- Avalanche’s RWA TVL reached $1.3 billion, driven by long-term infrastructure growth

- Institutional adoption, including BlackRock’s BUIDL expansion, boosted usage and credibility

- Stablecoin and tokenized fund growth points to utility-led demand rather than speculation

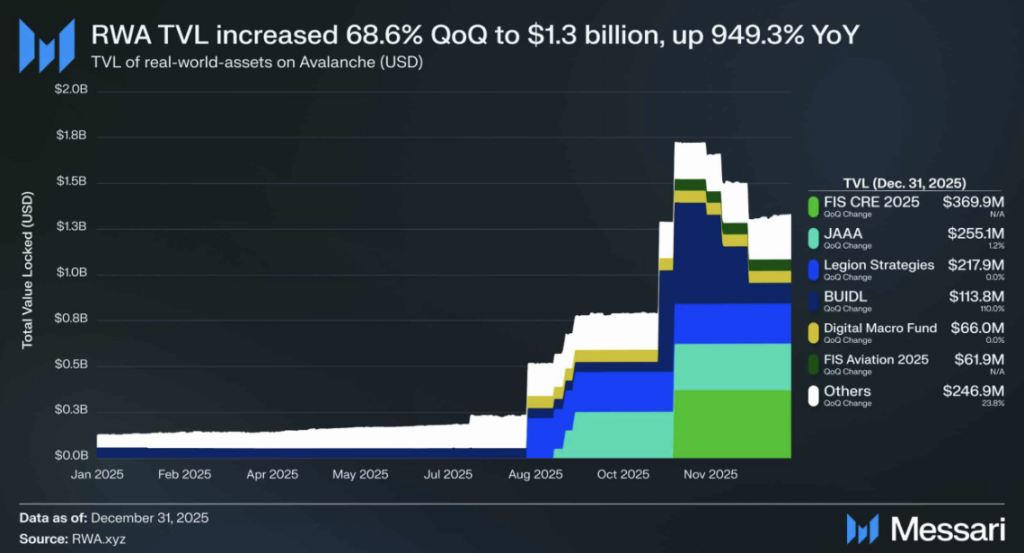

Avalanche’s real-world asset footprint has quietly reached a meaningful threshold. RWA total value locked on the network now sits around $1.3 billion, a figure built over years rather than months. This didn’t come from hype cycles or sudden inflows, but from infrastructure choices that steadily made the chain easier to use at scale.

A big part of that story is Avalanche’s subnet architecture. By isolating workloads, subnets reduce congestion, keep latency low, and allow throughput to scale without everything slowing to a crawl. That structure matters when usage grows, especially when institutions are involved and tolerance for downtime is basically zero.

Institutional Capital Validates the Design

Avalanche’s compliance-friendly setup has also made it attractive to regulated players. That groundwork paid off in Q4 2025, when BlackRock expanded its roughly $500 million BUIDL fund onto Avalanche. The move instantly lifted TVL and, more importantly, validated the network as a viable home for large allocators.

Other tokenized assets followed. FIS tokenized real estate and aviation loans added depth, not just volume. As capital arrived, activity picked up fast. Daily C-Chain transactions climbed to around 2.1 million, driven by RWAs, gaming, and enterprise use cases that don’t depend on retail speculation to survive.

Looking ahead, the mix of expanding RWAs, new gaming and media-focused chains, and continued institutional adoption points to growth that feels durable. Not explosive, maybe, but steady in a way markets tend to reward over time.

Why Avalanche Stands Out in On-Chain RWAs

Avalanche has positioned itself differently from many rival chains. Instead of optimizing for fast retail cycles, it’s built around institutional durability. The subnet and Evergreen frameworks allow for private or semi-private chains that can follow regulatory requirements, which is exactly what traditional finance needs for RWAs.

Performance backs that up. Avalanche offers sub-second finality, high throughput, EVM compatibility, and consistently low fees. At scale, those features reduce operational risk, something institutions care about far more than squeezing out marginal yield.

That combination explains why Avalanche holds one of the largest RWA shares outside Ethereum, according to RWA.xyz, within a global RWA market of roughly $19 billion. Capital retention also tells a story. Strong transfer volumes and secondary liquidity on venues like Trader Joe suggest assets aren’t just landing on Avalanche, they’re actually being used.

Fees remain modest, but that’s almost the point. Avalanche’s edge isn’t fee extraction, it’s infrastructure that doesn’t break when real money shows up.

Stablecoins Signal Real Settlement Demand

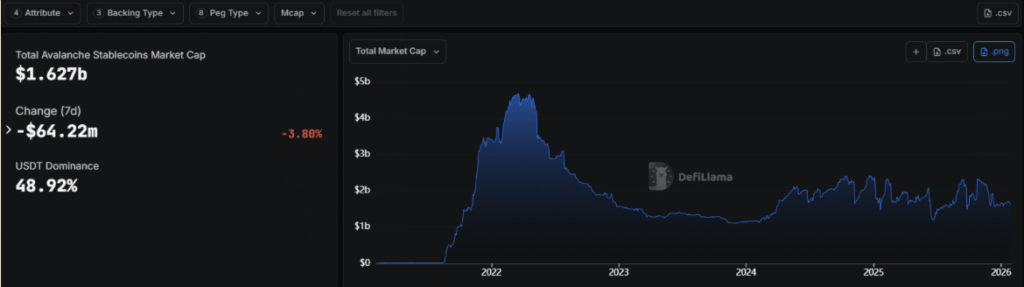

Avalanche’s stablecoin growth adds another layer. Total stablecoin supply fluctuates between about $1.63 billion and $2.19 billion, depending on the snapshot, but either way the scale is meaningful. USDT dominates, with roughly $796 million to $1.52 billion in circulation, representing about half the market.

USDC makes up another 19 to 32%, around $516 million, a distribution that lines up with institutional liquidity preferences rather than meme-driven rotations. That mix matters.

Over the past 30 days alone, stablecoin transfer volume reached roughly $69 billion, up 5.76%, pointing to sustained, high-value settlement activity. Even more telling, combined stablecoins and tokenized funds have grown more than 70% since January 2024, now exceeding $2 billion in aggregate value.

This isn’t the kind of growth tied to short-lived hype. It tracks utility, tokenized funds, cross-border payments, and enterprise settlement flows. Quiet, maybe, but hard to ignore.