- Sharplink Gaming shares plunged over 67% in after-hours trading following an S-3 SEC filing that investors misread as a major stock dump.

- The panic came just days after the company announced plans to build a $1 billion Ethereum treasury, which had previously sent the stock soaring.

- Executives insist no shares were sold, but confusion around the filing erased most of SBET’s recent 1,900% rally gains.

Sharplink Gaming (SBET) stunned the market Thursday evening, with shares plunging more than 67% in after-hours trading after the company filed an S-3 registration statement with the U.S. Securities and Exchange Commission. What looked, at first glance, like a routine filing quickly spiraled into full-blown panic. Many investors assumed the move signaled a massive stock dump, just days after Sharplink had boldly announced plans to build a $1 billion Ethereum treasury.

The Minneapolis-based betting platform had already closed regular trading at $32.53, down 12.25% for the day, which wasn’t exactly comforting. But the real shock came later. Within hours, SBET cratered to as low as $8 before clawing its way back toward $10.55, still marking a brutal 67.6% collapse from the day’s close. It was the kind of move that feels less like a correction and more like a trapdoor opening beneath the floor.

Ethereum Treasury Dreams Turn Into Market Fear

The irony is that just weeks ago, Sharplink was being celebrated. On May 30, the company revealed plans to raise up to $1 billion through a private investment in public equity (PIPE) deal, with most of the proceeds earmarked for Ethereum purchases. Traders loved the narrative. SBET rocketed from $6 on May 23 to an eye-popping $124, as speculators rushed in, eager to front-run what they believed would be a massive ETH accumulation strategy.

But hype can turn fragile fast. The new SEC filing registered nearly 58.7 million shares for potential resale, and that single phrase — potential resale — was enough to shake confidence. Investors interpreted it as insiders lining up to cash out, effectively flipping the script on the Ethereum pivot story. BTCS CEO Charles Allen summed it up bluntly, calling it a “prisoner’s dilemma,” where everyone races to sell before someone else does. A classic rush for the exits, messy and emotional.

Executives Deny Any Actual Selling

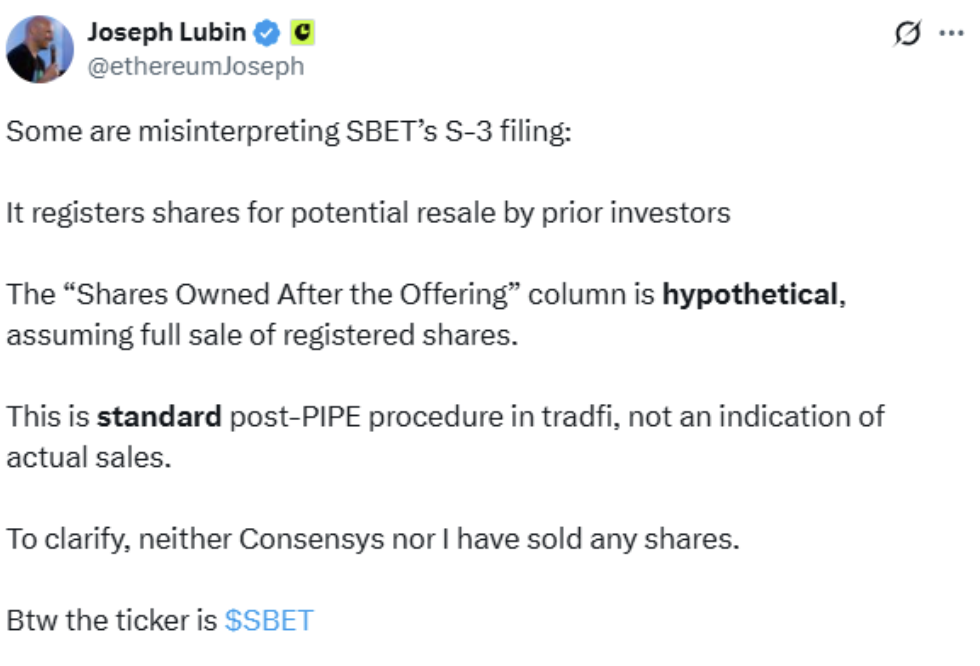

huu8Joseph Lubin, Chairman of Sharplink and CEO of Consensys, pushed back hard against the speculation. He clarified that the filing was standard procedure after a PIPE deal and did not indicate any actual share sales. According to Lubin, some market participants were simply misreading the document, confusing administrative formalities with insider dumping.

Consensys’ general counsel, Matt Corva, echoed that explanation. The deal had closed weeks earlier, he noted, and the S-3 was just formalizing the ability for early investors to potentially resell shares if they choose. A specific column in the filing showing “Shares Owned After the Offering” as zero caused additional confusion, but Lubin emphasized that the figure was hypothetical, assuming a full resale scenario. Still, once fear takes hold, logic doesn’t always win.

From Crypto Momentum to Harsh Reality

Sharplink’s Ethereum treasury strategy had positioned it alongside a growing list of public companies experimenting with crypto-backed balance sheets, inspired by Michael Saylor’s Bitcoin-heavy Strategy. With over 582,000 BTC on its books, Strategy turned corporate treasury management into a kind of crypto bet. Sharplink’s $425 million initial PIPE raise to kickstart its ETH reserves was seen as one of the boldest Ethereum-focused plays yet.

But markets can be ruthless when expectations get ahead of clarity. Ethereum itself was trading near $2,640 at publication, down 4% over 24 hours, which didn’t exactly help sentiment. After soaring more than 1,900% in a week at its peak, SBET’s 67% plunge wiped out most of those gains in a flash. Now the company’s recovery may hinge on one thing: delivering on that Ethereum purchase quickly, and communicating it clearly. Because in this environment, hesitation can cost millions, maybe more.