- Standard Chartered warns stablecoins may pull $500 billion from U.S. bank deposits

- Regional banks face the most pressure as deposits underpin their earnings model

- Regulatory clarity could accelerate adoption rather than slow it

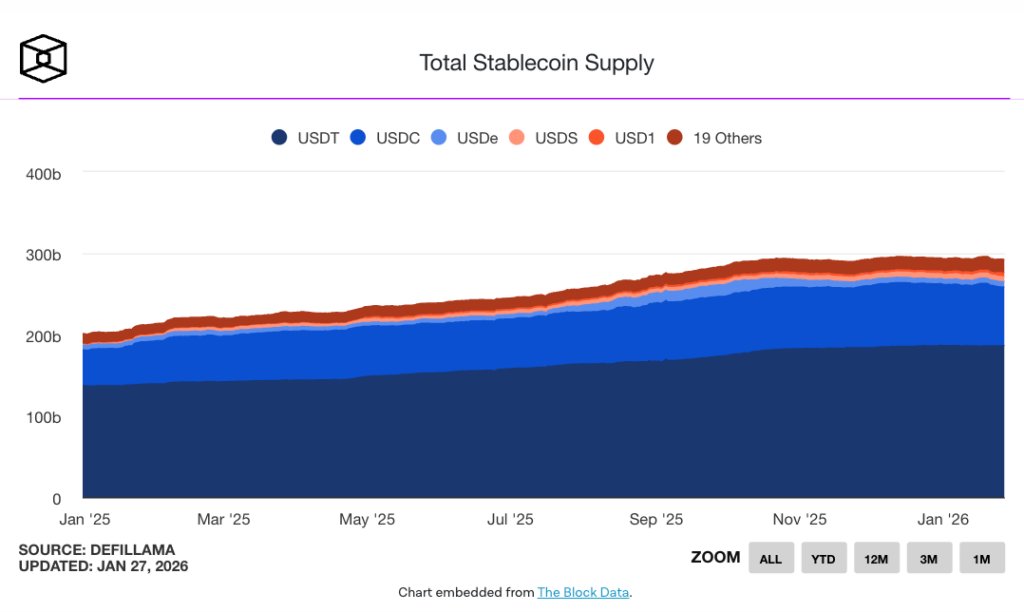

Standard Chartered’s warning confirms what many in traditional finance have been quietly acknowledging for a while. Stablecoins are no longer niche tools used only by crypto-native traders. If even a modest share of everyday payments and savings moves on-chain, bank deposits do not disappear overnight, but they do thin out over time. A potential $500 billion shift is not a sudden run on banks, it is a slow change in behavior, happening wallet by wallet.

This kind of transition matters because deposits are the foundation of the banking system’s funding model. When money migrates elsewhere, the impact compounds gradually but meaningfully.

Why Regional Banks Feel the Pressure First

The weakest point is net interest margin. Regional banks rely heavily on deposits to fund loans and generate earnings. When funds sit in stablecoins instead of checking or savings accounts, that margin narrows. Large global banks have diversified revenue streams and balance sheet buffers that soften the blow. Brokerages and asset managers barely notice.

Regional banks, however, feel the impact much faster. This shift is not driven by speculative crypto activity. It is driven by businesses and individuals choosing faster settlement, easier cross-border transfers, and programmable money that works beyond traditional banking hours.

Regulation May Accelerate Adoption, Not Slow It

The debate in Washington highlights the real tension. Crypto firms want stablecoins treated as modern financial infrastructure. Banks want guardrails that protect deposits and preserve their role. Even major institutions have acknowledged that interest-bearing stablecoins could unlock market sizes far larger than today’s ecosystem.

Once rules are clearly defined, uncertainty drops. Historically, that is when adoption accelerates. Regulation may delay growth briefly, but clarity often acts as a catalyst rather than a brake.

The Issuer Model Changes the Equation

One overlooked factor is how stablecoin issuers manage reserves. Firms like Tether and Circle hold only limited portions of reserves as traditional bank deposits. That means funds leaving banks do not automatically cycle back into the system. When you add strong demand from emerging markets, the effect becomes structural instead of cyclical.

This dynamic reshapes how liquidity moves through the financial system and weakens the assumption that deposits will always return home.

Conclusion

This is not a death sentence for banks. It is a forcing function. Institutions that adapt their funding models, integrate with tokenized rails, and accept new forms of money movement will adjust. Those that wait may find that deposits no longer behave the way they once did, and by the time that becomes obvious, the shift may already be locked in.