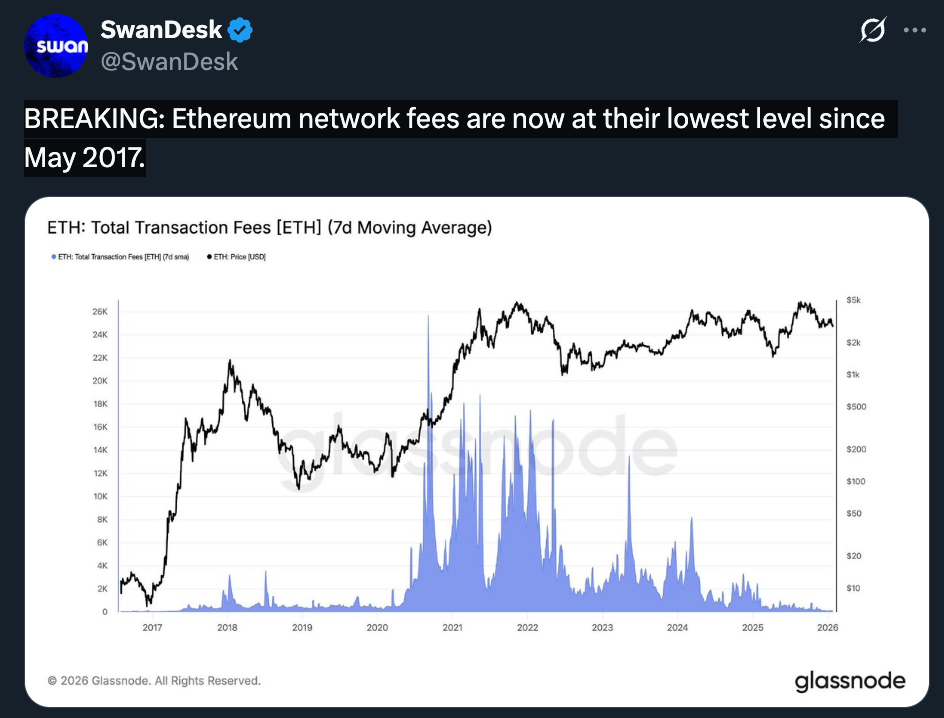

- Ethereum transaction fees have fallen below one cent, the lowest levels since 2017

- Network usage remains high, signaling real efficiency gains rather than weak demand

- Layer-2 adoption and recent upgrades are reshaping how Ethereum scales

Ethereum transaction fees have slipped to their cheapest point since May 2017, averaging under $0.01. For years, high gas costs were the network’s biggest pain point, often pricing out smaller users and experiments. What makes this moment different is that fees collapsed without usage collapsing alongside them.

Daily transactions reached roughly 2.9 million in January, a level that previously would have sent fees soaring. Instead, costs stayed minimal, suggesting Ethereum’s bottlenecks are finally loosening rather than demand simply disappearing.

Why Upgrades and Layer-2s Matter More Than Ever

This shift is largely the result of technical progress. Capacity-focused upgrades like Fusaka, combined with the explosive growth of Layer-2 networks, have moved a huge share of activity off the base layer. Less congestion means cheaper transactions without sacrificing security.

For developers, this opens the door to building applications that were previously impractical due to gas costs. For users, it makes everyday actions like transfers, small DeFi trades, and even NFTs feel reasonable again instead of punitive.

The Tradeoffs Behind Cheaper Transactions

Lower fees are great for adoption, but they also change Ethereum’s economics. With fewer fees being burned through EIP-1559, ETH’s deflationary pressure weakens. That shifts the narrative away from fee scarcity and toward long-term usage, application growth, and Layer-2 ecosystems as the primary drivers of value.

How ETH accrues value in a low-fee environment remains an open question, especially if demand accelerates again.

Conclusion

Ethereum’s fee collapse is not just a short-term anomaly. It signals that years of scaling work are finally paying off. If the network can keep fees low while supporting high demand, Ethereum becomes less about expensive settlement and more about usable infrastructure. That transition could quietly reshape how crypto is built and adopted.