- Japan’s first listed Bitcoin treasury firm is doubling down on BTC accumulation

- New capital will fund Bitcoin purchases, income strategies, and balance sheet flexibility

- The company is targeting 1% of Bitcoin’s total supply by 2027

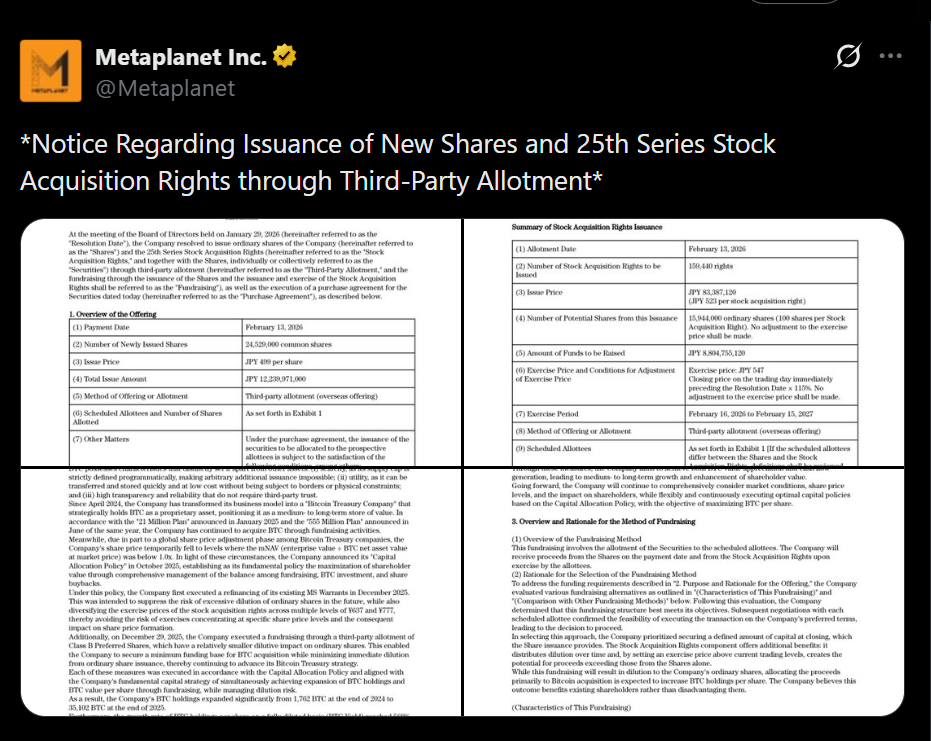

Metaplanet, Japan’s first publicly listed Bitcoin treasury firm, announced plans to raise approximately $137 million through a new stock offering and warrants. The capital raise marks another step in the company’s transformation from a traditional operating business into a Bitcoin-focused treasury vehicle.

The Tokyo-based firm has made Bitcoin accumulation its central financial strategy, aligning itself with a growing group of corporates treating BTC as a long-term reserve asset rather than a speculative trade.

Funding Bitcoin Growth and Income Operations

According to the company, the proceeds will be used primarily to expand its Bitcoin holdings and scale its Bitcoin Income business. A portion of the funds will also go toward partially repaying existing credit facility borrowings, preserving balance sheet flexibility for future initiatives.

This approach reflects a deliberate strategy: maintain access to leverage while steadily increasing Bitcoin exposure, rather than exhausting borrowing capacity all at once.

From Hotels to Bitcoin Accumulation

Metaplanet originally operated in the hotel management sector before pivoting toward Bitcoin as a treasury asset. That shift has already placed the firm among the world’s largest corporate Bitcoin holders, with more than 35,000 BTC valued at roughly $3 billion.

The company now ranks as the fourth-largest corporate holder of Bitcoin, a notable position for a firm that only recently adopted a crypto-native balance sheet strategy.

A Bold Target: 1% of Bitcoin’s Supply

Looking ahead, Metaplanet has set an ambitious goal of acquiring 210,000 BTC by 2027, equivalent to 1% of Bitcoin’s total supply. If achieved, that target would place the firm in rare territory, rivaling the most aggressive Bitcoin treasury strategies globally.

The goal underscores how corporate Bitcoin accumulation is becoming a competitive race, not just a hedge or branding exercise.

Conclusion

Metaplanet’s $137 million raise is less about diversification and more about conviction. By reinforcing its Bitcoin treasury strategy while maintaining financial flexibility, the company is signaling that Bitcoin is not a side bet but its core identity. Whether the 1% supply target is reached or not, Metaplanet’s trajectory shows how deeply Bitcoin is embedding itself into corporate balance sheets worldwide.