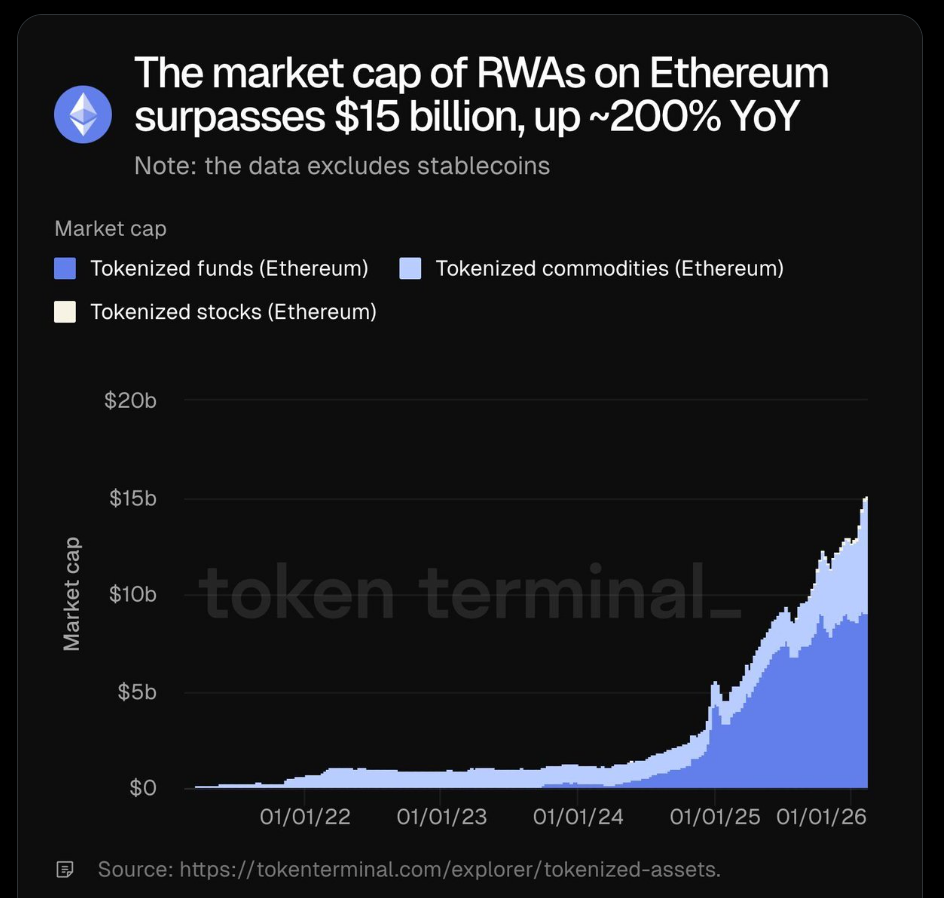

- Ethereum’s RWA market has crossed $15B, up roughly 200% year over year

- Most of the growth is coming from institutional tokenization of TradFi assets

- The key debate is whether this strengthens DeFi or quietly centralizes it

Crossing $15 billion in tokenized real-world assets on Ethereum isn’t some cute headline number. It’s a signal that demand is showing up with size, and it’s showing up consistently. A roughly 200% year-over-year jump suggests that this isn’t a one-off trend driven by a single product, it’s a broader shift in how capital is choosing to move.

On the surface, it looks like a major win for crypto. Ethereum is increasingly being treated like a settlement layer for things that used to live entirely in traditional finance, such as treasuries, bonds, private credit, and commodity-linked assets. That’s not hype anymore. That’s usage.

Most RWA Growth Is Institutional, and That Changes the Tone

If you follow the money, the story gets more complicated. Much of the RWA growth on Ethereum is being pushed by institutions tokenizing traditional assets and plugging them into on-chain infrastructure. This is not a wave of crypto-native builders reinventing finance from scratch. It’s the existing financial system taking familiar products and moving them onto more efficient rails, which is smart, but also kind of… revealing.

This isn’t necessarily bad, and it’s not something DeFi should reject outright. But it does shift the narrative away from disruption and toward optimization. The vibe changes when the biggest players are not trying to replace the old system, they’re trying to upgrade it.

Crypto DeFi Could Be Maturing, or It Could Be Getting Absorbed

There are two ways to interpret what’s happening. One is that crypto is finally maturing into something credible enough for serious capital to commit to. The other is that incumbents have found a way to use blockchain without surrendering control, which is arguably the more likely outcome in the early stages.

If RWAs become a core pillar of DeFi while staying permissioned, custodied, and institution-controlled, then Ethereum may end up hosting a cleaner version of legacy finance. It would still be on-chain, yes, but the power structures wouldn’t really change. And if the hierarchies don’t change, the revolutionary edge starts to dull.

The Next Phase Will Decide What Ethereum Actually Becomes

RWAs might be the bridge that brings trillions of dollars on-chain over the next decade. Or they might turn Ethereum into backend infrastructure for the same institutions crypto once positioned itself against. Both paths are possible, and weirdly, both can happen at the same time.

The growth is real, and it’s hard to argue against that. The more important question is what direction this growth takes from here, and who ends up controlling the rails. Because if Ethereum becomes the global settlement layer, the real winner won’t just be the tech. It’ll be whoever owns the access.