- Stablecoin supply declines often reflect rotation, not liquidation

- ERC-20 data alone no longer captures how liquidity moves in crypto

- True risk appears only when institutions exit the system entirely

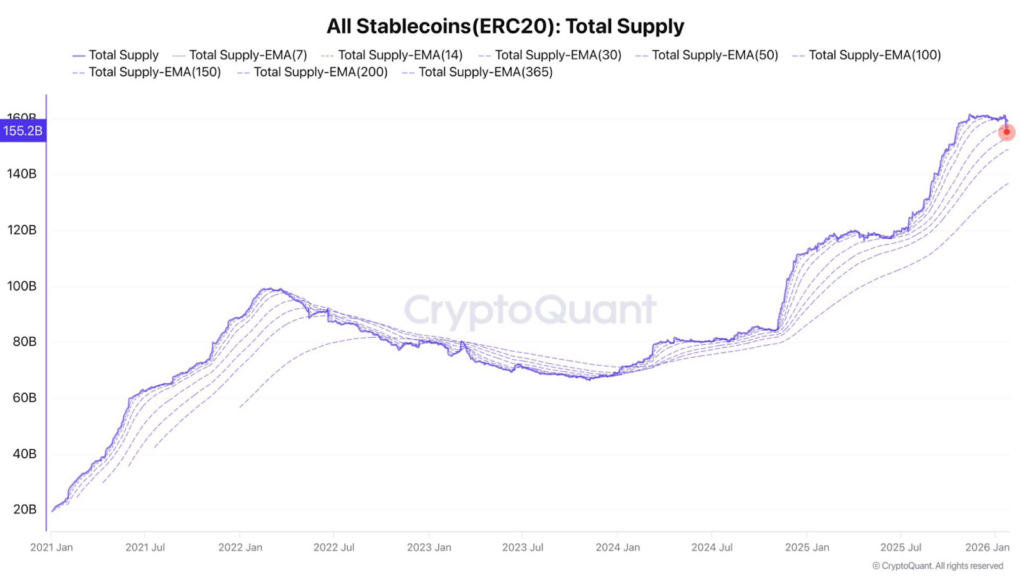

A sharp drop in ERC-20 stablecoin supply has sparked familiar fears that liquidity is fleeing crypto markets. On the surface, it looks ominous. Dig deeper, though, and the picture is far less dramatic. Stablecoins today are not idle cash sitting in wallets waiting for a spot buy. They are constantly moving across chains, platforms, and instruments in ways that simple supply charts no longer capture.

Rotation Is Not Capital Leaving Crypto

A shrinking ERC-20 stablecoin market cap can mean several things, and liquidation is only one of them. Funds rotate between chains, migrate into non-ERC-20 formats, or move into derivatives markets where balances never appear on public supply metrics. Traders often reduce spot exposure while maintaining risk through futures and options, which lowers visible supply without signaling panic.

Short-term data amplifies confusion. A single week of changes can reflect rebalancing by a handful of large desks rather than a shift in market conviction. In modern crypto plumbing, billions can move quietly without meaning capital has exited the ecosystem.

What Would Actually Signal Trouble

The real warning sign is not rotation but retreat. That shows up when institutions redeem to fiat at scale, exchange balances fall consistently, open interest dries up, and funding stays weak across venues. Those signals point to capital stepping away entirely, not just repositioning. So far, that broader pattern has not clearly emerged.

Conclusion

A falling ERC-20 stablecoin supply is something to watch, not something to fear. In corrective phases, rotation is normal and often healthy. Structural exits are rare, unmistakable, and noisy. Until those appear, this looks like market plumbing adjusting rather than a true bear market alarm.