- MicroStrategy’s Bitcoin holdings sparked debate after a new BTC purchase announcement.

- Industry figures defended the legitimacy of Strategy’s custodial setup and audits.

- Despite short-term pressure, institutional interest could support an MSTR rebound.

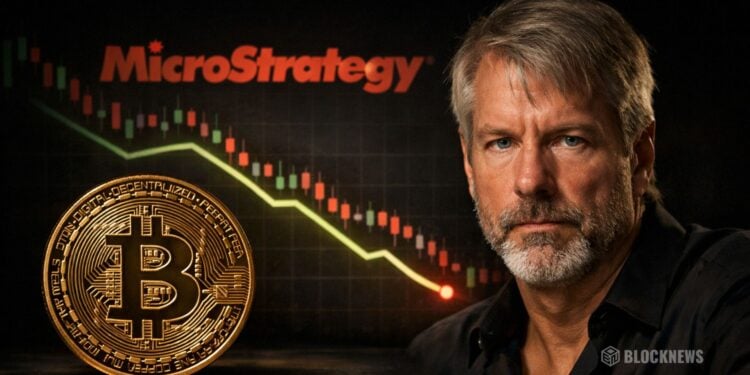

MicroStrategy shares took a hit on Wednesday, Jan. 29, as chatter across the crypto community questioned whether the company’s Bitcoin holdings are as solid as claimed. The sell-off followed renewed scrutiny after Chairman Michael Saylor announced another large BTC purchase, a move that usually draws applause but this time sparked debate instead. Despite the noise, Saylor quickly stepped in to make one thing clear, the company buys real Bitcoin, not paper claims or synthetic exposure.

Community Debate Over Strategy’s Bitcoin Exposure

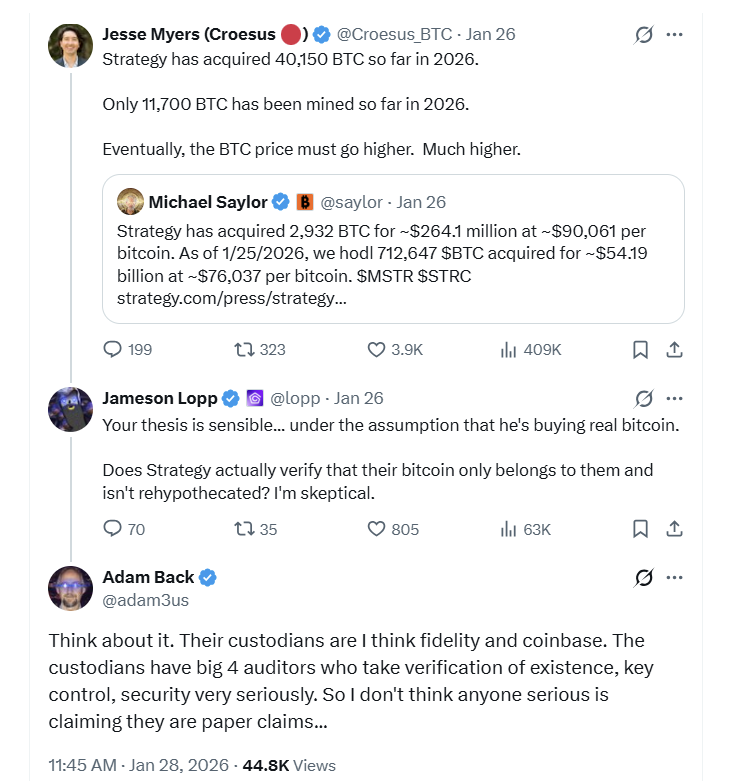

The discussion gained momentum on X shortly after Saylor revealed that Strategy had acquired an additional 2,932 BTC, a purchase valued at roughly $264.1 million at an average price near $90,061 per coin. According to Saylor, the firm now holds 712,647 BTC as of Jan. 25, 2026, accumulated at a total cost of about $54.19 billion, or roughly $76,037 per Bitcoin. Those numbers alone are staggering, and they naturally attract attention, sometimes skeptical attention.

Jesse Myers, Head of Bitcoin Strategy, added fuel to the bullish side of the argument by pointing out that Strategy has already acquired 40,150 BTC in 2026, while only around 11,700 BTC have been mined so far this year. To him, the imbalance is obvious and supports a higher BTC price over time. Still, not everyone was convinced, with some voices asking whether the holdings were fully owned and controlled, or if rehypothecation was quietly in play.

Custody, Audits, and the “Real Bitcoin” Question

Bitcoin developer Jameson Lopp acknowledged the logic behind the supply argument but made his support conditional on one key issue, that Strategy actually controls real, on-chain Bitcoin. He raised concerns around custody structures and whether the BTC could be encumbered in less transparent ways. That prompted a swift response from cryptographer Adam Back, who pushed back hard on the skepticism.

Back highlighted that Strategy’s custodians include Fidelity and Coinbase, both widely regarded as institutional-grade operators. He noted that these firms undergo strict audits from Big 4 accounting companies, with specific attention paid to asset existence, key control, and overall security practices. In his view, claims of widespread paper BTC simply don’t hold up when credible custodians and auditors are involved, though critics still argue that transparency in custody is rarely perfect.

Saylor Pushes Back as MSTR Looks for a Bounce

As the debate rolled on, Saylor addressed the concerns directly, stating plainly that Strategy does not rehypothecate and that its Bitcoin holdings are legitimate and on-chain. Additional commentary from industry figures suggested that large portions of Strategy’s BTC are held across Coinbase Custody, Anchorage Digital, and Fidelity, with some balances harder to trace due to how certain custodians aggregate client funds. Even so, no concrete evidence of rehypothecation has surfaced so far, which has cooled some of the louder accusations.

On the market side, MSTR stock has been under pressure, trading near recent lows after dropping 1.94% in the past 24 hours to around $158.45. The stock is down roughly 3.5% over the last five days, though it remains up modestly on a monthly and year-to-date basis. As usual, MSTR continues to move closely with Bitcoin, and recent BTC weakness has weighed on sentiment. Still, with institutional players like Vanguard reportedly building sizable positions, some investors believe the stock may be setting up for a recovery once Bitcoin finds its footing again.