- PEPE remains trapped in a descending channel as whale selling accelerates during broader market weakness

- Large holders offloaded over 4.25T PEPE, reinforcing bearish momentum and aggressive spot selling

- Technical indicators stay oversold, with downside risk toward $0.0000043 unless $0.0000051 is reclaimed

Pepe has been stuck inside a descending channel ever since it was rejected near $0.00000688 about two weeks ago. What started as a slow fade turned sharper after the recent market-wide crash, pushing the memecoin down to a local low around $0.0000044. At the time of writing, PEPE is trading near $0.000004541, down roughly 5.6% on the day and extending a downtrend that’s now stretched across the entire week.

Price action hasn’t shown much relief. Each bounce attempt has been weaker than the last, and sellers continue to step in early, keeping pressure firmly tilted to the downside.

Whale Dump Adds to Bearish Pressure

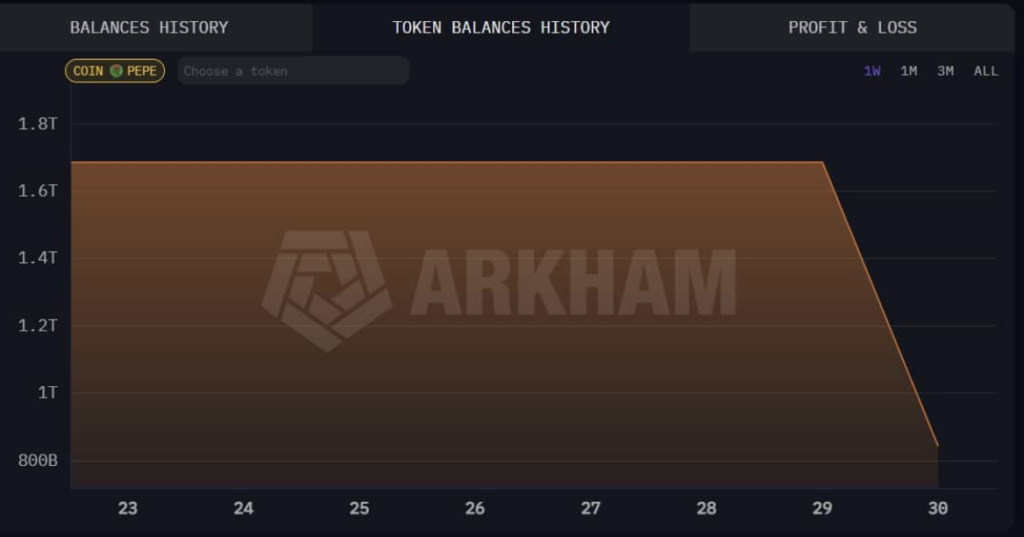

As PEPE struggled, a long-term whale resurfaced and decided it was time to sell. After holding roughly 1.7 trillion PEPE tokens since October, the whale offloaded 858 billion tokens worth about $3.88 million. That move alone was enough to raise eyebrows, given the wallet had been inactive on the sell side since it began accumulating back in 2023.

Even after the sale, the whale still holds around 842 billion PEPE, valued at roughly $3.82 million, according to Arkham data. Still, the timing matters. Selling into weakness rarely boosts confidence, and this move didn’t happen in isolation.

Nansen data shows that top holders collectively offloaded around 4.25 trillion PEPE following the broader market dip. That kind of outflow points to growing anxiety among large holders, not quiet accumulation. When whales start trimming during a downtrend, it usually reflects fear of deeper losses rather than profit-taking at strength.

Selling Dominates Spot Flow

Volume data reinforces the bearish picture. On January 30, PEPE’s sell volume dipped slightly to about 4.46 trillion, down from 6.56 trillion the day before. Over the same period, buy volume came in at roughly 3.79 trillion and 5.72 trillion, respectively. Despite some fluctuation, sell pressure continued to outweigh buying.

The result was a negative buy-sell delta across both days, a clear sign that aggressive spot selling remains in control. As more supply hits the market, price struggles to stabilize, let alone recover. Whale-driven selling only adds fuel to that dynamic.

Momentum Signals Point Lower

Momentum indicators aren’t offering much comfort either. Following the broader market drop, PEPE’s Stochastic RSI made a bearish crossover and slid to around 13.5, pushing deeper into oversold territory. Oversold doesn’t automatically mean a bounce, especially when selling pressure stays this consistent.

PEPE is also trading below its short- and long-term moving averages, including the 20, 50, 100, and 200 EMAs. That alignment reflects sustained bearish control rather than temporary weakness. As long as price remains under those levels, rallies are likely to get sold into quickly.

If sellers, especially whales, continue to dominate, PEPE risks slipping further toward the $0.0000043 area. For any meaningful bullish shift, the memecoin would need a daily close above $0.0000051, with the 20 EMA acting as immediate resistance. Until then, the path of least resistance still points down.