- A woman claiming to be Justin Sun’s former partner has accused him of orchestrating coordinated TRX price manipulation using multiple Binance accounts during the token’s early years.

- While unverified, the allegations closely mirror prior SEC claims involving wash trading, artificial volume, and insider profit-taking tied to TRON and BitTorrent.

- The claims resurface amid renewed political scrutiny over paused crypto enforcement cases, potentially reopening debate around TRON’s early trading practices and regulatory influence.

Tron founder Justin Sun is facing renewed scrutiny after a woman claiming to be his former girlfriend publicly accused him of orchestrating large-scale market manipulation during TRX’s early days. The allegations, which surfaced this week, quickly reignited debate around Sun’s past and the long-running questions surrounding TRON’s rise.

According to the accuser, Sun allegedly used multiple Binance accounts to artificially inflate TRX’s price before dumping tokens on retail investors. While the claims have not yet been verified, their level of detail has drawn serious attention across the crypto space.

Justin Sun Accused of Using Binance Accounts to Manipulate TRX

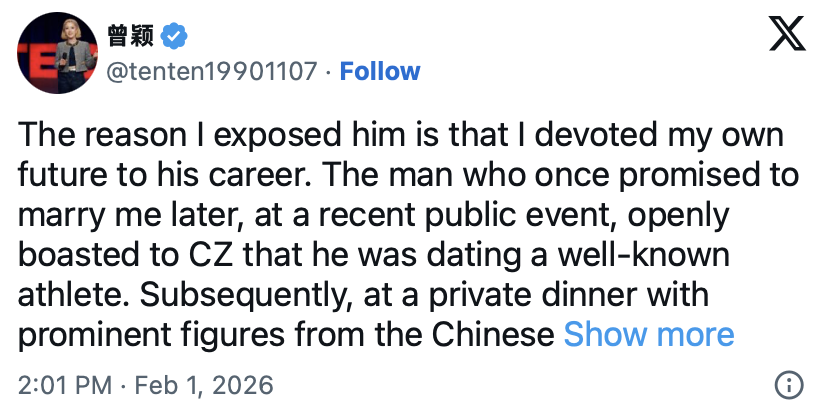

The woman, who identifies herself as Ten Ten (Zeng Ying), says she was romantically involved with Sun during TRON’s launch and early growth period. In her public statements, she alleges that Sun instructed several Beijing-based employees to use their personal identities and mobile phones to register numerous Binance accounts.

Those accounts, she claims, were then used in coordinated trading activity designed to push TRX’s price and market capitalization higher in late 2017 and early 2018. According to her account, aggressive buying created the appearance of organic demand, which was later followed by large-scale sell-offs.

Ten Ten alleges that these sell-offs dumped tokens onto retail investors and generated what she described as “enormous illegal profits.” She claims to be in possession of WeChat chat records, insider testimony from employees, and additional documentation supporting her claims.

“I am in possession of evidence showing that he used the identities and mobile phones of multiple employees to register numerous Binance accounts,” she wrote. She added that what has been shared publicly so far represents only a small portion of the material.

She has also stated her willingness to cooperate fully with any investigation by the U.S. Securities and Exchange Commission, urging regulators to contact her directly.

Allegations Mirror Prior SEC Claims

Although Ten Ten’s accusations remain unverified, they closely resemble allegations previously raised by the SEC. In March 2023, the regulator filed a civil lawsuit against Sun, Tron Foundation Limited, BitTorrent Foundation Ltd., and Rainberry Inc., formerly known as BitTorrent.

In that case, the SEC accused the entities of conducting unregistered offers and sales of TRX and BitTorrent Token, along with engaging in extensive market manipulation. The complaint alleged that Sun carried out wash trading by executing more than 600,000 trades between April 2018 and February 2019.

According to the SEC, these trades were made through controlled or nominee accounts to create artificial trading volume and price stability without genuine changes in ownership. The agency also accused Sun of orchestrating undisclosed paid celebrity promotions to hype the tokens, claiming the scheme generated roughly $31 million in illegal proceeds.

While the SEC’s original case did not specifically reference employee identities or Binance accounts, the core allegations align closely with Ten Ten’s description of early TRX trading behavior. Coordinated trading, artificial volume inflation, and insider profit-taking sit at the center of both narratives.

The SEC case was stayed in February 2025, shortly after reports emerged that Sun had invested millions into Trump family–linked crypto ventures, including World Liberty Financial. Those investments were reported to have benefited Donald Trump by roughly $50 million.

The pause, which has since been extended, drew criticism from U.S. Representatives Maxine Waters, Sean Casten, and Brad Sherman in mid-January 2026. In a letter to SEC Chairman Paul Atkins, the lawmakers questioned what they described as a broader pullback in crypto enforcement.

They cited paused or dropped cases involving Sun, Binance, Coinbase, and Kraken, and warned of a potential “pay-to-play” dynamic tied to political influence. “The SEC’s request to stay the Sun litigation, and subsequent efforts to settle the matter, may have been unduly influenced by Sun’s relationship with the Trump family,” they wrote.

Personal Motives, Public Stakes

In her statements, Ten Ten framed her decision to come forward as both personal and moral. She said she witnessed alleged exploitation of retail investors, money laundering activity, and the use of wealth to manufacture praise and political protection.

She also publicly appealed to Donald Trump and Eric Trump to distance themselves from Sun, questioning the integrity of U.S. justice given the alleged ties. Ten Ten stated that she is preserving evidence securely and expressed concern for her personal safety.

Sun has not addressed the substance of the accusations. His only public response was a brief post on X, saying, “Ignore the FUD and keep building & holding.”

As of February 1, 2026, neither Binance nor the SEC has issued public comments regarding the new claims.

It’s impossible to ignore that allegations from former partners carry the risk of personal bias. Still, the level of detail, the overlap with prior SEC findings, and the timing amid heightened political and regulatory scrutiny give the claims weight beyond routine social media drama.

If substantiated, they could intensify pressure for renewed examination of TRON’s early trading practices, enforcement consistency, and the growing intersection between crypto, politics, and influence.

At the time of writing, TRON’s TRX token was trading around $0.2843, down roughly 0.5% over the past 24 hours.