- American Bitcoin has grown its BTC stack to nearly 5,900 coins since late 2025

- The firm reports a triple-digit BTC yield since its Nasdaq debut

- Corporate Bitcoin accumulation continues to reshape public market exposure

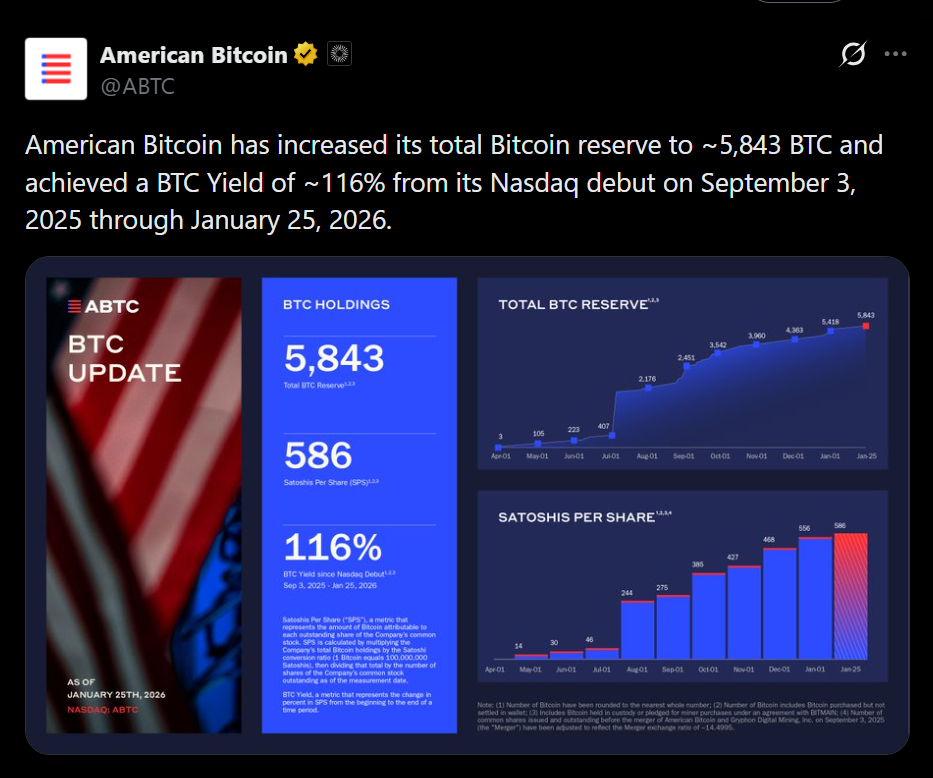

American Bitcoin, a publicly traded Bitcoin treasury company backed by Donald Trump Jr. and Eric Trump, has added another 416 BTC to its balance sheet, bringing total holdings to 5,843 Bitcoin. At current prices, that stash is valued at roughly $514 million, cementing the firm’s position as one of the more aggressive corporate accumulators in the market.

The purchase highlights how quickly American Bitcoin has scaled its treasury strategy, doing so in just five months since listing on Nasdaq in September 2025.

Triple-Digit Yield Signals an Aggressive Strategy

The company also disclosed a Bitcoin yield of approximately 116% between its Nasdaq debut on Sept. 3, 2025, and Jan. 25, 2026. That metric reflects the firm’s ability to increase its Bitcoin exposure relative to its equity base, rather than simple price appreciation alone.

This approach mirrors strategies used by other Bitcoin-focused public companies, where accumulation speed and capital structure matter as much as market timing.

Climbing the Corporate Bitcoin Rankings

With its latest addition, American Bitcoin now ranks as the 18th-largest corporate holder of Bitcoin globally. In the process, it has overtaken companies like Nakamoto Inc. and GameStop Corp., underscoring how quickly newer entrants can climb the leaderboard with a focused accumulation plan.

The move reinforces a broader trend where Bitcoin treasuries are no longer limited to early adopters but are increasingly being built by newer public firms with explicit BTC-first mandates.

Stock Performance Tells a More Cautious Story

Despite the Bitcoin accumulation, ABTC shares rose only modestly in premarket trading and remain down about 11% year-to-date. Ongoing geopolitical tension and macro uncertainty continue to weigh on crypto-linked equities, even as underlying Bitcoin exposure grows.

This divergence highlights a familiar pattern: equity markets often lag treasury strategy narratives during periods of broader risk aversion.

Conclusion

American Bitcoin’s rapid accumulation shows how quickly a focused crypto treasury strategy can scale in public markets. While short-term stock performance remains mixed, the firm’s growing Bitcoin position places it firmly within the expanding class of companies treating BTC as a core reserve asset rather than a speculative add-on.