- ADA has defended the $0.33 region twice this year but remains in a broader downtrend

- Whale wallets accumulated over 450 million ADA while retail investors sold into weakness

- Technical structure suggests a possible dip toward $0.27 before any sustained rebound

Cardano has once again found itself leaning on a familiar level. ADA has now retested support just above $0.33 twice this year, a zone that keeps coming back into focus as the broader trend remains heavy. Despite being a large-cap asset with a fully diluted valuation near $15 billion, Cardano has stayed locked in a falling structure since early 2025, with rallies struggling to gain real traction.

That said, the tone under the surface has started to shift, slowly. Selling pressure has eased over the past few months, and while price hasn’t reflected it yet, some traders are already looking further ahead. There’s growing chatter around a potential rebound in 2026, driven by capital rotation away from traditional metals and into crypto, along with expectations for clearer regulation. None of that flips the trend overnight, but it does change how the current weakness is being interpreted.

Cardano Whales Accumulate as Retail Steps Away

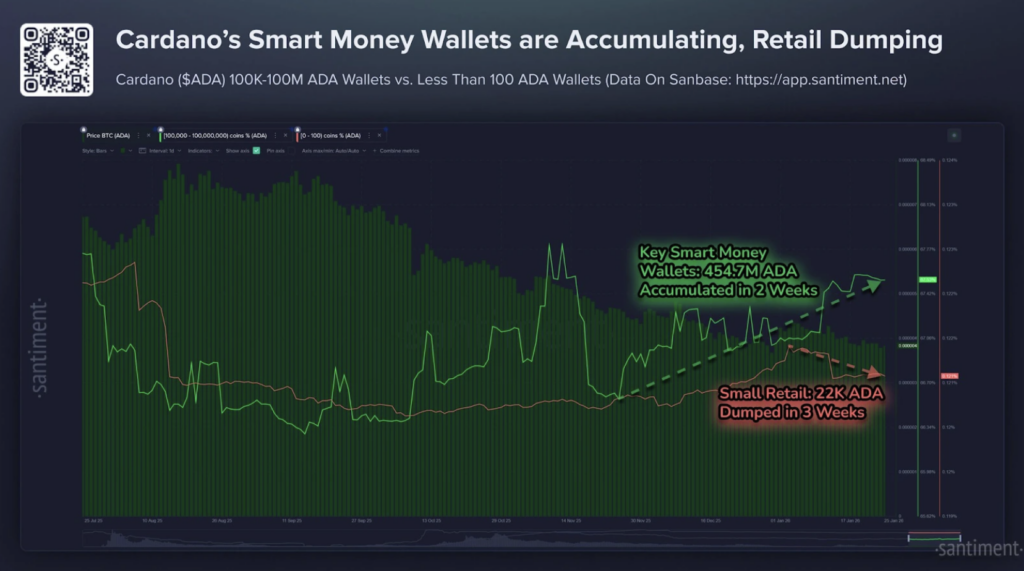

On-chain data adds an interesting layer to the picture. According to Santiment, Cardano wallets holding between 100,000 and 100 million ADA have accumulated roughly 454.7 million coins over the past two weeks. At current prices, that’s more than $160 million worth of ADA quietly moving into larger hands.

At the same time, smaller wallets are doing the opposite. Addresses holding fewer than 100 ADA have sold around 22,000 coins over the last three weeks, a modest figure in dollar terms, but still telling. This split between whale accumulation and retail distribution is something Santiment has flagged many times in the past. Historically, when larger holders buy into weakness while retail exits, it often sets the stage for a stronger recovery later on.

What Comes Next for ADA Price

From a technical standpoint, ADA is still in a vulnerable spot. The ADA/USD pair is hovering around the $0.34 area, which hasn’t proven to be a particularly strong support historically. With Bitcoin and Ethereum both maintaining mid-term bearish momentum, Cardano could still see more downside before any meaningful reversal takes shape.

On the weekly chart, ADA recently confirmed a downside break from a rising trend structure. That kind of move typically invites a deeper retest, and in this case, the next major support sits closer to $0.27. A dip into that zone wouldn’t necessarily break the long-term thesis, but it would likely be painful in the short term. If buyers do step in there, though, it could mark the base for a larger rebound cycle.

For now, ADA remains caught between weakening price action and improving on-chain signals. The disconnect doesn’t guarantee an upside move, but it does suggest that the story may be more nuanced than the chart alone implies.