, but so is the upside if buyers step in.

High Reward Also Means High Risk

This setup cuts both ways. If support fails, XRP could slide rapidly toward the $1 range, especially if broader market conditions worsen. Bitcoin remains fragile, and a deeper BTC drawdown toward $70,000 would likely drag XRP lower alongside it. That’s why Melker emphasized discipline, noting that this type of trade only makes sense for participants who can afford to cut losses quickly if the level breaks.

Bulls and Bears Are at a Standoff

At the moment, neither side has full control. Bulls are betting on a technical rebound toward $1.70 or even $2 if sentiment improves, while bears point to heavy selling pressure and weak momentum as reasons to expect further downside. With volatility elevated and confidence shaken, XRP’s next move will likely be dictated by broader market direction rather than token-specific news.

Conclusion

XRP’s drop to $1.50 has turned optimism into caution almost overnight. What makes this moment notable is not just the size of the crash, but how cleanly it defines risk. For traders, this is a make-or-break zone. For everyone else, it’s a reminder that sharp rallies and equally sharp reversals remain part of crypto’s reality.