- Chainlink broke below its $12–$15 range despite ETF inflows and new partnerships

- Institutional demand remains steady, but sellers still control short-term price action

- Oversold conditions may spark bounces, though structure remains firmly bearish

Chainlink is trading around $10.83 today after slipping below a consolidation range that held for nearly two months between $12 and $15. The breakdown has surprised some traders, especially given the steady stream of positive developments around the project. ETF inflows are still coming in, and a new institutional partnership was announced this week, yet price keeps grinding lower.

That disconnect between fundamentals and price action is becoming harder to ignore. For now, sellers are clearly in control, even as the long-term narrative continues to strengthen in the background.

Turtle Partnership Adds Utility, Not Momentum

On Wednesday, Turtle announced a strategic partnership with Chainlink aimed at bringing institutional liquidity fully on-chain. Under the agreement, Chainlink’s CCIP and Data Feeds become required infrastructure for Turtle’s liquidity stack, effectively embedding LINK into cross-chain capital market flows.

Turtle currently connects more than 410,000 wallets and works with hundreds of institutional liquidity providers across multiple ecosystems. The partnership deepens Chainlink’s role in pricing, risk modeling, and cross-chain rebalancing for institutional dealflow. Michael Mendes, Head of DeFi at Chainlink Labs, described the move as a major step toward defining how liquidity moves across on-chain markets.

Despite that, the market barely reacted. Price continued lower, suggesting traders remain focused on structure rather than headlines, at least for now.

ETF Inflows Stay Positive as Spot Price Drops

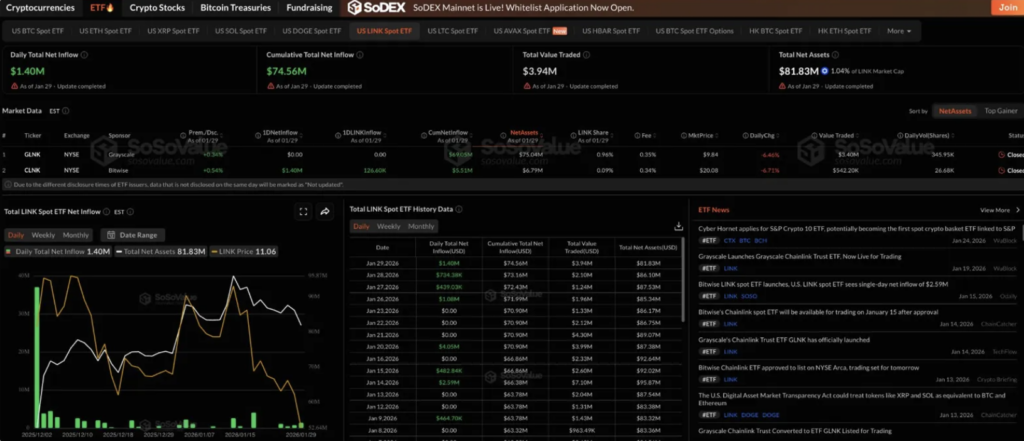

ETF data adds another layer to the divergence. Chainlink spot ETFs recorded $1.4 million in net inflows on January 29, pushing cumulative inflows to $74.56 million. Total net assets now sit around $81.83 million, with both Grayscale and Bitwise funds continuing to attract institutional capital.

Interestingly, LINK ETFs now hold nearly ten times the assets under management of DOGE ETFs, highlighting stronger institutional conviction in Chainlink’s utility-driven thesis compared to meme-based exposure. Even so, ETF demand has not translated into immediate spot price support, a reminder that flows and price don’t always move in sync.

Range Breakdown Shifts the Technical Picture

From a technical standpoint, the damage is clear. On the daily chart, LINK trades below all four major EMAs, confirming a bearish structure. The 20-day EMA sits near $12.26, followed by the 50-day at $12.91, the 100-day at $14.09, and the 200-day near $15.45. That stacked resistance overhead makes any recovery attempt difficult.

The December–January range between $12 and $15 has now broken decisively. Price failed multiple times to clear the $15 area before rolling over, and the loss of $12 support signaled a shift in control toward sellers. RSI has dipped to around 29.8, entering oversold territory for the first time since November. While that can lead to short-term bounces, it doesn’t guarantee a reversal on its own.

Hourly Chart Confirms Persistent Selling Pressure

Zooming into the hourly timeframe, the downtrend looks orderly but relentless. LINK has been making lower highs since the January 18 peak near $14, with each bounce sold into. The Parabolic SAR remains bearish around $11.09, and price continues to trade below session VWAP near $10.85.

Immediate support sits near the lower VWAP band at $10.76. Price briefly wicked down to $10.62 earlier in the session before bouncing, hinting at some demand around the $10.60 area. Still, the steady slide from $14 to roughly $10.80 over less than two weeks reflects sustained distribution rather than a single panic move.

Until LINK can reclaim broken levels and show strength above the former range, price action remains vulnerable, even with strong fundamentals quietly building underneath.