- Strategy added 2,932 BTC, lifting total holdings to 712,647 Bitcoin

- The purchase was funded through equity sales under an ATM program

- The move reinforces Bitcoin as Strategy’s core treasury reserve asset

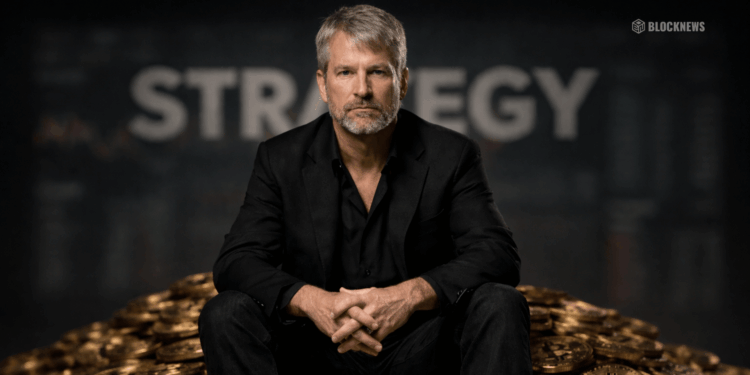

Strategy has quietly expanded its Bitcoin treasury once more, pushing total holdings to 712,647 BTC after a fresh acquisition round. The company bought 2,932 BTC between January 20 and January 25 for roughly $264 million, paying an average price of $90,061 per coin. At current market levels, that stack is valued at about $62.5 billion, reinforcing Strategy’s position as the most aggressive corporate Bitcoin holder in the world.

How Strategy Funded the Latest Bitcoin Buy

The purchase was financed through Strategy’s at-the-market offering program, according to a recent SEC filing. Over the past week, the firm sold 70,201 STRC shares and more than 1.6 million MSTR shares, raising approximately the same $264 million used to acquire Bitcoin. This playbook has become familiar: issue equity, convert proceeds into BTC, and expand the balance sheet exposure without touching operating cash flow.

Bitcoin as the Core Treasury Strategy

Under Michael Saylor’s direction, Strategy continues to treat Bitcoin as its primary reserve asset rather than a speculative side bet. Each incremental purchase strengthens the company’s long-term thesis that BTC functions as a superior store of value compared to cash or traditional fixed-income instruments. Even amid volatility, Strategy’s actions suggest unwavering confidence in Bitcoin’s role within corporate treasuries.

What This Means for the Broader Crypto Market

Large, repeat purchases like this matter beyond Strategy itself. They reinforce the narrative that Bitcoin is being absorbed by long-term holders who are less sensitive to short-term price swings. While equity dilution remains a concern for some shareholders, the crypto market tends to read these moves as structural demand rather than opportunistic trading.