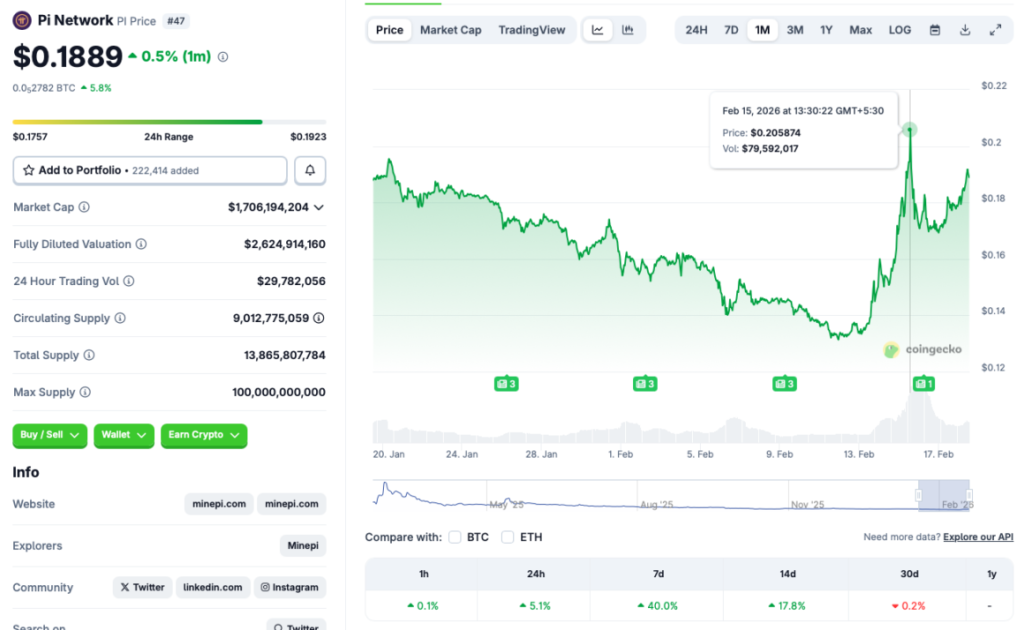

- PI is up 5.1% in 24 hours, 40% in a week, and 17.8% over 14 days

- The rally appears tied to Pi Network’s mainnet launch and Feb. 15 upgrades

- Forecasts still warn of a potential correction toward $0.13 this month

Pi Coin (Pi Network/PI) has become one of the strongest performers in crypto right now, and it’s doing it loudly. According to market data, PI is up 5.1% over the past 24 hours, roughly 40% over the last week, and nearly 18% on the 14-day chart. That kind of move instantly pulls attention, especially when Bitcoin and Ethereum are struggling to trend cleanly.

What makes this even more noticeable is that PI is outperforming major assets like BTC, ETH, and XRP during the same window. In a market where most tokens are fighting for liquidity, anything showing strength like this becomes a magnet for traders.

The Main Driver Looks Like Pi Network’s Mainnet Push

The simplest explanation for the rally is that Pi Coin finally has a catalyst that feels real. PI’s latest move appears tied to its mainnet launch and key upgrades that kicked off around Feb. 15, 2026. The project has framed this phase as a step toward deeper decentralization, and the market tends to reward anything that looks like progress, especially when it’s tied to infrastructure.

PI also caught a tailwind from broader crypto inflows over the weekend. Bitcoin briefly reclaimed $70,000 on Sunday before sliding back toward the $67,000 range. Even though BTC didn’t hold the breakout, that short burst of market strength likely helped PI get its first leg higher.

The Rally Could Fade if Bitcoin Stays Weak

Even with the hype, PI is still trading in a market where Bitcoin controls the mood. BTC struggling to regain momentum often leads to market-wide dips, and smaller assets usually feel it first. That’s why there’s a real chance PI’s rally cools off quickly, especially if traders start taking profits after such a sharp weekly run.

This is the part meme-style and hype-driven rallies always run into. They move fast, but they also correct fast. PI’s strength is real, but the broader market backdrop is still fragile, and that matters more than people want to admit.

FOMO and Seasonal Liquidity Could Keep PI Hot Longer

That said, PI may have something else going for it: pure FOMO. When a token is one of the only things moving, traders rotate into it simply because they want action. That dynamic can keep rallies alive longer than fundamentals would suggest, sometimes for weeks, especially if the market stays bored elsewhere.

There’s also the idea that liquidity could increase as billions of dollars in tax refunds begin returning to household accounts. If even a small slice of that capital flows into crypto, speculative assets like PI could benefit disproportionately. It’s not guaranteed, but it’s the kind of macro tailwind traders watch closely in Q1.

Analysts Still Expect a Pullback Toward $0.13

Despite the rally, not everyone believes PI can sustain this move. CoinCodex analysts have projected a bearish short-term outlook, expecting PI to fall toward $0.13 by the end of the month. If that plays out, it would imply a correction of roughly 31.5% from current levels.

That doesn’t mean PI is “done.” It just means the rally may be ahead of itself. In crypto, strong moves often come with equally sharp pullbacks, and PI’s surge has been fast enough that a reset would not be surprising at all.