- Vitalik Buterin withdrew 16,384 ETH as the Ethereum Foundation enters a phase of fiscal restraint

- ETH price is under pressure near long-term support despite record network activity

- Oversold indicators suggest downside may be slowing, but structure remains fragile

Ethereum co-founder Vitalik Buterin has withdrawn 16,384 ETH, worth roughly $44.7 million, as the Ethereum Foundation shifts into a more fiscally disciplined phase. The move isn’t about retreating or scaling back ambition. Instead, it reflects a recalibration, one meant to balance aggressive technical goals with long-term sustainability, especially in a tougher market environment.

In a detailed post on X, Buterin explained that the foundation is entering a period of mild austerity. The goal, he said, is to deliver on Ethereum’s demanding roadmap while preserving resilience and decentralization, without burning through resources too quickly. It’s a careful line to walk, and one the foundation seems increasingly serious about.

A Leaner Approach to Building Ethereum

Buterin also noted that he plans to personally take on development work that would normally require dedicated foundation funding. The ETH he withdrew won’t be dumped or spent all at once. Instead, it will be deployed gradually over several years to support open-source infrastructure across finance, governance, communications, and privacy-focused technologies.

Rather than chasing an “Ethereum everywhere” strategy, Buterin emphasized building tools for people who actually need blockchain systems. He framed Ethereum as an alternative to power concentration, not a competitor in a race to dominate. In his words, the project aims to support autonomy and security in a world that often rewards size and aggression over resilience.

That philosophical shift feels especially notable given current market conditions.

ETH Price Weakness Meets Rising Network Activity

This transition comes as Ether trades near $2,710, hovering around a six-month low and far below its October peak near $4,831. Price sentiment has clearly cooled, but on-chain activity tells a different story. Following December’s Fusaka upgrade, Ethereum has seen a surge in usage, with daily active addresses and transaction counts hitting record highs.

In other words, price and fundamentals aren’t moving in sync right now. That disconnect has defined much of this cycle, and it’s adding to the tension traders are feeling.

ETH Approaches Long-Term Support Levels

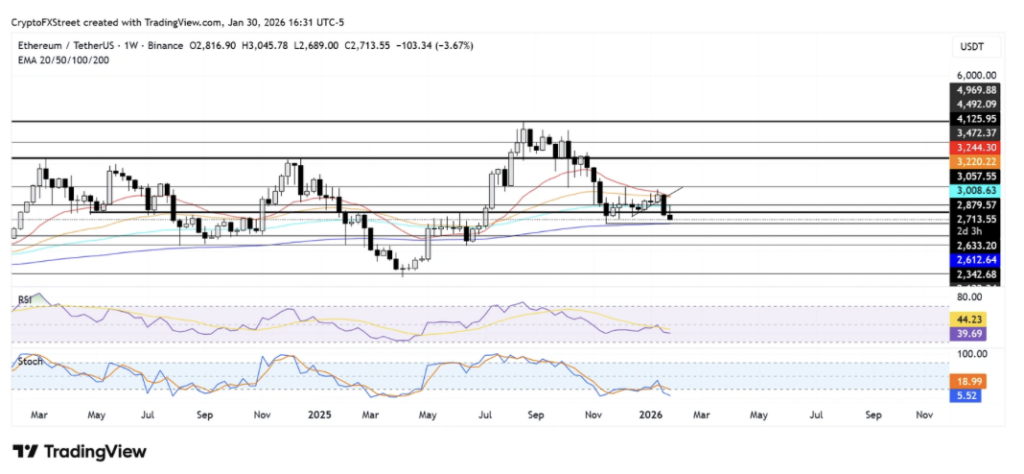

From a market perspective, Ethereum has seen about $281.3 million in liquidations over the past 24 hours, largely driven by long positions, according to Coinglass data. ETH was recently rejected near the $3,060 level, close to the 100-week EMA, and has since drifted toward the $2,630 support zone.

That level matters. The $2,630 area is reinforced by the 200-week EMA, a region bulls defended back in June and again in November last year. A clean break below it could open the door toward $2,340. On the flip side, any meaningful recovery would require ETH to reclaim its key weekly EMAs, something it hasn’t managed yet.

Momentum indicators remain soft. RSI is below neutral, while the Stochastic Oscillator sits in oversold territory. Historically, extended oversold conditions in the Stoch can lead to reversals, but timing those turns is never easy.

For now, Ethereum appears to be tightening both financially and technically. Whether that discipline pays off will depend on how the network continues to grow, and whether price eventually follows usage higher.