- PI is outperforming most crypto assets after Sunday’s rebound

- The broader market is still weak, with BTC back near $68K

- Analysts warn PI could still correct sharply toward $0.12

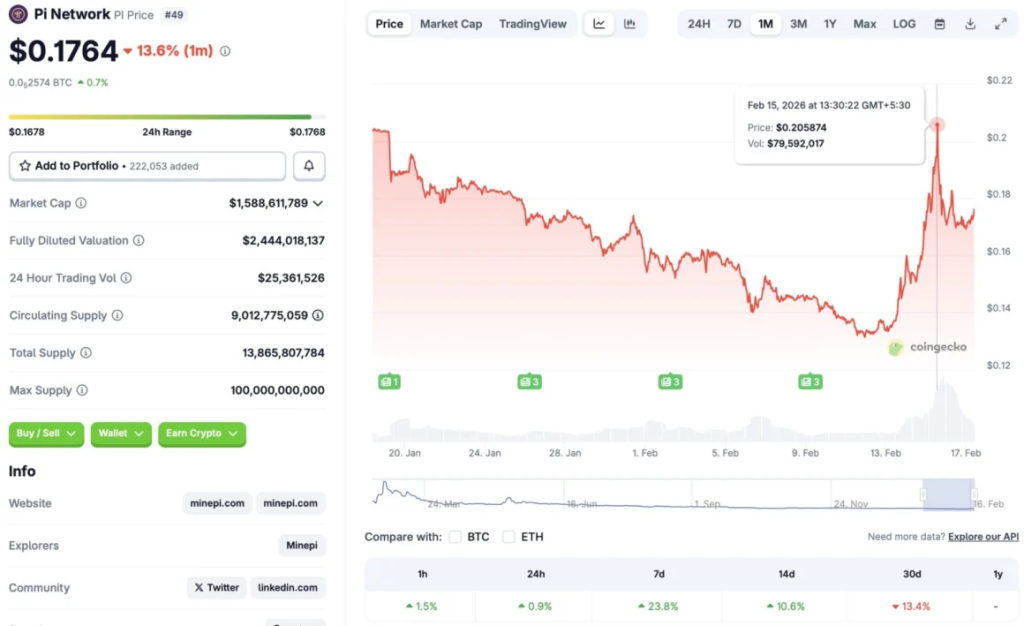

Pi Coin (Pi Network/PI) has managed to stay in the green across most time frames, even as the broader crypto market fades back into weakness. The token rallied to the $0.20 mark on Sunday, Feb. 15, 2026, during the same weekend burst that briefly pushed Bitcoin (BTC) back to $70,000. But unlike most coins that immediately rolled over, PI has held onto a meaningful chunk of its gains.

According to CoinGecko data, PI is up 0.9% over the last 24 hours, 23.8% on the week, and 10.6% over the last 14 days. The one red flag is the monthly view, where PI remains down 13.4%. That detail matters because it shows the rally may still be more of a rebound than a full reversal.

Why PI Is Acting Stronger Than the Rest

The most likely explanation is simple: PI is trading on its own local momentum rather than following Bitcoin tick-for-tick right now. A lot of assets bounced on Sunday and then immediately gave it back once BTC slipped to $68,000. PI didn’t. That suggests either stronger spot demand, lighter leverage, or simply less sell pressure from traders who were already underwater.

Still, it’s hard to argue the market mood has improved. Investors remain risk-off, and the bigger flows are still going into safe havens like gold and silver. Crypto is not the center of attention right now, and that limits how far any isolated rally can run before it gets pulled back into gravity.

The Biggest Risk: Bitcoin Still Controls the Tape

Even if PI looks healthier than most coins today, it’s still living inside the same macro environment. Bitcoin is under pressure, and the entire altcoin market tends to weaken when BTC can’t reclaim momentum. If BTC continues grinding lower or breaks down sharply, PI will have a hard time staying insulated.

That’s the real issue for PI bulls. It’s not whether PI has short-term strength, it’s whether it can keep that strength if Bitcoin fails another recovery attempt.

CoinCodex Predicts a Sharp Pullback

CoinCodex researchers are leaning bearish in the short term. Their forecast suggests Pi Coin could dip to $0.12 by Feb. 26, 2026. If that plays out, it would represent nearly a 30% correction from current levels.

That kind of downside isn’t unusual in this market, especially when broader sentiment remains fragile. It also fits the current pattern where weekend rebounds get sold into once liquidity returns during the week.

Conclusion

Pi Coin is showing more resilience than most crypto assets right now, and holding $0.20 while Bitcoin slips is not nothing. But the broader environment still looks shaky, and the market is not behaving like it’s ready for a clean risk-on trend again.

Unless Bitcoin stabilizes and sentiment improves, PI’s rally still looks vulnerable to a sharp correction. For now, PI isn’t out of the weeds yet, it’s just walking through them better than most.