- Tokenized copper is gaining early traction on Solana, led by Remora Markets

- Trading data suggests widening participation rather than isolated speculation

- Growing platform revenue could feed directly into STEP buybacks and price pressure

Copper-linked real-world assets are still small in absolute terms, but recent data is starting to get noticed. On Solana, Remora Markets’ tokenized copper product, CPERr, pushed to an all-time high near $619,433 in late January, lining up with a clear uptick in trading activity. It’s not massive yet, but it’s enough to put tokenized copper back on the radar, especially as RWAs gain momentum across crypto.

This shift stands out because copper has largely been missing from on-chain markets. Until now, most metals activity has stayed concentrated around gold and silver, where liquidity, familiarity, and trust are already established.

Tokenization Moves Beyond Gold and Silver

Tokenization has re-emerged as a core crypto theme heading into 2026, and it’s slowly expanding beyond the usual assets. Gold and silver still dominate metal-based RWAs, largely because they’re easy to understand and already well integrated into traditional finance. Copper, by contrast, has seen limited awareness and capital allocation on-chain.

That gap, however, is starting to narrow. As infrastructure improves and platforms offer clearer market structure and transparency, traders appear more willing to experiment with less conventional assets. Copper is starting to benefit from that shift, even if it’s early days.

Remora Markets Shows Early Signs of Traction

Remora Markets, a Solana-based platform offering tokenized stocks and metals, provides a useful case study. Since launch, the platform’s revenue has reportedly crossed $110 million, growing from seven figures into eight as demand for tokenized NASDAQ stocks and metals picked up.

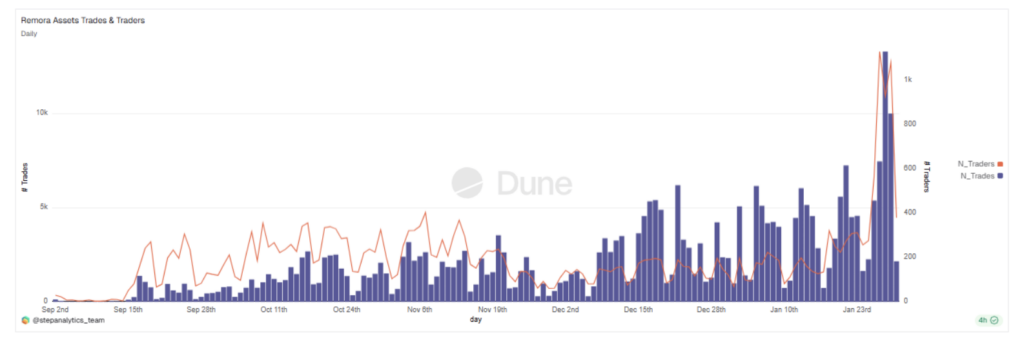

On-chain data supports that growth. Dune dashboards show both spot and perpetual volumes becoming more consistent. On January 28, combined activity jumped to roughly $8.5 million, with over 13,300 trades and more than 1,000 active traders. That kind of spread suggests participation is broadening, not just driven by a handful of wallets.

Copper Starts Climbing the Ranks

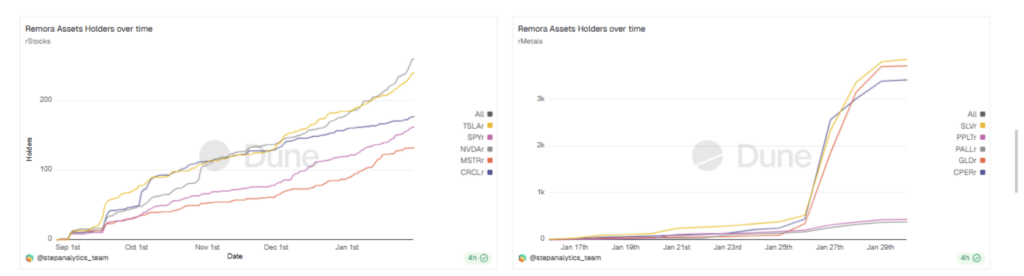

Within Remora’s product lineup, gold and silver still lead by a wide margin in both value and number of holders. That hasn’t changed. What has changed is copper’s position. CPERr has moved into third place, overtaking other metals that have seen slower growth.

Data from the final week of January shows the total value of Remora’s copper product pushing to new highs, even though the overall figures remain relatively modest. The pattern looks less like mature demand and more like early positioning, but that alone marks a shift from copper’s near absence in tokenized markets until recently.

ETF-Style Tokenization Adds Another Signal

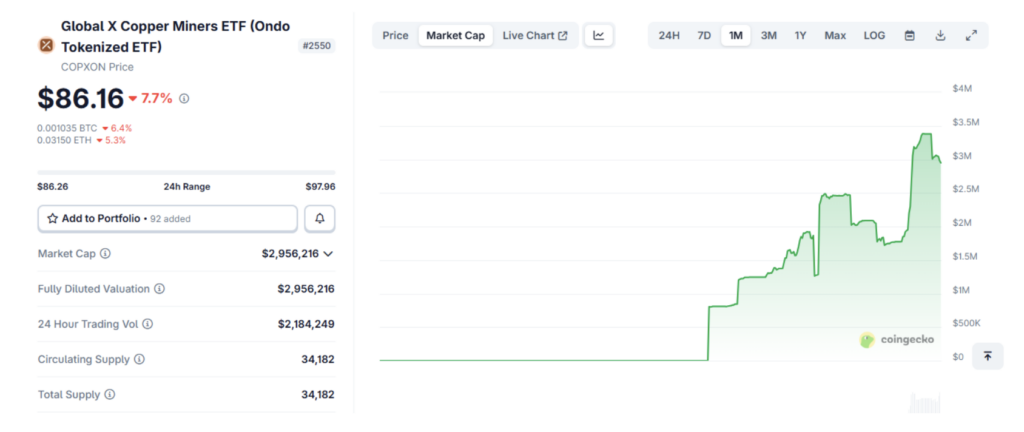

Outside of Remora, similar signals are emerging. Ondo’s tokenized Global X Copper Miners ETF, COPXON, reached a market cap of about $3 million within its first week. That’s still niche, but the speed of uptake suggests crypto-native investors are testing copper exposure through structures they already understand.

Compared to tokenized gold or silver, copper remains underrepresented. Liquidity is thinner, hedging tools are limited, and that keeps participation cautious. Still, the direction is notable, especially given copper’s role in the real economy.

Structural Demand Strengthens the Narrative

Copper’s importance goes far beyond speculation. Electrification, AI infrastructure, grid upgrades, electric vehicles, and defense technologies all rely heavily on copper. Add projected supply constraints over the next decade, and the metal carries a structural demand story that’s hard to ignore.

Viewed through that lens, tokenized copper isn’t just a short-term trade. It’s an attempt to bring real-world scarcity narratives on-chain, using infrastructure that Solana increasingly supports.

What This Means for STEP

Remora Markets itself doesn’t have a native token. Instead, it operates under Step Finance, using the STEP token. The team has confirmed that all revenue generated by Remora Markets will be used to buy back STEP, directly linking platform growth to token demand.

With Remora’s performance improving, attention is starting to turn toward STEP. The token is currently sitting in a critical demand zone, and a falling wedge pattern is forming on the chart. If a breakout plays out, some traders are eyeing a move as large as 800%, with upside targets near $0.20. Momentum indicators like MACD, AO, and RSI are already leaning bullish, though confirmation is still needed.